Home » Posts tagged 'Housing Bubble' (Page 6)

Tag Archives: Housing Bubble

“Fed Policy Is Toxic,” Michael Burry Warns “The Little Guy Will Pay” For The Next Crisis

“Fed Policy Is Toxic,” Michael Burry Warns “The Little Guy Will Pay” For The Next Crisis

As NYMag.com reports, in an email, which readers of the book will recognize as his preferred method of communication, the real-life head of Scion Asset Management answered some of questions about the state of the financial system, his ominous-sounding water trade, and what, if anything, we can feel hopeful about…

The movie portrays all of you as kind of swashbuckling heroes in some ways, but McKay suggested to me that you were very troubled by what happened. Is that the case?

I felt I was watching a plane crash. I actually had that dream again and again. I knew what was happening, but there was nothing I, or anyone else, could do to stop it. The last day of 2007, I couldn’t come home. I was in the office till late at night, I couldn’t calm down. I wrote my wife an email and just said, “I can’t come home; it’s just too upsetting what’s happening, and I didn’t want to come home to my kids like this.” As for punishment of those responsible, borrowers were punished for their overindulgences — they lost homes and lives. Let’s not forget that. But the executives at the lenders simply got rich.

Were you surprised no one went to jail?

I am shocked that executives at some of the worst lenders were not punished for what they did. But this is the nature of these things. The ones running the machine did not get punished after the dot-com bubble either — all those VCs and dot-com executives still live in their mansions lining the 280 corridor on the San Francisco peninsula.

…click on the above link to read the rest of the article…

This Is Canada’s Depression: Surging Crime, Soaring Suicides, Overwhelmed Food Banks “And The Worst Is Yet To Come”

This Is Canada’s Depression: Surging Crime, Soaring Suicides, Overwhelmed Food Banks “And The Worst Is Yet To Come”

The problem, apparently, was that despite the dramatic slump in oil, companies hadn’t yet begun to cut jobs or slash capex and so, officials were left with less money to put towards policing their growing populations.

As dangerous as it may be for small towns to experience exponential growth in what The Washington Post describedas “highly paid oil workers living in sprawling ‘man camps’ with limited spending opportunities,” what’s even more dangerous is the prospect that suddenly, the majority of those workers will be jobless. That is, if there’s anything that’s more conducive to raising the crime rate than legions of highly paid young men living in small towns with “limited spending opportunities,” it’s legions of formerly highly paid young men stuck in small towns with limited job opportunities.

With that in mind, America can look north to Calgary for a preview of what’s in store for America’s oil boom towns.

Although Alberta’s largest city bares little resemblance to Sidney and Bainville, the three do have one thing in common: oil. “Calgary boasted one of the lowest jobless rates in Canada as crude prices rose over $100 a barrel [but] it’s now reeling after a global glut pushed prices down by two-thirds,” Bloomberg notes.

…click on the above link to read the rest of the article…

“Canadians Should Be Concerned” As Energy Sector Job Losses Spike To 100,000 This Year

“Canadians Should Be Concerned” As Energy Sector Job Losses Spike To 100,000 This Year

Over the past year, we have extensively chronicled the tragic story of Alberta – Canada’s once booming oilpatch – disintegrate slowly at first, then very fast, into an economic and financial wasteland:

- “Canada Crude Contagion: Calgary Home Prices Drop Most In 2 Years”

- “Canada’s Biggest Oil Casualty To Date: Calgary’s Nexen Shutters Oil Trading Desk”

- “The Canadian Housing Bubble Has Begun To Burst”

- “Canada’s Oil Patch Confidence Crashes”

- “Canada Mauled by Oil Bust, Job Losses Pile Up – Housing Bubble, Banks at Risk”

- “The Stage Is Set For A Massive Housing Market Correction in Canada’s Oilpatch”

And, in one of the latest articles of this sad series describing the Alberta “bloodbath”, we said that the worst casualty of Canada’s recession has been the local commercial real estate market, where office vacancies are about to surpass the aftermath of the (first) great financial crisis.

