Home » Posts tagged 'coronavirus' (Page 6)

Tag Archives: coronavirus

The UN Is Now Admitting That This Coronavirus Pandemic Could Spark Famines Of “Biblical Proportions”

The UN Is Now Admitting That This Coronavirus Pandemic Could Spark Famines Of “Biblical Proportions”

What the head of the UN’s World Food Program just said should be making front page headlines all over the globe. Because if what he is claiming is true, we are about to see global food shortages on a scale that is absolutely unprecedented in modern history. Even before COVID-19 arrived, armies of locusts the size of major cities were voraciously eating crops all across Africa, the Middle East and parts of Asia, and UN officials were loudly warning about what that would mean for global food production. And now the coronavirus shutdowns that have been implemented all over the planet have brought global trade to a standstill, they are making it more difficult to maintain normal food production operations, and they have forced countless workers to stay home and not earn a living. All of this adds up to a recipe for a complete and utter nightmare in the months ahead.

David Beasley is the head of the UN’s World Food Program, and on Tuesday he warned that we could actually see famines of “biblical proportions” by the end of this calendar year. The following comes from ABC News…

The coronavirus pandemic could soon double hunger, causing famines of “biblical proportions” around the world by the end of the year, the head of the World Food Programme, David Beasley, told the U.N. Security Council on Tuesday.

Beasley warned that analysis from the World Food Programme, the U.N.’s food-assistance branch, shows that because of the coronavirus, “an additional 130 million people could be pushed to the brink of starvation by the end of 2020. That’s a total of 265 million people.”

He described what we are facing as “a hunger pandemic”, and he insisted that urgent action must be taken in order to avoid a nightmare scenario.

…click on the above link to read the rest of the article…

Mr. President: Open the Economy Now – Martin Armstrong

Mr. President: Open the Economy Now – Martin Armstrong

Legendary financial and geopolitical cycle analyst Martin Armstrong says shutting down the economy is far worse that the effects of the Wuhan China virus. Armstrong says, “This is just scare mongering, and there is another agenda going on. The WHO is part of the UN, and the UN is for this climate change, and this is what their objective has been: Shut down the world economy, bankrupt everything you possibly can, and then rebuild from scratch. . . . The devastation in the economy is unbelievable. Our computer is very well known. Just about all the intelligence agencies look at it because it’s the only fully functioning artificial intelligence system in the world. It was saying unemployment was going to rise dramatically and retest the Great Depression highs. . . .That’s never happened like that. Even in the Great Depression, it took three years to get to 25%. We passed 13% in the first month. . . . From the very beginning, I said something is not right. Something is wrong. . . . This is really going to push the debt bubble over the cliff. . . . The number that has died is minimal. More than twice that die from the flu. There is no logical explanation to have done this. The study they used was not even peer reviewed.”

So, if Armstrong were face to face with President Trump, what would he tell him? Armstrong says, “What he needs to do is open up the economy instantaneously. I think he needs to appoint a special prosecutor to investigate who started this. All the information I have is pointing to a deliberate and intentional movement to harm the economy. These people are elitists. Bill Gates was in Germany saying everybody should remain in lockdown until he comes up with a vaccine. . . .

…click on the above link to read the rest of the article…

Authorities on High Alert About Northern China Virus Outbreak, as Beijing District Is Marked ‘High-Risk’

Authorities on High Alert About Northern China Virus Outbreak, as Beijing District Is Marked ‘High-Risk’

Chaoyang district in Beijing city was officially designated a “high-risk region” for the virus outbreak on April 19. This is the first such region outside of Hubei province, China’s CCP virus epicenter, that authorities publicly acknowledged.

Meanwhile, the virus continues to spread in northeastern China’s Harbincity.

Pang Xinghuo, deputy director of Beijing municipal health commission, saidat a press conference on April 20: “A region with more than 50 infections and a cluster outbreak within 14 days will be counted as a high-risk region.”

However, Harbin, the capital of Heilongjiang province, did not get this designation—despite authorities having announced at least 58 domestic diagnosed patients between April 9 to April 19, and several cluster outbreaksoccurring at Harbin Medical University (HMU) First Affiliated Hospital, Harbin No. 2 Hospital, as well as in residential compounds.

The majority of the city is set as “low risk” areas. Only Daowai and Nangang districts were classified as “medium risk regions.”

Pang did not provide details about the cases in Chaoyang district, but the city’s health commission has only announced three domestic cases in the whole city between March 24 and April 20.

