Home » Posts tagged 'oil price' (Page 6)

Tag Archives: oil price

Huge Debt Payments Come At Worst Time Possible For Canadian Drillers

Huge Debt Payments Come At Worst Time Possible For Canadian Drillers

The collapse in oil prices has significantly deteriorated Canada’s oil companies’ finances and has made repaying their debt more challenging. Over the past decade, Canadian firms have borrowed money to survive the previous oil crisis of 2015-2016 and boost production post-crisis. But now the second price collapse in less than five years is leaving Canada’s oil patch, especially the smaller players, extremely vulnerable as debt maturities approach.

This year, the oil crash coincides with the highest-ever annual debt maturities in the Canadian energy sector, according to Refinitiv data cited by Reuters. In 2020, oil and gas firms have to repay US$3.7 billion (C$5 billion) in debt maturities, up by 40 percent compared to last year.

The debt pressure adds to the Canadian energy sector’s new predicament with low oil prices, low cash flows, and low overall demand for crude oil due to the coronavirus pandemic.

Some companies are set to default on debts, while others are looking at restructuring options and refinancing. Banks are not generally too keen to own energy assets. But the banks may be the ultimate judge of who can refinance, who can stay afloat, or who can go belly up in this crisis, legal and industry professionals told Reuters.

Some of Canada’s oil and gas firms had not overcome the previous crisis when this one hit.

According to Bank of Canada’s recent Financial System Review—2020, the COVID-19 crisis led to widespread financial distress in all sectors, but “Canada is also grappling with the plunge in global oil prices, which hit while many businesses in the energy sector were still recovering from the 2014–16 oil price shock.”

The energy sector has the most refinancing needs over the next six months, at US$4.43 billion (C$6 billion), and faces the most potential downgrades, according to Bank of Canada.

…click on the above link to read the rest of the article…

How Saudi Arabia Caused The Worst Oil Price Crash In History

How Saudi Arabia Caused The Worst Oil Price Crash In History

- Saudi Arabia made good on its promise to flood the market with oil after the collapse of the previous OPEC+ deal in early March.

- The Kingdom’s oil exports jumped by 3.15 million bpd to 11.34 million bpd in April.

Saudi Arabia made good on its promise to flood the market with oil after the collapse of the previous OPEC+ deal in early March, exporting a record 10.237 million barrels per day (bpd) in April 2020, up from 7.391 million bpd in March, data from the Joint Organisations Data Initiative (JODI) showed.

Total oil exports from Saudi Arabia, including crude oil and total oil products, also soared in April – by 3.15 million bpd to 11.34 million bpd, mostly due to the surge in crude oil exports, according to the data released by the JODI database, which collects self-reported figures from 114 countries.

Production at the world’s top crude oil exporter also jumped in April—to over 12 million bpd, at 12.007 million bpd, the database showed.

After flooding the market with oil in April and contributing to the oil price crash, OPEC’s de facto leader and largest producer, Saudi Arabia, agreed that same month to a new round of OPEC+ cuts in response to the demand crash and plunging oil prices. Saudi Arabia had to reduce its oil production to 8.5 million bpd in May and June under the OPEC+ deal for removing 9.7 million bpd of collective oil production from the market.

According to OPEC’s secondary sources in the latest Monthly Oil Market Report (MOMR), Saudi Arabia slashed its crude oil production in May to the required level of 8.5 million bpd.

…click on the above link to read the rest of the article…

Canadian Banks Hit Hard By Low Oil Prices

Canadian Banks Hit Hard By Low Oil Prices

Canada’s government has been perhaps surprisingly ready to help the country’s ailing oil industry. Interest-only loans, backstopping loans that troubled companies can’t pay have been among the steps taken so far. But they may not be enough. Canada’s oil industry has arguably suffered more than its peers across its southern border or even most producers around the world. Already cheap because of pipeline troubles, Canadian oil slumped to new lows amid the oil price war and the coronavirus pandemic earlier this year. While it has since improved in line with the international benchmarks, it hasn’t improved enough for the comfort of the local extractive industry. And it may drag banks down with it.