But, it turns out the biggest casualty of Canada’s recession, which unless oil rebounds strongly soon will follow Brazil into an all out depression, are people themselves. As CBC reports the suicide rate in Alberta has increased dramatically in the wake of mounting job losses across the province.

Sadly, as The Financial Post reports, the situation looks set to get worse… as policy uncertainty has exacerbated the pain of low prices…

…click on the above link to read the rest of the article…

Suicides In Alberta Soar In Wake Of Canada’s Oilpatch Depression

Suicides In Alberta Soar In Wake Of Canada’s Oilpatch Depression

Over the past year, we have extensively chronicled the tragic story of Alberta – Canada’s once booming oilpatch – disintegrate slowly at first, then very fast, into an economic and financial wasteland:

- “Canada Crude Contagion: Calgary Home Prices Drop Most In 2 Years”

- “Canada’s Biggest Oil Casualty To Date: Calgary’s Nexen Shutters Oil Trading Desk”

- “The Canadian Housing Bubble Has Begun To Burst”

- “Canada’s Oil Patch Confidence Crashes”

- “Canada Mauled by Oil Bust, Job Losses Pile Up – Housing Bubble, Banks at Risk”

- “The Stage Is Set For A Massive Housing Market Correction in Canada’s Oilpatch”

And, in the last article in this sad series describing the Alberta “bloodbath”, we said that the biggest casualty of Canada’s recession has been the local commercial real estate market, where office vacancies are about to surpass the aftermath of the (first) great financial crisis.

We were wrong: the biggest casualty of Canada’s recession, which unless oil rebounds strongly soon will follow Brazil into an all out depression, are people themselves. As CBC reports the suicide rate in Alberta has increased dramatically in the wake of mounting job losses across the province.

According to the Canadian media, the most recent data only goes to June, but according to the chief medical examiner’s office, 30 per cent more Albertans took their lives in the first half of this year compared to the same period last year.

That’s how bad Canada’s economic recession is: the real casualties are no longer metaphorical economic objects, but the very people who until recently enjoyed comfortable lives only to succumb to an unprecedented collapse in the local economy.

Here are the statistics as reported by CBC:

- From January to June 2014, there were 252 suicides in Alberta.

- During the same period this year, there were 327.

…click on the above link to read the rest of the article…

Looney Plunges As Canadian GDP Collapses Most Since 2009

Looney Plunges As Canadian GDP Collapses Most Since 2009

Who could have seen that coming? It appears, for America’s northern brethren, low oil proces are unequivocally terrible. Against expectations of a flat 0.0% unchanged September, Canadian GDP plunged 0.5% – its largest MoM drop since March 2009 and the biggest miss since Dec 2008. With Canada’s housing bubble bursting, it’s time for the central planners to get back to work and re-invigorate the massive mal-invesment boom (and ban pawning of luxury goods).

In the past year, we have extensively profiled the collapse of ground zero of Canada’s oil industry as a result of the plunge in the price of oil, in posts such as the following:

- “Canada Crude Contagion: Calgary Home Prices Drop Most In 2 Years“

- “Canada’s Biggest Oil Casualty To Date: Calgary’s Nexen Shutters Oil Trading Desk“

- “The Canadian Housing Bubble Has Begun To Burst“

- “Canada’s Oil Patch Confidence Crashes“

- “Canada Mauled by Oil Bust, Job Losses Pile Up – Housing Bubble, Banks at Risk“

- “The Stage Is Set For A Massive Housing Market Correction in Canada’s Oilpatch“

Since then it has gotten far, far worse for Canada… GDP is down 0.5% MoM (and unchanged YoY – the worst since Nov 09)

The initial reaction is a tumbling looney…

Sweden Warns Of Dire “Consequences” From Massive Housing Bubble, Heavily Indebted Households

Sweden Warns Of Dire “Consequences” From Massive Housing Bubble, Heavily Indebted Households

Late last month, Sweden tripled down on QE, as the Riksbank announced it would expand its asset purchases by SEK65 billion. Or, visually:

The recent history of Swedish monetary policy is viewed by some as a cautionary tale about what can happen when a central bank attempts to normalize policy too “early.” As a reminder, the Riskbank began raising rates in 2010. Reminiscing about the bank’s decision four years later, Paul Krugman blew a gasket on the way to accusing Sweden of being a nefarious lot of job hating heretics hell bent on perpetuating global inequality by enriching creditors at the expense of impoverished debtors.

