The Failure of Neoliberalism

Backing Up Macro Alf, & Showcasing Ravel, in 11 plots and two averages

The macro commentator Alfonso Peccatiello, who writes as @MacroAlf on Twitter/X and publishes the Macro Compass newsletter, recently posted an excellent thread on private debt that cited my work:

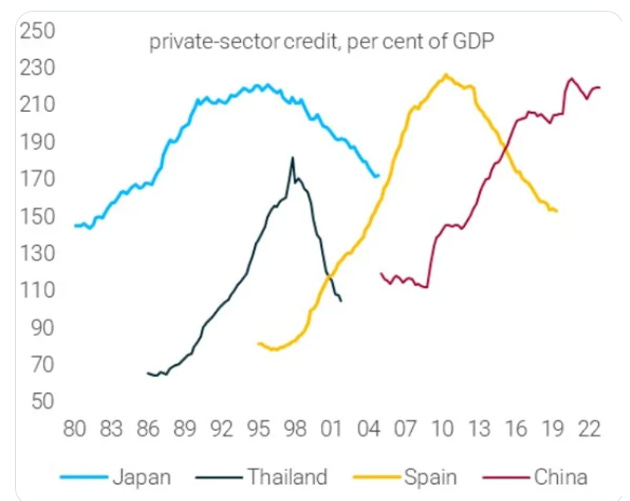

Let me show you one of the most underrated and yet crucial long-term macro variables in the world. Debt. But not government debt: people should stop obsessing it! The government can print money in its own currency. Of course, this has limitations: capacity constraints, inflation, credibility…but there is much more vulnerable source of debt out there. Private sector debt levels and trends are by far a more important macro variable to follow.

Let me explain why. The private sector doesn’t have the luxury to print money: if you get indebted to your eyeballs and you lose your ability to generate income, the pain is real. This amazing chart from my friend @darioperkins proves the point quite eloquently…

Figure 1: Alf’s chart of private debt to GDP bubble for 4 key economies

This post follows up on Alf’s lead by producing a private debt-focused profile of all the major economies in the OECD whose debt levels are also recorded by the Bank of International Settlements. It combines data on inflation and unemployment rates from the OECD with private and government debt and house price data from the BIS.

The plots in this post run in reverse alphabetical order from the United States (see Figure 2) to Australia. Their message is the same that Alf made in his tweet stream (x-stream?): private debt matters, and the fact that conventional Neoclassical economics ignores it is a major reason why it has failed as a guide to economic theory and policy.

…click on the above link to read the rest…