Bloomberg reported earlier this month that Canada’s largest banks reported an almost two-fold increase in impaired energy loans over their second quarter due to the oil price plunge and the pandemic. The increase amounted to more than US$1.47 billion (C$2 billion). What’s more, according to the report the country’s top six lenders had boosted their new lending to energy companies jumped by as much as 23 percent during that same quarter.

“Canadian banks’ energy exposure risks are increasing, with oil in a freefall and Canadian oil producers fighting to survive, as cash burn accelerates and liquidity dwindles,” a Bloomberg Intelligence analyst said in April when banks and companies were both bracing for this year’s renegotiation of borrowing bases amid the price plunge. According to Paul Gulberg, if just a tenth of the loans that Canadian banks had on their books at that time went bad, the lenders could lose a collective US$4.40 billion (C$6 billion).

…click on the above link to read the rest of the article…

Oil Market Heading For Months Of Deficit

Oil Market Heading For Months Of Deficit

The oil market is set for a deficit from August onwards, even after OPEC+ eases the current cuts that are up for a tentative extension through July, Rystad Energy analysts said on Friday.

Assuming that global demand recovery continues in the coming months, the oil market will still be in deficit even after the OPEC+ group relaxes the current cuts from 9.7 million bpd to 7.7 million bpd, as currently planned, Rystad Energy’s Head of Oil Markets, Bjornar Tonhaugen, said, as carried by Oilfield Technology.

“That will ensure a fundamental support for prices, while also spurring a quicker reactivation of curtailed US oil production, and eventually frac crews ending their holidays early,” Tonhaugen said in a note.

“Indications show that a bit more than 300 000 bpd from shut US production is actually coming back online already from June as a result of the current price levels,” he said.

Some U.S. producers have already restarted some curtailed production as prices have rallied in recent weeks and as they need the cash from operations, regardless of how little.

The market deficit coming this summer, however, doesn’t mean that there will be a global oil supply crunch, because inventories and floating storage have yet to begin depleting.

“So, even if demand exceeds supply for a while, that does not mean that we really have a problem to source oil. Oil is there, lots of it, waiting to be drawn from storage facilities,” Rystad Energy’s Tonhaugen said.

Improving global oil demand and faster-than-expected production curtailments from outside the OPEC+ pact are set to push the oil market into deficit in June, according to Goldman Sachs. Yet, there is little room for an oil price rally in the near term because of the still sizeable oversupply of crude oil and refined products, Goldman Sachs said in a note in the middle of May.

Earlier this week, Russia’s Energy Minister Alexander Novak said he expected a shortage in the oil market in July.

Oil Producers May Ditch Old FPSO Offshore Projects In This Downturn

Oil Producers May Ditch Old FPSO Offshore Projects In This Downturn

The swift oil price crash caused by the Covid-19 pandemic will reduce the combined free cash flow of FPSO fields, which have produced above three quarters of their original resources at just $2.20 per barrel this year. This is a jaw-dropping decline from 2019’s $11.10 per barrel, a Rystad Energy impact analysis reveals. We also estimate that 40% of the 96 assets which have produced more than 75% of their original resources will end 2020 with a negative cash flow. Given our base case oil price outlook, with prices recovering next year and into 2022, free cash flow will climb back to 2019 levels. However, as these mature fields see production stagnate, free cash flow will quickly return to a decline, ultimately threatening the profitability of many FPSO assets.

“A concern arising for operators is whether the profitability of producing fields will degrade to such an extent that prematurely shutting down ageing fields will prove to be the most rational decision,” says Aleksander Erstad, a Rystad Energy energy service analyst.

Field economics alone are causing headaches for many FPSO operators, but other challenges might also compound the problems.

Unplanned production shut-ins on FPSOs due to Covid-19 outbreaks have already occurred, and continue to be a risk that could seriously harm both the health of individuals and the field’s profitability. Some FPSOs are also the target of supply cuts, a factor which could add to other woes and result in several late producing FPSOs being shut down for good.

Fields utilizing leased FPSOs are in the worst position, with around 70% of late producing assets estimated to have net present values below zero. This puts not only operators in an uncomfortable position, but also FPSO suppliers, who are faced with two possible outcomes – none of which are favorable.