Of course Krugman needn’t have been so hard on the Riksbank. After all, they reversed course a little over a year later and since then, it’s been nothing but easing as the repo rate fell 35 bps into negative territory.

The problem, as we’ve documented quite extensively, is that Sweden’s adventures in NIRP-dom have done little to boost inflation (to be fair, unemployment has fallen).

For the Paul Krugmans of the world, that’s evidence of a hangover from the series of hikes the Riksbank embarked on beginning in 2010. For anyone who is sane, it’s evidence that, i) unconventional monetary policy is bumping up against the law of diminishing returns , and ii) when everyone is easing, no one gets the benefits.

But while NIRP may not be doing much for inflation, it sure has been effective at creating a rather scary looking housing bubble. Have a look:

We discussed this at length in “Sweden Goes Full Krugman, Gets Massive Housing Bubble.” Here’s what the Riskbank had to say about this after its September meeting:

“Low interest rates contribute to the trends of rising house prices and increasing indebtedness in the Swedish household sector continuing.

…click on the above link to read the rest of the article…

“It’s A Bloodbath” – Here Is The Biggest Casualty Of Canada’s Recession

“It’s A Bloodbath” – Here Is The Biggest Casualty Of Canada’s Recession

In the past year, we have extensively profiled the collapse of ground zero of Canada’s oil industry, Calgary, as a result of the plunge in the price of oil, in posts such as the following:

- “Canada Crude Contagion: Calgary Home Prices Drop Most In 2 Years”

- “Canada’s Biggest Oil Casualty To Date: Calgary’s Nexen Shutters Oil Trading Desk”

- “The Canadian Housing Bubble Has Begun To Burst”

- “Canada’s Oil Patch Confidence Crashes”

- “Canada Mauled by Oil Bust, Job Losses Pile Up – Housing Bubble, Banks at Risk”

- “The Stage Is Set For A Massive Housing Market Correction in Canada’s Oilpatch”

Since then it has only gotten worse for Canada, and as of two it culminated with the first official recession in 7 years.

Additionally, in September we profiled the expected collapse of the Calgary commercial real estate market when we reported that in Alberta Canada now has 1.7 million square feet of empty office space, the most in North America, with another 5.2 million under construction! After years of booming construction, the natural resource rich country is starting to feel the pinch.

Overnight Bloomberg followed up on this stunning deterioration when it, too, reported that “office-tower owners in Canada’s energy hub are about to feel the full force of the oil-price crash.”

Using data from real estate brokers including Jones Lang LaSalle Inc. and Avison Young, Bloomberg calculates that vacancy is already at a five-year high in Calgary and rents are the lowest since 2006 after thousands of office jobs were cut. Energy company tenants have now begun to ask for rental relief and are offering subleases for as little as half the going rate.

The backlog is even worse: five new office towers with about 3.8 million square feet (353,031 square meters) of space hits the market in the next three years.

…click on the above link to read the rest of the article…

Australian Housing Illusion Set to Burst

Australian Housing Illusion Set to Burst

Possibly driving an already weak economy into recession.

Every day, we have investment banks and others telling us that the Australian housing party is over. Estimates for price declines over the next year or so vary from 7.5% to a plunge of 25%.

Even the Reserve Bank of Australia is in on the act. But it is trying to put a positive spin on any downturn after having for years encouraged new house and apartment construction as being “good for the economy.”

