USDCNY volumes getting a bit embarrassing now.

Home » Posts tagged 'currency devaluation' (Page 5)

Tag Archives: currency devaluation

These Currencies Could Be The Next To Tumble In Global FX Wars

These Currencies Could Be The Next To Tumble In Global FX Wars

Earlier this week, Kazakhstan moved to a free float for the tenge, prompting the currency to plunge by some 25%.

The move came after the country’s exporters could no longer stand the pain from plunging crude prices and the RUB’s relative weakness. China’s move to devalue the yuan was the straw that broke the camel’s back.

Here, summed up in one chart, was the problem:

This “may prop up growth in the country and help [the] fiscal sector to accommodate external pressures in case they continue to mount,” Deutsche Bank said, commenting shortly after the news hit.

In many ways, the decision to float the tenge (like the move by Vietnam to allow the dong to swing in a wider channel) is emblematic of what’s taking place in FX markets from Brazil to South Korea.

Shockwaves from China’s devaluation have conspired with sluggish global demand and an attendant commodities slump to wreak havoc on developing market currencies the world over. For Asia ex-Japan, the outlook is especially dire, as the PBoC’s FX bombshell threatens to undermine regional export competitiveness, put upward pressure on the region’s REER, and will likely serve to further depress demand from the mainland.

Idiosyncratic political events have only made the situation worse for the likes of Brazil, Turkey, and Malaysia.

Here are some brief comments from Citi:

Is this Asian Currency Crisis Part 2? It sure feels like it. It would be more accurate to call it the Great EM Deval-Meltdown as emerging market currencies are in freefall and another peg bites the dust overnight (Kazakhstan). There are few pegs left besides Saudi Arabia and EURCZK and both are under pressure. The 1-year SAR forwards are at 12-year wides and EURCZK is pinned to the 27.00 floor. Take a look at the white chart below right which shows Malaysian Ringgit and you can get a sense of the 1997/1998 crisis vs. now.

…click on the above link to read the rest of the article…

It Starts: Broad Retaliation Against China in Currency War

It Starts: Broad Retaliation Against China in Currency War

The biggest global “tail risk” is China’s deteriorating economy and an emerging market debt crisis, according to BofA Merrill Lynch’s monthly poll of fund managers. And 48% of them were expecting the Fed to raise rates, despite languid growth and low inflation expectations.

Hot money is already fleeing emerging markets. Higher rates in the US will drain more capital out of countries that need it the most. It will pressure emerging market currencies and further increase the likelihood of a debt crisis in countries whose governments, banks, and corporations borrow in a currency other than their own.

This scenario would be bad enough for the emerging economies. But now China has devalued the yuan to stimulate its exports and thus its economy at the expense of others. And one thing has become clear today: these struggling economies that compete with China are going to protect their exports against Chinese encroachment.

Hence a currency war.

It didn’t help that oil plunged nearly 5% to a new 6-year low, with WTI at $40.55 a barrel, after the EIA’s report of an “unexpected” crude oil inventory buildup in the US,now, during driving season when inventories are supposed to decline!

And copper dropped to $5,000 per ton for the first time since the Financial Crisis, down 20% so far this year. Copper is the ultimate industrial metal. China, which accounts for 45% of global copper consumption, is the bull’s eye of all the fretting about demand. 5,000 is the line in the sand. A big scary number. Other metals fared similarly.

Copper powerhouse Glencore, whose shares plunged nearly 10% today, blamed“aggressive and synchronized large-scale short selling” for the copper debacle, instead of fundamentals. But fundamentals have been whacking copper for years, and shorts have simply been joyriding the trend.

…click on the above link to read the rest of the article…

Currency Wars Continue As Kazakh Currency Crashes 25% After Peg Abandoned

Currency Wars Continue As Kazakh Currency Crashes 25% After Peg Abandoned

On Tuesday we remarked on the increasingly perilous plight of yet another country whose economy has come under increased pressure from plunging oil prices and China’s move to devalue the yuan: Kazakhstan.

Just one day after allowing the tenge to fall sharply in the interbank market and no longer able to take the pain from falling crude prices, the country moved to a free float for the tenge overnight, causing the currency to plunge by a quarter.

The move is clearly a desperate attempt to preserve export competitiveness in the face of a falling rouble and a devalued yuan. This is the third time the country’s central bank has devalued the currency since 1999 – the last time was in February of 2014.