The Epoch Times also obtained a series of internal documents from the Heilongjiang provincial government, in which authorities admitted that “the outbreak in Harbin is in an aggregated, explosive situation.”

Chaoyang District

State-run newspaper Beijing News reported on April 20 that people from Chaoyang district were being treated differently when they travel to other cities.

“It doesn’t matter whether the person is working or living in Chaoyang district. Before he or she enters our residential compound, he or she has to stay at a quarantine center for 14 days. The cost is 175 yuan ($25) per day, and must be paid by the person,” the report quoted a government staff in Shijiazhuang city, Hebei province as saying.

Peter Schiff: The Questions Nobody Is Asking

Peter Schiff: The Questions Nobody Is Asking

There seems to be growing optimism that we’re nearing the end of the coronavirus lockdown. Stocks have rallied despite dismal economic numbers. But Peter Schiff says there are some important questions nobody is asking, especially when it comes to the insane Federal Reserve monetary policy.

The US stock market ended last week on an upswing and gold was down as optimism and risk-on sentiment returned. The optimism was due to a possible treatment for coronavirus along with some movement toward reopening the US economy. There seems to be some sentiment that the market has found its bottom.

Peter doesn’t think so.

I still am doubting this rally. I don’t think the bear market is over. I don’t think the bear market ends with stocks like Netflix and Amazon making new all-time record highs. I still think those stocks have to have some kind of comeuppance. I think they have to take those out and shoot them. So, I am looking for another sell-off in the broad markets.”

Peter said there is one thing the market has going for it — the Federal Reserve. In fact, a lot of people seem to think that’s all you need.

As long as you’ve got the Fed on your side and they’re going to keep on printing money, which they’re going to do and they’re going to print more and more of it, people are going to make a bet. And they’re going to bet on the Fed by buying stocks. What they should be doing is buying gold.”

Gold stocks have been strong in recent weeks, but some of the bigwigs on Wall Street are already talking like the gold rally is over. Peter said it’s barely begun.

…click on the above link to read the rest of the article…

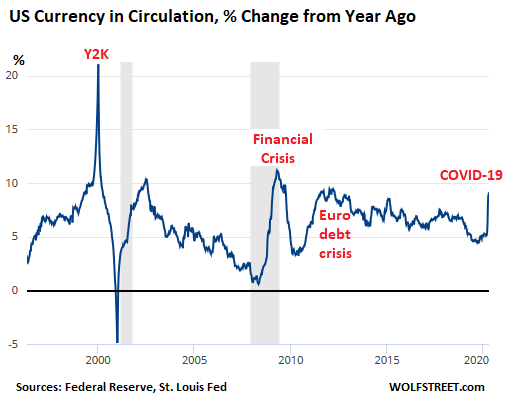

Demand for Bank Notes in Dollars & Euros Spikes Despite Fears of Covid-19 Contaminated Cash

Demand for Bank Notes in Dollars & Euros Spikes Despite Fears of Covid-19 Contaminated Cash

A curious phenomenon.

In the United States, as coronavirus concerns grew and state after state went into lockdown, and as consumption plunged and unemployment exploded at a previously unimaginable rate, the amount of physical dollars in circulation spiked to $1.89 trillion, as of the Federal Reserve’s balance sheet on April 16, having jumped 9.1% compared to a year earlier.

During the darkest days of the Financial Crisis, the demand for U.S. dollar banknotes spiked at year-over-year rates of over 8% for ten straight months and peaked at rate of 11%. But that was nothing compared to what happened during the Y2K craze, when fears that computer systems would malfunction when dates rolled over in the new millennium triggered a mad rush for US dollar banknotes. In December 1999 the total value of dollar bills in circulation spiked by 16.9% from a year earlier, the highest rate since the war-years of the 1940s:

The total value of euro banknotes in circulation in March, as countries across the Eurozone went into Covid-19 triggered lockdowns, increased by €36 billion from February, to €1.31 trillion, according to the ECB. It was the fastest monthly increase since October 2008. And it was up 8.1% from a year earlier. This all happened as consumption in the region slumped to unprecedented levels.

Bank notes denominated in US dollars and euros, the two biggest global reserve currencies, are stashed away in large quantities in other countries with unstable currencies, and they’re used to trade certain types or merchandise on the global black market. The euro is also used as currency in some areas that are not part of the Eurozone. And the dollar is used actively in countries that are either fully or partially dollarized. The Fed has estimatedthat around 70% of 100 dollar bills, which account for nearly 80% of the total value of U.S. currency, are held abroad.