The full impact of new housing supply will not be felt for a year or so. It is almost certain that there will be a major surplus when everything now under construction is complete. This is a bad omen for the Australian economy, where building and selling of houses and apartments has been playing an outsized role.

Macquarie Bank has estimated that new supply will be greater than 200,000 dwellings, whereas demand will be 170,000 to 180,000.

The effect: downward pressure on both house prices and rents; and possibly, an already weak economy driven into recession. There are many signs of a coming downturn:

- For Sale signs are springing up everywhere.

- Auction clearance rates continue to decline. In parts of Sydney it is down to 40%.

- More properties are now being bought by investors, mostly domestic, than by owner-occupiers.

- Household debt has soared, it is now around 140% of income.

- The house-price-to-income ratio is a stratospheric 6.4 times.

- Rental yield is now around 1% after costs.

- Some banks have raised mortgage rates in an attempt to calm the market and are charging investors more than owner-occupiers.

- The big four banks have recently raised $18 billion to help cover potential losses from the housing market.

- Some sell-side analysts now have the big four banks as a sell because of housing exposure.

…click on the above link to read the rest of the article…

Sweden Launches MOAR QE, As Krugman Paradise Quadruples Down After Dovish Draghi

Sweden Launches MOAR QE, As Krugman Paradise Quadruples Down After Dovish Draghi

Over the last six months, we’ve documented Sweden’s descent into the Keynesian Twilight Zone in great detail.

Once upon a time, the Riksbank actually tried to raise rates, only to be lambasted by a furious Paul Krugman who accused the central bank of unnecessarily transforming Sweden from “recovery rockstar” to deflationary deathtrap. Tragically, the Riksbank listened to Krugman and reversed course in 2011. Before you knew it, rates had plunged 35 basis points into NIRP-dom. Unemployment subsequently fell, but the promised lift in inflation didn’t quite pan out. Sweden did, however, get a massive housing bubble for their trouble:

Obviously, those charts beg the question of why in the world Sweden (or Denmark, or Norway for that matter… or hell, even the US) are trying to contend that there’s no inflationary impulse, but let’s leave that for another day.

As for the Riksbank’s QE program, things began to go awry during the summer when the central bank managed to buy such a large percentage of the stock of government bonds that market depth was affected, causing investors to reconsider the trade off between liquidity and the benefits of frontrunning central bank asset purchases. In short, government bond yields began to rise in what perhaps marked the first instance of QE actually breaking.

But that didn’t stop the Riksbank from doubling down and increasing their asset purchases just a week later.

Since then, it’s been touch and go, with Stefan Ingves looking warily south towards Frankfurt hoping Mario Draghi doesn’t do something that sends the krona soaring on the way to ushering in a deflationary impulse.

Well, that’s exactly what Draghi did last week when the ECB telegraphed either a further depo rate cut, an expansion of PSPP, or both in December. That pretty much sealed the deal for the Riksbank – either cut, expand QE, or concede defeat in the global currency wars.

…click on the above link to read the rest of the article…

Why Is Wealth/Income Inequality Soaring?

Why Is Wealth/Income Inequality Soaring?

If conventional labor and finance capital have lost their scarcity value, then the era in which financialization reaped big profits is ending.

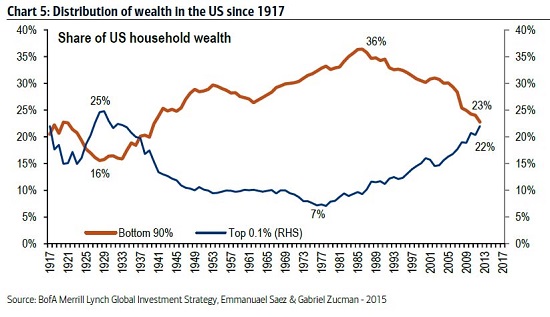

Why is wealth/income inequality soaring? The easy answer is of course the infinite greed of Wall Street fat-cats and the politicos they buy/own.