Although central bank governor Kairat Kelimbetov put on a brave face and very rationally explained that “this is not a devaluation, this is a transition to a freely floating rate when the market itself determines a balanced exchange rate on the basis of demand and offer,” it’s quite clear that the situation for the country’s exporters had become dire and bringing the tenge more inline with moves seen in the currencies of China and Russia (Kazakhstan’s top trading partners) was probably long overdue. Here’s Bloomberg:

The central Asian nation, which counts Russia and China as its top trading partners, said it was switching to a free float, triggering a 23 percent slide in the tenge to a record 257.21 per dollar. Following the shock yuan devaluation last week, a gauge of 20 developing-nation exchange rates capped its longest slump since 2000, and losses continued this week as Vietnam devalued the dong and currencies from Russia to Turkey fell at least 3 percent.

…click on the above link to read the rest of the article…

Canada “Getting Clocked” by Something Far Bigger than Oil

Canada “Getting Clocked” by Something Far Bigger than Oil

Canada is likely in a technical recession, after the economy shrank for the first five months of the year. It’s heavily dependent on commodities. The oil bust and the broader commodity rout have been blamed liberally. The theory goes that the problem is contained. The oil patch may be wallowing in the mire. But no problem, the rest of Canada is fine.

The swoon of the Canadian dollar against the US dollar has caused a bout of false hope that this would make Canadian exports of manufactured goods more attractive to buyers in the US and elsewhere, and that the economy could thus export its way out of trouble. This theory has now run aground.

Because the threat to manufacturing in Canada comes from Mexico.

“I think Mexico’s just a cheaper place to produce, and you have enough human capital and engineering skills to produce almost everything you can produce in Canada and do it a lot cheaper,” Steven Englander, Citibank’s global head of G-10 currency strategy, told Bloomberg.

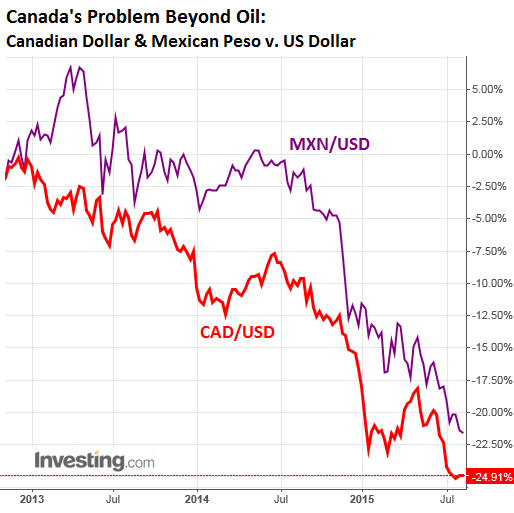

And the multi-year swoon of the Canadian dollar against the US dollar isn’t going to help. Over the last three years, the loonie has lost 25% against the US dollar, the peso 21%. Over the past 12 months, the loonie lost 16% against the dollar, but practically in lockstep with the peso.

This chart shows the move of the two currencies against the dollar as a percentage change from three years ago. It’s like a downhill tango:

So devaluing the loonie sounds like a good old central bank solution. But it hasn’t boosted exports of manufactured goods:

The US dollar value of non-oil exports from Canada to the US reached $32 billion during the peak month in 2008, crashed during the Financial Crisis, and recovered, but by 2012 started petering out at $30 billion a month, has since lost ground, and remains below where it had been before the financial crisis.

…click on the above link to read the rest of the article…

China Stocks Crash, More Than Half Of Market Halted Limit Down; PBOC Loss Of Control Spooks Global Assets

China Stocks Crash, More Than Half Of Market Halted Limit Down; PBOC Loss Of Control Spooks Global Assets

China sure has its micro-managing hands full these days.

Just hours after the PBOC announced a modestly “revalued” fixing in the CNY, which curiously led to weaker trading in the onshore Yuan for most of the day before a forceful last minute intervention by the central bank pushed it back down to 6.39…

… it was the local stock market spinning plate – which had been relatively stable during the entire FX devaluation process – that China lost control over, and after 7 days of margin debt increases the Shanghai Composite plunged by 6.2% in late trade,tumbling 245 points to 3748, just 240 points above its recent trough on July 8, a closing level some 27% off its June peak. The smaller Shenzhen Composite Index fell 6.6% to 2174.42. This was the biggest single-day rout since July 27.

According to Reuters, “volatility in both indexes spiked in the afternoon in what is becoming a mysteriously recurring pattern in China’s stock markets since Beijing stepped in to avert a full-blown price crash in early summer.”

There were various reasons cited for the selling: one was that with Chinese housing data coming in stronger than expected, that Beijing may limit its future interventions to promote further easing of financial conditions and thus, supporting the market as we warned last night after the housing data came out:

…click on the above link to read the rest of the article…

Indonesia Impaled: Currency Crashes To 1998 Asian Crisis Low As Exports Crater

Indonesia Impaled: Currency Crashes To 1998 Asian Crisis Low As Exports Crater

On Monday we laid out the rather dire road ahead for the world’s emerging economies in the face of China’s entry into the global currency wars. The path ahead is riddled with exported deflation and decreased trade competitiveness for a whole host of emerging economies [and] all of this is set against a backdrop of declining global growth and trade, a trend which many had assumed was merely cyclical, but which in fact may prove to be structural and endemic.”

