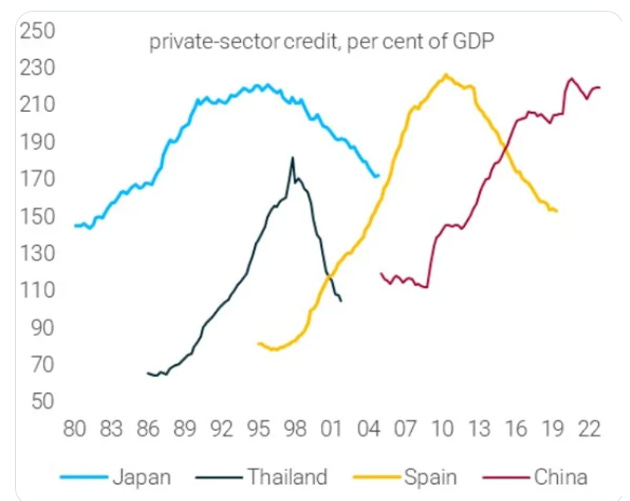

Below, we follow the breadcrumbs of simple math and bond market signals toward an oft-repeated pattern of how once-great nations become, well…not so great any more.

Debt Destroys Nations

Debt, once it passes the Rubicon from extreme to just plain madness, destroys nations.

Just ask the former Spanish, British or Dutch empires. Or ask the inter-war Germans. Ask the Yugoslavians of the 1990’s or ask a historian of Ancient Rome or a merchant in modern Argentina.

It’s all pretty much the same story, just different a different stage or curtain call.

Like Hemingway’s description of poverty, the process begins slowly at first, and then all at once.

Part of this process involves currency debasement needed to pay down more desperate issuance of IOUs, a process evidenced by rising rather than “transitory” inflation.

Thereafter, comes increased social unrest, and hence increased centralization from the political left or right in the name of “what’s best for us.”

Sound familiar?

Centralization—The Last, Failed Act

Centralization never works in the long run, but that has never stopped opportunists from trying.

Just look at our central bankers.

In a centralized rather than free market, the very name “central bank” should be a dead give-away as to their real role and profile.

As private central banks have been slowly increasing their hidden power and control over national markets and hence national welfare, the very notion of free price discovery in bonds, and indirectly in stocks, is now all but an extinct financial creature in the neo-feudalism which long ago replaced genuine capitalism.

How the Central Game is Played—From Temporary Prosperity to Permanent Ruin

When central banks like the Fed repress rates and print gobs and gobs of money, bonds are artificially supported, which means their prices go up and their yields are compressed.

…click on the above link to read the rest…