But greed can’t be the only factor, for greed is hardly unknown in the bottom 90% as it is in the top .1%. The only difference between the guy who took out a liar loan to buy a house he couldn’t afford so he could flip it for a fat profit and the mortgage broker who instructed him on how to scam the system and the crooked banker dumping toxic mortgage-backed securities on the Widows and Orphans Fund of Norway is the scale of the scam.

The difference isn’t greed, it’s the ability to avoid the consequences or have the taxpayers eat the losses, i.e. moral hazard. The bottom 90%er with the liar loan mortgage and the flip-this-house strategy eventually suffered the consequences when Housing Bubble 1.0 blew up in spectacular fashion.

Moral hazard describes the difference between decisions made by those with skin in the game, i.e. those who will absorb the losses from their bets that go south, and those who’ve transferred the risks and losses to others.

The too-big-to-fail banks that bought political protection simply shifted the losses to taxpayers. Then the Federal Reserve helpfully paid banks for deposits at the Fed while reducing the amount banks had to pay on depositors’ savings to bear-zero, effectively rewarding the banks with free money for ripping off the taxpayers.

America’s financialized cartel-state system institutionalizes moral hazard. This is one cause of rising inequality, as the super-wealthy are immunized by their purchase of political influence.

The top .1%’s share of the pie has been rising in the era of financialization and institutionalized moral hazard, everyone else’s share has declined:

…click on the above link to read the rest of the article…

How Much Longer Can Our Unaffordable Housing Prices Last?

How Much Longer Can Our Unaffordable Housing Prices Last?

Markets discover price via supply and demand: Big demand + limited supply = rising prices. Abundant supply + sagging demand = declining prices.

Eventually, prices rise to a level that is unaffordable to the majority of potential buyers, with demand coming only from the wealthy. That’s the story of housing in New York City, the San Francisco Bay Area and other desirable locales that are currently magnets for global capital.

In the normal cycle of supply and demand, new more affordable housing would be built, and prices would decline.

But that isn’t happening in hot real estate markets in the U.S. What’s happening is rental housing is being built to profit from rising rents and luxury housing is being built to meet the demand from wealthy overseas buyers.

With limited land in desirable urban zones and high development fees, it’s not possible to build affordable housing unless the government subsidizes the costs.

Meanwhile, the supply of existing homes for sale is limited by the owners’ recognition that they won’t be able to replace their own home as prices soar; it makes financial sense to stay put rather than sell and try to move up.

Some homeowners are cashing in their high-priced homes and retiring to cheaper regions. But this supply is being overwhelmed by a flood of offshore cash seeking real estate in the U.S.

This is part of the global capital flows I described in my recent analysis What Happens Next Will Be Determined By One Thing: Capital Flows. As China and the emerging market economies stagnate, capital that was invested in these markets in the boom years is moving into dollar-denominated assets such as bonds and houses.

But will current conditions continue unchanged going forward?

Let’s start with the basics of demographic demand for housing and the price of housing.

…click on the above link to read the rest of the article…

Australia Is “Going Down Under”: “The Bubble Is About To Burst”, RBS Warns

Australia Is “Going Down Under”: “The Bubble Is About To Burst”, RBS Warns

Thanks to a variety of idiosyncratic political crises and country-specific stumbling blocks, Brazil, Turkey, Malaysia, and to a lesser extent Russia, have received the lion’s share of coverage when it comes to assessing the EM damage wrought by the comically bad combination of slumping commodities prices, depressed Chinese demand, slowing global trade, and a “surprise” yuan devaluation.

Put simply, the intractable political stalemate in Brazil, the civil war in Turkey, the 1MDB scandal in Malaysia (and the fact that the country was at the center of the 1998 meltdown), and the hit Russia has taken from depressed crude prices mean that if you want to pen a story about emerging market chaos, those four countries have plenty to offer in terms of going beyond the generic “falling commodities + a decelerating China = bad news for EM” narrative.