…click on the above link to read the rest of the article…

The coronavirus scoreboard: The illusion of understanding and control

The coronavirus scoreboard: The illusion of understanding and control

Cable television news now frames its news anchors with constantly updated coronavirus statistics, usually the number of cases and the number of dead. There is a sense of urgency in those numbers as viewers watch them tick higher. But, by definition those numbers cannot move otherwise since they are totals of past events.

A more useful indicator would be current active cases. But, that would be hard to count since so many cases are mild or at least uncounted among those now ordered to stay home. And, there are not currently enough testing materials to do complete testing of the world’s population. As it turns out, the number of people who have had the virus may be 50 to 80 times higher than what is currently being recorded. The best we can do for now is to track the number of new cases identified by tests not yet widely available in many areas and see if they decline.

More than anything public officials want to convey the impression of understanding what we face and having solutions to control the outbreak. What they have done successfully in some places through severe social distancing and stay-at-home orders is to reduce the velocity of the spread of the virus without any ability to reduce the number of people who will ultimately contract it. It is really only a matter of time before all those who remain susceptible will get infected unless they hide in total isolation away from humans for good or until an effective vaccine is available—which may be a long time and possibly never. See here and here.

All the counting and the relentless predictions about when a vaccine might be available are really the result of a narrative that says we will soon return to the world we left when coronavirus arrived.

…click on the above link to read the rest of the article…

Meat Prices Suddenly Surge As Food Processing Plants Shut Down, With 1000s Of Tons Left To Spoil

Meat Prices Suddenly Surge As Food Processing Plants Shut Down, With 1000s Of Tons Left To Spoil

As we pointed out earlier in the week, China-owned Smithfield Food’s decision to temporarily shutter the largest pork processing plant in the US, based in Sioux Falls, SD, due to a coronavirus outbreak is a much more significant even than the mainstream media gave credit for. While WaPo focused on bashing the state’s governor, whose refusal to issue a ‘stay at home’ order was blamed for the outbreak, the real significant wasn’t accorded sufficient time and attention, we feel.

The real takeaway here, is that the supply chain for American staples was badly damaged by the outbreak, with the damage still more extensive and stubborn than government officials have really acknowledged. Two months on, and millions of Americans are still having trouble finding toilet paper and sterilizing wipes. A comprehensive list of products in perpetual short-supply would be quite lengthy, at this point.

For all we know, Smithfield might be only the beginning. Earlier on Sunday, we noted a Hormel foods plant in Illinois has been forced to close temporarily after a cluster of cases in the surrounding counties was traced back to workers at the plant. That could leave millions of Americans without access to popular processed foods like Spam. An unopened can of Spam can keep for between 2 an 5 years, depending on storage conditions.

If closures like these continue, it could add further strain on the supply chain. Everywhere you look, you see experts talking about an overabundance of food thanks to the closure of restaurants, which has resulted in unprecedented levels of food waste. But sadly, thanks to the way our food distribution is set up, if there’s no way to process the products, package them and then distribute them to markets around the country, then the food will spoil before it’s eaten.

…click on the above link to read the rest of the article…

Between a Rock and a Hard Place: Pandemic and Growth

Between a Rock and a Hard Place: Pandemic and Growth

There is no way authorities can limit the coronavirus and restore global growth and debt expansion to December 2019 levels.

Authorities around the world are between a rock and a hard place: they need policies that both limit the spread of the coronavirus and allow their economies to “open for business.” The two demands are inherently incompatible, and so neither one can be fulfilled.

The problem is the intrinsic natures of the virus and the global economy. This virus is highly contagious during its asymptomatic phase, which is long (5 to 20 days), and therefore impossible to control with the conventional tools of identifying people with symptoms and isolating them, and tracking their contacts with others.

While there is much we do not know for certainty about Covid-19, what’s clear (and not well-reported) is that its lethality is not exactly like a normal flu. The number of otherwise healthy people under the age of 60 who die of a regular flu is near-zero. The number of otherwise healthy people under the age of 60 who die of Covid-19 is not large as a percentage of cases but it is worryingly above zero. A great many otherwise healthy people under the age of 60 have died of Covid-19.

Yes, the vast majority of those who die are elderly and suffering from chronic health issues, but the number of younger, healthier people who are dying makes this virus consequentially different from a typical flu.

Everyone looking at total deaths (currently much lower than the fatalities in a typical flu season) is missing the semi-random lethality of Covid-19 in younger, healthier people, or at least certain strains of the virus in certain conditions (air pollution, viral load, etc.) and in not yet fully understood sub-populations.

