Time Bomb under Canada’s Housing Bubble Makes a Loud Tick

The Bank of Canada has been fretting about the ballooning debt of Canadian households. Last year, it repeatedly called it a risk to “financial stability,” perhaps in preparation for raising its benchmark interest rate. Then Canada’s economy tanked.

In July, when the freaked-out Bank of Canada cut its benchmark rate for the second time this year, it admitted that the rate cut comes at the price of “financial stability risks” which “remain elevated.” Governor Stephen Poloz added: “Of particular note are the vulnerabilities associated with household debt and rising housing prices.”

These rate cuts didn’t do much to support Canada’s resource economy that has been spiraling down in the wake of the commodities rout. But they made up for it by inflating the housing bubble even further.

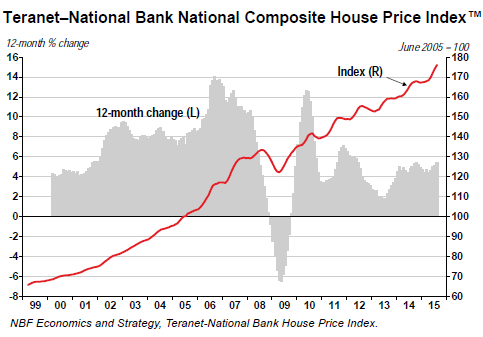

The Teranet–National Bank house price index, released September 14, hit new records every month this year. In August, it was up 5.4% year-over-year. Note how the index has soared since the peak of the prior housing bubble that ended with the Financial Crisis:

The index masks what Marc Pinsonneault, senior economist at NBF’s Economics and Strategy, calls the “dichotomy” of Canada’s housing market. In some cities, price increases are cooling, year over year: Victoria +3.2%, Edmonton +0.8%, Calgary +0.7%. In other cities, prices are actually falling year-over-year: Winnipeg -0.4%, Ottawa-Gatineau -0.4%, Montreal -0,5%, Quebec City -0.7%, and Halifax -1.4%.

But they’re sizzling in Vancouver +9.7%, Hamilton +8.8%, and Toronto +8.7%. And prices for non-condo homes in Vancouver and Toronto – the two cities account for 54.1% of the index – jumped over 10%!

On cue, total consumer debt rose 4.9% year-over-year in July to C$1.86 trillion. A trend that has been picking up speed recently: on a monthly basis, consumer debt jumped in July at an annualized rate of 5.4%. Mortgage debt – over two-thirds of total consumer debt – soared at an annualized rate of 6.9%.

…click on the above link to read the rest of the article…