…click on the above link to read the rest of the article…

U.S. Oil Companies Are Cutting Production Much Faster Than Expected

U.S. Oil Companies Are Cutting Production Much Faster Than Expected

The United States is on track to cut 1.7 million barrels of oil production per day, according to Reuters calculations of state and company data shared on Thursday.

It was U.S. President Donald Trump that suggested at the beginning of April, prior to the most recent OPEC deal signing that the United States would cut its oil output as a natural response to the worsening market conditions. The statement was not initially good enough for OPEC, who wanted more of a commitment from the world’s largest producer and consumer of crude oil.

“Well, I think it’s automatic. Because they’re already cutting. I mean, if you look, they’re cutting back. Because it’s… it’s market. It’s demand. It’s supply and demand. They’re already cutting back, and they’re cutting back very seriously,” U.S. President Trump said at a press briefing early last month.

OPEC+ eventually agreed to cut production by 9.7 million bpd—a landmark figure that is significantly larger than previous OPEC cuts in recent years. Its non-OPEC allies who partnered with OPEC in the deal pledged to cut an additional 10 million bpd.

U.S. Energy Secretary said last month that the DoE expected that production in the United States would fall by between two and three million bpd by the end of the year—it appears the cuts have come even quicker than the department expected.

The need for the production cuts grew more evident as the United States shut down nearly all activity in an attempt to flatten that curve of infections that sought to overwhelm the country’s healthcare system. Doing so, however, has idled much of the economy and crippled demand—and as such, its oil and gas industry that fuels that economy.

The cuts from U.S. producers may seek to quiet the disgruntlement of OPEC and Russia, in particular, who expressed their displeasure that the U.S. would not require its producers to curb production. After all, the U.S. shale industry has benefited greatly from previous rounds of OPEC cuts.

THE END OF A U.S. OIL GIANT: ExxonMobil’s Days Are Numbered

THE END OF A U.S. OIL GIANT: ExxonMobil’s Days Are Numbered

ExxonMobil, the largest oil company in the U.S. and a direct descendant of John D. Rockefeller’s Standard Oil, days are numbered. The once-great profitable oil giant is now borrowing money just to pay dividends. How long can this charade go on?

Good question. Now, some may believe that ExxonMobil was forced to borrow money to pay dividends due to the collapse in oil prices as a result of the global contagion. However, the company hasn’t been able to pay shareholder dividends from its cash from operations over the past four quarters, even with much higher oil prices.

The leading culprit as to why ExxonMobil lacks the available cash to pay dividends stems from the lousy economics of its U.S. oil and gas wells, especially the company’s shale oil portfolio. Ever since ExxonMobil ramped up its domestic shale oil production, that’s when the financial troubles at the company began to intensify.

The best way to compare ExxonMobil’s U.S. Upstream (oil and gas wells) performance, BEFORE and AFTER SHALE, is to go back to 2004. Even though the oil price fell considerably in Q1 2020, it was higher than the oil price in 2004. For example, ExxonMobil’s U.S. Upstream Sector earned $4.9 billion in 2004 with an average oil price of $41.51 compared to a $704 million loss on a $42.82 oil price:

Furthermore, look at the U.S. oil production differences between 2004 and Q1 2020. According to ExxonMobil’s 2006 Annual Report, the company’s average U.S. oil production in 2004 was 414,000 barrels per day (bd) versus 699,000 bd in Q1 2020. Even with higher oil production and similar oil price, ExxonMobil’s U.S. Upstream Earnings in Q1 2020 were dismal in comparison. Moreover, the company invested $1.9 billion in CAPEX for all of 2004 on its U.S. oil and gas wells compared to the $2.8 billion just for Q1 2020.

…click on the above link to read the rest of the article…

US To Remove Patriot Missile Protection From Saudi Arabia Amid Oilpocalypse

US To Remove Patriot Missile Protection From Saudi Arabia Amid Oilpocalypse

Petrodollar panic?

As tensions between OPEC (cough – the Saudis – cough) and Washington rise over the supply (and price) of oil globally amid a pandemic-driven demand collapse, it would appears President Trump may have just gone ‘nuclear’.

“…there will be blood.”

