Despite all the ominous press being devoted to the soon-to-be-inverted yield curve, it’s not always clear why such a thing matters. In other words, how, exactly does a line on a graph slipping below zero translate into a recession and equities bear market, with all the turmoil that those things imply?

The answer (which is both simple and really easy to illustrate with charts) is that banks – the main driver of our hyper-financialized society – still make at least some of their money by borrowing short and lending long. They take money that’s deposited into savings accounts and short-term CDs (or borrowed in the money markets) and lend it to businesses and home buyers for years or decades. In normal times long-term rates are higher than short-term to compensate lenders for tying their money up for longer periods. The banks earn that spread, which can be substantial if borrowers make their payments.

When the yield curve flattens and then inverts — that is, when short rates exceed long rates — banks lose the ability to make money this way. They lend less, which restricts building and buying and spooks the broader markets.

So, here’s the flattening, apparently soon-to-invert yield curve:

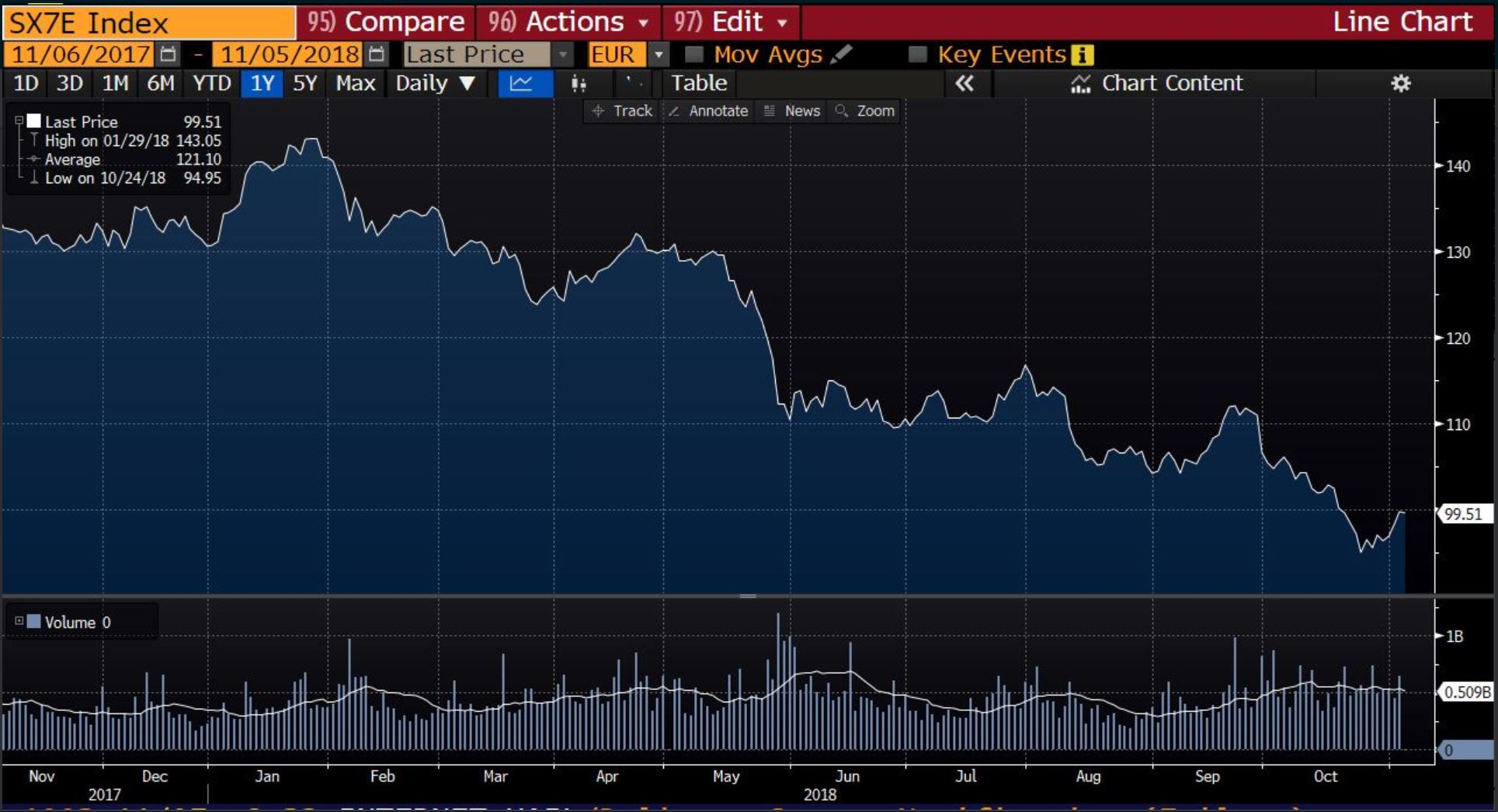

And here’s how bank stocks are behaving in response. The following chart is for the BKX bank stock ETF that includes all the major US banks. Note how it was stable for the first nine months of the year and then fell off a cliff as it became clear that the yield curve really was going to invert.

…click on the above link to read the rest of the article…