But just because other vulnerable countries aren’t beset with ethnic violence and/or street protests doesn’t mean they too aren’t facing crises due to falling commodity prices and the slowdown of the Chinese growth machine.

One such country is Australia, which in some respects is an emerging market dressed up like a developed economy, and which of course has suffered mightily from the commodities carnage and China’s transition away from an investment-led growth model.

Out with a fresh look at the risks facing Australia is RBS’ Alberto Gallo. Notable excerpts are presented below.

* * *

From RBS

Australia has become a commodity focused economy, with an increasing exposure to China. For the past decades, Australia has been buoyed by the rapid Chinese expansion, which outpaced the rest of the world. Australia benefited from China’s strong demand for commodities given its investment-led growth model. China is Australia’s top export destination and 59% of those exports are in iron-ore. But as China struggles to manage its ongoing credit crunch and continues its shift to consumption-led growth Australia’s economy is likely to be hurt by lower demand for commodities.

…click on the above link to read the rest of the article…

The Echo Bubble in Housing Is About to Pop

The Echo Bubble in Housing Is About to Pop

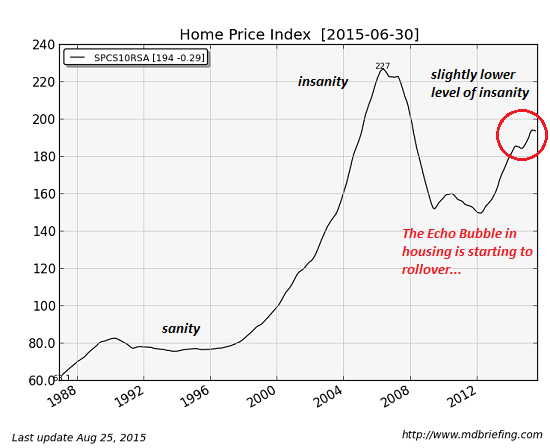

And here’s the knife in the heart of the Echo Housing bubble: declining household income.

The Federal Reserve-induced Echo Housing Bubble is finally starting to roll over, and the bubble’s pop won’t be pretty. Why is the bubble finally popping now?

All the factors that inflated the Echo Housing bubble are running dry. These include:

— unprecedented low mortgage rates

— FHA mortgage approvals for anyone who fogs a mirror

— frantic cash buying by Chinese millionaires desperate to get their money out of China

— the Federal Reserve buying up trillions of dollars in mortgages

— lemming-like buying of housing for rentals by everyone from Mom and Pop to huge hedge funds.

The well’s gone dry, folks. There isn’t going to be another push higher or a third housing bubble after this one pops.

Let’s start with the basics: demographic demand for housing and the price of housing. There are plenty of young people who’d like to buy a house and start a family (a.k.a. new household formation), but few have the job or income to buy a house at today’s nosebleed level–a level just slightly less insane than the prices at the top of Bubble #1.

Charts courtesy of Market Daily Briefing)

It’s considered bad form to describe today’s prices as insane. It tends to hurt the feelings of everyone who’s counting on the Echo Bubble to 1) make them even richer or 2) bail them out of the hole they fell into after Housing Bubble #1 popped.

Exhibit B is the insanely low mortgage rate, which has finally reversed course and is notching higher after 30 years of going lower. Why are today’s rates insane? Risk. Mortgages are intrinsically risky. People who are terrific credit risks lose their jobs, experience horrendous medical crises, get divorced, etc., and the net result is a default that is unexpected.

…click on the above link to read the rest of the article…

Time Bomb under Canada’s Housing Bubble Makes a Loud Tick

Time Bomb under Canada’s Housing Bubble Makes a Loud Tick

The Bank of Canada has been fretting about the ballooning debt of Canadian households. Last year, it repeatedly called it a risk to “financial stability,” perhaps in preparation for raising its benchmark interest rate. Then Canada’s economy tanked.