The Wall Street Journal reports that The U.S. is removing Patriot anti-missile systems from Saudi Arabia and is considering reductions to other military capabilities – marking the end, for now, of a large-scale military buildup to counter Iran, according to U.S. officials.

As a reminder, OilPrice.com’s Simon Watkins warned last week that President Donald Trump was considering all options available to him to make the Saudis pay for the oil price war as the crash that followed has done significant damage to the U.S. oil industry.

With last month having seen the indignity of the principal U.S. oil benchmark, West Texas Intermediate (WTI), having fallen into negative pricing territory, U.S. President Donald Trump is considering all options available to him to make the Saudis pay for the oil price war that it started, according to senior figures close to the Presidential Administration spoken to by OilPrice.com last week. It is not just the likelihood that exactly the same price action will occur to each front-month WTI futures contract just before expiry until major new oil production cuts come from OPEC+ that incenses the U.S. nor the economic damage that is being done to its shale oil sector but also it is the fact that Saudi is widely seen in Washington as having betrayed the long-standing relationship between the two countries. Right now, many senior members on Trump’s closest advisory circle want the Saudis to pay for its actions, in every way, OilPrice.com understands.

Oil Suddenly Crashes After Jobs Report

Oil Suddenly Crashes After Jobs Report

It would appear no one told the machines that ADP would report a devastatingly ugly jobs print this morning…

Oil started sliding earlier but the ‘better than expected’ ADP print actually seemed to spark a panic puke for some reason ahead of this morning’s EIA inventory/production report.

The Oil Wells That Will Never Recover

The Oil Wells That Will Never Recover

It is very common today to read about shutting-in of producing oil and gas wells to reflect the reality there are fewer and fewer places to store oil right now. An old oilfield maxim-the cheapest storage is in the ground. It wasn’t coined to meet the criteria that are extant today as regards surface storage limitations, but rather to reflect costs of production versus sales prices. As we are all learning though, these two scenarios are very much related.

I get a lot of questions from readers of my articles, and students in my Reservoir Drill-In Fluids design classes about what happens with oil and gas wells that are shut-in. As discussed, there is a lot of this going on right now due to the oil glut we are experiencing. That answer is generally, that there are definite problems associated with doing this, but it’s not guaranteed they will occur in every instance. Sometimes you just get lucky. More often than not though, the sub-surface gremlins that reside in oil and gas reservoirs are going to get you. There is a reason that service companies earn billions of dollars annually pumping stuff down wells to fix perceived problems with production. So the question before us now is what are some of the mechanisms that cause problems restoring production to oil and gas wells after they have been shut-in?

One thing that can happen to oil and gas wells when they are shut in after being on production is a change in wettability. We will discuss ‘wettability’ in some detail in this article, but essentially amount to the surface wetting condition of the discrete particles of sand and other constituents that comprise the rock in oil and gas reservoirs. Water coning is one frequent contributor to this problem.

…click on the above link to read the rest of the article…

Game Over For Oil, The Economy is Next

GAME OVER FOR OIL, THE ECONOMY IS NEXT

It’s game-over for most of the U.S. oil industry.

Prices have collapsed and storage is nearly full. The only option for many producers is to shut in their wells. That means no income. Most have considerable debt so bankruptcy is next.

Peggy Noonan wrote in her column recently that “this is a never-before-seen level of national economic calamity; history doesn’t get bigger than this.” That is the superficial view.

Coronavirus has changed everything. The longer it lasts, the less the future will look anything like the past.

Most people, policy makers and economists are energy blind and cannot, therefore, fully grasp the gravity or the consequences of what is happening.

Energy is the economy and oil is the most important and productive portion of energy. U.S. oil consumption is at its lowest level since 1971 when production was only about 78% of what it was in 2019. As goes oil, so goes the economy…down.

The old oil industry and the old economy are gone. The energy mix that underlies the economy will be different now. Oil production and price are unlikely to regain late 2018 levels. Renewable sources will fall behind along with efforts to mitigate climate change.

It’s Really Bad

2020 global liquids demand may average 20 mmb/d less than in 2019 (Figure 1). This estimate is really a thought experiment because it is impossible to know what supply and demand are in the present much less in the next quarter or beyond. This is a time of unimaginable flux and uncertainty because no one knows how long economic activity will be depressed, how long it will take to recover or if it will recover.