…click on the above link to read the rest of the article…

For Oil and Its Dependents, It’s Code Blue

For Oil and Its Dependents, It’s Code Blue

The great price collapse of 2020 will topple companies and transform states.

If oil has been laid low by the coronavirus, then the nations whose economies most depend on it might soon be on ventilators. By any prognosis the great oil price collapse of 2020 has pushed the world’s most volatile commodity into Code Blue.

No one expects oil, its peddlers or consumers to emerge wealthier or wiser from this crisis. Oil company bankruptcies, already happening before the pandemic, will escalate. And more petro states will begin to stumble, like Venezuela, down the rabbit hole of collapse.

The pandemic, combined with suicidal overproduction and a brief price war between Russia and Saudi Arabia, has reduced oil consumption and revenues on a scale that is mindboggling.

Prior to the pandemic, the world gulped about 100 million barrels a day, filling the atmosphere with destabilizing carbon. Today it sips somewhere between 65 million and 80 million barrels.

At least 20 to 30 per cent of global demand has vanished and nearly two dozen petro-producing countries including Canada have agreed to withhold nearly 10 million barrels from the market. Few expect this agreement will stop the price bleeding.

In fact, the price of Western Canadian Select or diluted bitumen remains below five dollars a barrel — cheaper than hand sanitizer. That’s a drop of more than 80 per cent compared to the month before.

Because the spending of oil fertilizes economic growth and expands national GDPs, most of the world’s economists now predict a long depression after the pandemic.

…click on the above link to read the rest of the article…

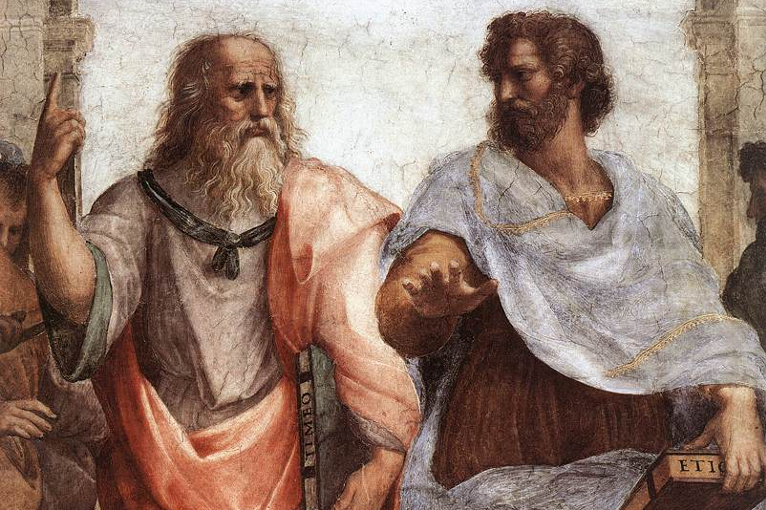

Pandemic Armchair Philosophy Blog 04-15-2020

Pandemic Armchair Philosophy Blog 04-15-2020

First, a recap. The Pandemic Armchair Philosophy Blog was born in the early months of the Covid-19 pandemic, and is designed to demonstrate philosophy’s practical side in these challenging times. It encourages readers–and not just professional philosophers–to utilize the hard-wired human propensities to think, imagine and create. It’s of the armchair variety because we are urged to stay inside these days, and because philosophizing can be done while sitting down.

I am a professional philosopher who has spent more than three decades in the American academy, nearly all of it introducing “the craft of thinking”[1] to pre-professional college students studying engineering, business and the sciences. I have benefitted as much from their practicality as I hope they have from my heartfelt insistence that philosophy’s craft matters for its own sake, as well as for its everyday applications regardless of occupation.

A viral pandemic shifts our sense of space and time. Hard-wrought plans and journeys that made such good sense just a few months ago are now open to uncertainty. Paths are detoured or blocked for who-knows how-long. What better time to step back and consider alternatives, to review those hidden assumptions about success, happiness and work-life balance, and to do some of the deep thinking that philosophy is famously known and occasionally ridiculed[2] for?

But how quickly have our lives and inboxes filled up! Video calls consume us from morning till night, punctuated by a bombardment of poems, podcasts, grocery-washing advice and funny clips from well-meaning friends and colleagues; not to mention the 24 hour news cycle. We shouldn’t begrudge the craving for social connections in times like these. Neither should we forget the importance of self-reflection. Philosophy helps us to step back and see the questions now lying all around in plain view.