In July, when the freaked-out Bank of Canada cut its benchmark rate for the second time this year, it admitted that the rate cut comes at the price of “financial stability risks” which “remain elevated.” Governor Stephen Poloz added: “Of particular note are the vulnerabilities associated with household debt and rising housing prices.”

These rate cuts didn’t do much to support Canada’s resource economy that has been spiraling down in the wake of the commodities rout. But they made up for it by inflating the housing bubble even further.

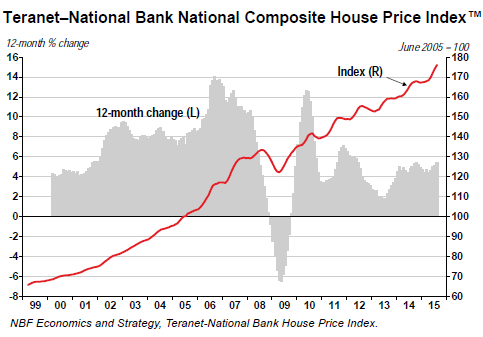

The Teranet–National Bank house price index, released September 14, hit new records every month this year. In August, it was up 5.4% year-over-year. Note how the index has soared since the peak of the prior housing bubble that ended with the Financial Crisis:

The index masks what Marc Pinsonneault, senior economist at NBF’s Economics and Strategy, calls the “dichotomy” of Canada’s housing market. In some cities, price increases are cooling, year over year: Victoria +3.2%, Edmonton +0.8%, Calgary +0.7%. In other cities, prices are actually falling year-over-year: Winnipeg -0.4%, Ottawa-Gatineau -0.4%, Montreal -0,5%, Quebec City -0.7%, and Halifax -1.4%.

But they’re sizzling in Vancouver +9.7%, Hamilton +8.8%, and Toronto +8.7%. And prices for non-condo homes in Vancouver and Toronto – the two cities account for 54.1% of the index – jumped over 10%!

On cue, total consumer debt rose 4.9% year-over-year in July to C$1.86 trillion. A trend that has been picking up speed recently: on a monthly basis, consumer debt jumped in July at an annualized rate of 5.4%. Mortgage debt – over two-thirds of total consumer debt – soared at an annualized rate of 6.9%.

…click on the above link to read the rest of the article…

Macau’s Economy Blows Up

Macau’s Economy Blows Up

China’s crackdown on corruption, or at least the ostentatious display of the spoils of corruption, and its selective hunt for corrupt officials, which to some observers resembles a political purge, may or may not tamp down on actual corruption, which is what greases the wheels in the Chinese economy. But it’s certainly doing a number on Macau.

Macau is the only place in China where Chinese can legally gamble away their wealth without having to resort to the stock market or other schemes. It’s also a convenient place where they can circumvent China’s currency controls to siphon money out of China and send it to “safe havens,” such as over-priced homes in the most expensive trophy cities in the US near the peak of US Housing Bubble 2.

Until February 2014, Macau was on an awesome ride that had kicked off in 2001, when it permitted foreign casino operators to build gambling palaces. In 2002, Macau became the number one gambling destination in the world. Even during the Financial-Crisis, Macau’s gaming revenues rose nearly 10%. These endlessly soaring revenues were a thermometer into China’s economic boom.

So in its crackdown on corruption, China is hitting Macau in both departments: scaring high-rollers away and monkey-wrenching its capital-controls evasion machinery. And this year, Macau has taken a third blow: the deteriorating economy in mainland China.

As a result, Macau’s real GDP plunged 24.5% in the first quarter year-over-year and then went ahead and plunged an even more terrible 26.4% in the second quarter, to 77.5 billion Macau patacas ($9.7 billion), the lowest level since early 2011.

The Statistics and Census Service (DSEC) in its report today blamed “exports of gaming services,” as it calls gambling revenues that had plunged 40.5% year over year, and “exports of other tourism services,” which had plunged 21.5%. “Total exports of services” crashed by 35.9%.

…click on the above link to read the rest of the article…