…click on the above link to read the rest of the article…

Oil Price Crash Was Inevitable

Oil Price Crash Was Inevitable

The oil price crash was inevitable.

To understand why we have to review a bit of history.

In 2013, I began warning of the risk to oil prices due to the ongoing imbalances between global supply and demand. Those warnings fell on deaf ears.

Nobody wanted to pay much attention to the fundamentals at a time when near-zero interest rates were pushing banks, hedge funds, and private equity firms, to chase the “yield” in the energy space. Naturally, with money flooding into the system, companies were forced to drill economically unproductive wells to meet investor demands, which drove supplies higher.

Disclaimer

This week’s #MacroView is a broader commentary on the more general issues of the oil market. However, given this backdrop of what oil prices will likely remain suppressed far longer than most currently imagine, some opportunities exist in the energy space.

We recently added positions in Exxon (XOM), Chevron (CVX), and the SPDR Energy ETF (XLE) to our portfolios. We believed the companies offered significant value before the crisis, and offer even more due to the sell-off in oil.

Based on our discounted cash flow model for XOM and CVX, we think both companies are 25% undervalued. The model assumes very conservative earnings projections for the next three years and a low EPS growth rate after that. In addition to trading at a steep discount, we think their strong balance sheets put these companies in a prime position to purchase sharply discounted energy assets in the months ahead.

These stocks, and the sector, will be volatile for a while, but we intend to add to these positions in the future and potentially hold them for a long time.

Now, for the rest of the story.

…click on the above link to read the rest of the article…

How Oil Prices Could Go To $100

How Oil Prices Could Go To $100

“We’re in a deflationary moment that surpasses anything seen in most people’s lifetimes,” proclaimed a New York Times byline on Tuesday, the morning after oil prices went negative. The West Texas Crude Intermediate benchmark plummeted to previously unimaginable depths, closing the day at negative $37.63 per barrel. The novel coronavirus has wreaked unprecedented havoc on the global economy, shutting down entire industrial sectors and bringing countries across the world to a halt as the global community shelters in place to slow the spread of the COVID-19 pandemic. Economists have warned that the fallout is going to be the largest economic downturn that we have seen in our lifetimes, but few could have foreseen the absurdity of negative oil prices.

Few, but not none. Three weeks ago, on April 1, CNBC published a report titled “Oil prices could soon turn negative as the world runs out of places to store crude, analysts warn,“ which predicted exactly what is happening now. “Global oil storage could reach maximum capacity within weeks, energy analysts have told CNBC, as the coronavirus crisis dramatically reduces consumption and some of the world’s most powerful crude producers start to ramp up their output.”

While the situation is totally unprecedented it’s impossible to say what will happen next for oil markets, some experts think that oil is poised for a major comeback. Even though oil prices are lower than they have ever been, “one energy fund thinks $100 a barrel is achievable,” reported the Midland Reporter-Telegram earlier this week. At the time of the report, oil was only at an 18-year low rather than an all-time low. The article intro continued: “But first, prices need to fall even further.” Well, they got their wish.

…click on the above link to read the rest of the article…

COVID-19 and oil at $1: Is there a way forward?

COVID-19 and oil at $1: Is there a way forward?

Many people are concerned today with the low price of oil. Others are concerned about slowing or stopping COVID-19. Is there any way forward?

I gave a few hints regarding what is ahead in my last post, Economies won’t be able to recover after shutdowns. We live in a world with a self-organizing economy, made up of components such as businesses, customers, governments and interest rates. Our basic problem is a finite world problem. World population has outgrown its resource base.

Some sort of economy might work with the current resource base, but not the present economy. The COVID-19 crisis and the lockdowns used to try to contain the crisis push the economy farther along the route toward collapse. In this post, I suggest the possibility that some core parts of the world economy might temporarily be saved if they can be made to operate fairly independently of each other.

Let’s look at some parts of the problem:

[1] The world economy works like a pump.

To use a hand water pump, a person forces a lever down, and the desired output (water) appears. Human energy is required to power this pump. Other versions of water pumps use electricity, or burn gasoline or diesel. However the pump operates, there needs to be some form of energy input, for the desired output, water, to be produced.