…click on the above link to read the rest of the article…

Pandemic ‘poses particular challenges’ for food processing plants: Freeland

Pandemic ‘poses particular challenges’ for food processing plants: Freeland

Agriculture Minister Marie-Claude Bibeau warns labour shortages could affect the food supply

Deputy Prime Minister Chrystia Freeland says the government is working on ways to support Canada’s food processing plants during the COVID-19 pandemic in response to concerns about labour shortages.

“I am so grateful to all of our farmers and ranchers and food processors, but you’re right that the coronavirus poses particular challenges to food processing facilities because of the dangers of contagion there,” Freeland said during her briefing with reporters today.

“That is something that our government has been working on, that I’ve been personally focused on over the past few days.”

Cases of COVID-19 have been confirmed at three Alberta meat packing plants, according to the union that represents plant workers.

United Food and Commercial Workers Canada Union local 401 president Thomas Hesse said three cases of COVID-19 have been confirmed at the JBS plant in Brooks, Alta.

At the Cargill plant in High River, there are 38 COVID-19 cases, and in March one worker at Harmony Beef in Balzac tested positive, he said.

Hesse said the union has reached out to those plants, and to the Olymel pork plant in Red Deer, to ask them to proactively shut down to keep their workers safe.

“They’ve all said no. But Cargill has in some ways done what we’ve asked because of pressure,” Hesse said, noting that the plant has reduced its operations.

Meanwhile, the Olymel hog slaughter and cutting plant in Yamachiche, Que., reopened Tuesday after shutting down for two weeks following an outbreak among employees there.

…click on the above link to read the rest of the article…

Cover-19 and the Death of Market Fundamentalism

COVID-19 AND THE DEATH OF MARKET FUNDAMENTALISM

On top of the countless human tragedies, there will be many long-lasting social and economic impacts of the COVID-19 pandemic. Perhaps none will be more profound though, than the death of free market fundamentalism and the return of the State.

Why now? After all, there have long been moral, social and environmental risks posed by an unfettered market. Risks that present a strong case for action by the State – with inequality and climate change being the two most glaring examples. It didn’t help.

This is different. COVID-19 presents a blindingly powerful economic case for change. It shows that an ideological, quasi-religious approach to regulating markets, sometimes called neo-liberalism and, until the virus, the dominant political approach in the west, is fatally flawed. It creates a weak and unstable economy, which magnifies risks and is unable to manage shocks1. It threatens itself.

Of course, a pandemic would always have had a very large and disruptive economic impact. However, we can already see that those countries with a coherent, competent, respected and well-resourced State – everything market fundamentalists have sought to undermine – are likely to have both lower economic and human cost.

Thus, market fundamentalism is no longer even in the interests of the corporate sector or the financial elites. It creates unmanageable economic risks and ultimately poses an existential risk to capitalism, as argued by Nobel Prize winning economist, Joseph Stiglitz2. Therefore, any corporate or finance leader who continues their knee jerk support for actions to ‘free up markets, ‘reduce taxes’, to ‘get government out of the way’, will now know the consequences.

This is not about being for or against ‘the market’ or the ‘corporate sector’. It is not about ‘curbing corporate power’ or developing ‘an alternative economic system’. Capitalism, correctly defined and well managed, can be a powerful and effective component of an intelligently designed, democratic and fair society.

…click on the above link to read the rest of the article…

Covid-19 and the Collapse of Cash

Covid-19 and the Collapse of Cash

In my last article I referred to how since fears of Covid-19 in the UK took root in March, cash usage has fallen dramatically. Whilst the drop off has been substantial, the trend of cash payments being in decline is long established. Based on early evidence, the coronavirus pandemic has exacerbated this decline.

For context, in March 2019 an Access to Cash Review was published which detailed the precarious state of Britain’s cash network. The review, funded by Link (the UK’s biggest cash machine network) showed that over the past decade cash payments had fallen from 63% of all payments to 34%. To quote the report directly, ‘a straight-line trajectory of current trends would see an end of cash use by 2026‘.

Twelve months on, the predicament with cash is now far more serious. Before getting into that, here is a summary of where we find ourselves in regards to cash in the midst of Covid-19.

In January the severity of the coronavirus spread in China became more apparent by the day. The first case of the virus was reported in the UK at the end of the month, weeks before cash usage began its descent. To give an idea of how the cash network infrastructure looked at the time, we can use Link’s monthly ATM Footprint Report as a guide. The most recent report shows that between January 2018 and February 2020, the number of free-to-use ATM’s had reduced from 54,500 to 45,000 – a 17% drop in just two years that equates to 9,500 ATM’s.