An economy follows a similar pattern, except that the list of inputs and outputs is longer. With an economy, we need the following inputs, including energy inputs:

- Human energy

- Supplemental energy, such as burned biomass, animal power, electricity, and fossil fuel.

- Other resources, including fertile land, fresh water and raw materials of various kinds.

- Capital goods, built in previous cycles of the “pump.” These might include factories and machines to put into the factories.

…click on the above link to read the rest of the article…

Futures, Oil Plunge As Crude Contagion Spreads To All Markets

Futures, Oil Plunge As Crude Contagion Spreads To All Markets

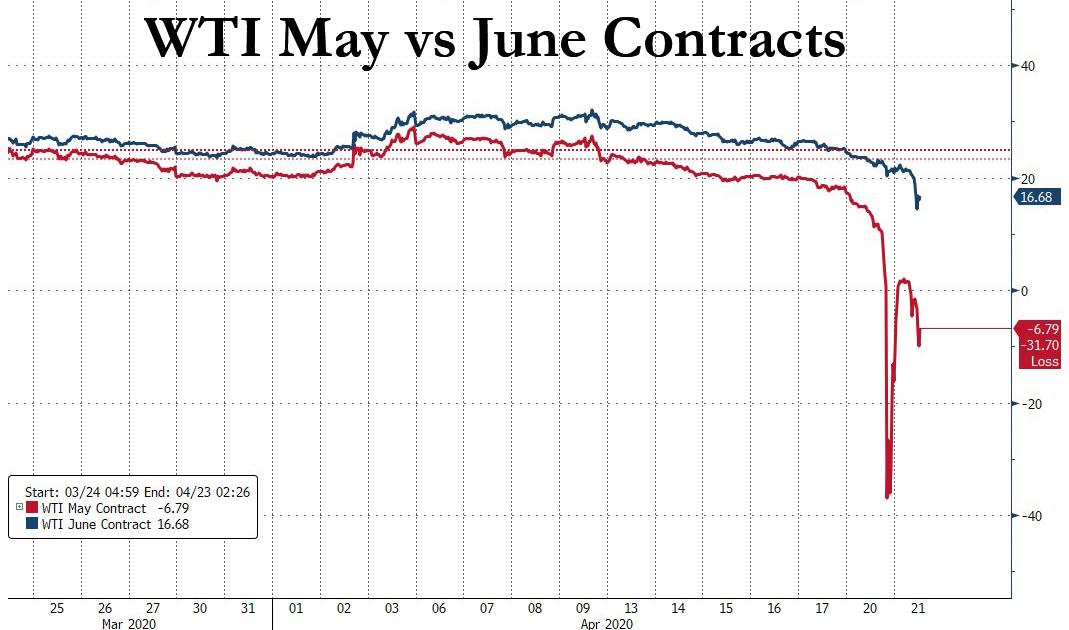

The experts said ignore the May WTI meltdown – it is irrelevant and is only confined to the deliverable contract. The experts were wrong.

Not only was the Monday May WTI meltdown not contained, with the contract still trading negative after closing down nearly $40 on Monday in their first ever sub-zero dive as traders realized Cushing was on the out of storage space, but overnight it spread to the more-active June contract which crashed almost 50% plunging to the low teens, before stabilizing down 23.5%, to $15.64 a barrel. June trading volumes were roughly 80 times those of the expiring May contract.

…. with Brent also dragged in, dropping as low as $18/barrel and last trading down $5.25, or 21% at $20.32 per barrel…

… as the world’s oil benchmark dropped below $20. And as the oil meltdown accelerated, it inflicted huge losses sweeping through markets as the world runs out of places to store unwanted crude and grapples with negative pricing.

The plunge in oil is taking place even as President Trump said late on Monday that he is looking at putting as much as 75mln bbls into SPR which would top it out and that the oil price drop is short-term in which a lot of people got caught out and was largely a financial squeeze. Furthermore, Trump suggested oil producers need to do more by the market in terms of output cuts and that the administration will either ask permission from Congress to buy oil or we will store it, while he also responded we will look at it when questioned about stopping shipments of oil from Saudi Arabia.

…click on the above link to read the rest of the article…