Well don’t look now, but trade just collapsed for Indonesia as exports and imports plunged 19.2% and 28.4% (more than double to consensus estimate), respectively in July.

Imports of raw materials dove 24%. Manufacturing and palm oil exports fell 7.1% and 2.4%, respectively, nearly tripling June’s declines. Oil and gas exports fell nearly 8%.

Meanwhile, Bank of Indonesia kept its policy rate on hold at 7.5% and indeed the bank looks to be stuck in a dilemma similar to what we described earlier this month when we noted that “EM central bankers are grappling with slumping exports and FX-pass through inflation or, more simply, bankers are caught between a ‘can’t cut to boost the economy’ rock and a ‘can’t hike to tame inflation’ hard place. The rupiah, like the Malaysian ringgit, is trading near multi-decade lows and hit its weakest level since August 1998 earlier in the session. Depressed commodity prices and slumping demand from China aren’t helping.

And neither is Beijing’s devaluation of the yuan which means that suddenly, Indonesia has lost export competitiveness to China while anything China imports from Indonesia will now cost more.

…click on the above link to read the rest of the article…

This Week In Energy: The Growing Threat From China

This Week In Energy: The Growing Threat From China

Oil prices dropped to new six-year lows this week as WTI dipped below $42 per barrel. The big piece of news this week was the currency depreciation in China. It seems we are talking more and more these days about the warning signs coming from China’s economy and how the trouble there is depressing oil prices. In June and July, it was the stock market crash, and this week it is the currency depreciation. The yuan dropped 3 percent by the end of the week after stabilizingat 6.3975 per dollar.

The move to devalue the yuan was aimed at providing a jolt to Chinese exports. But a more pessimistic take on the move is that China’s economy is starting to raise some red flags. The grip that the central government has had on the economy appears to be slipping. The Chinese government has carefully crafted a reputation of control, backed up by two decades of phenomenal growth.

Presiding over such a period of unprecedented economic expansion has created an aura of invincibility and inevitability. But the economy is starting to appear fragile, with high levels of provincial debt, an inflated stock market, and growing unease about environmental pollution that could force the government to pullback on growth. To make matters worse, the port city of Tianjin suffered a massive explosion this week that killed dozens of people and spewed toxic chemicals into the air. The incident is emblematic of China’s growth-at-all-costs model, which is starting to run its course as people become fed up.

Related: Energy Investors May Have A Long Wait Ahead

That is the backdrop for the currency move this week, and the devaluation sent a shock through the oil markets. Oil demand has been growing, but not quick enough to soak up extra crude supplies. A weaker Chinese currency will make oil comparatively more expensive, so could knock Chinese oil demand down a bit, a bearish development for oil.

…click on the above link to read the rest of the article…

Malaysia Meltdown: Asian Currency Crisis 2.0 Sends Ringgit, Stocks, Bonds Crashing

Malaysia Meltdown: Asian Currency Crisis 2.0 Sends Ringgit, Stocks, Bonds Crashing

When China went the “nuclear” (to quote SocGen) devaluation route earlier this week in a last ditch effort to rescue its export-driven economy from the perils of an increasingly painful dollar peg, everyone knew things were about to get a whole lot worse for an EM currency basket that was already reeling from plunging commodity prices, slumping Chinese demand, and the threat of an imminent Fed hike.

Sure enough, EM currencies from Brazil to South Korea plunged, and monetary authorities – unsure whether to play down the move or cry foul – scrambled to respond.

With some Asian currencies already falling to levels last seen 17 years ago, some analysts fear that an Asian Currency Crisis 2.0 may be just around the corner.

That rather dire prediction may have been validated on Friday when Malaysia’s ringgit registered its largest one-day loss in almost two decades.

As FT notes, “sentiment towards Malaysia has been damped by a range of factors including sharp falls in global energy prices since the end of June. Malaysia is a major exporter of both oil and natural gas, with crude accounting for almost a third of government revenue.” The central bank meanwhile, “has opted to step back from intervening in the market in response to the falling renminbi, unleashing pent-up downward pressure on the ringgit.” That, apparently, marks a notable change in policy. “The most immediate challenge is the limited scope of Malaysia’s central bank to step in,” WSJ says, adding that “for weeks, it tried to stem the currency’s slide, digging into its foreign-exchange reserves to prop up the ringgit and warning banks from aggressively trading against its currency.”

Surveying the damage, here’s the one-day:

And the one week:

And the one month:

…click on the above link to read the rest of the article…

Both ECB And BOJ Warn More QE May Be Response To Chinese Currency War

Both ECB And BOJ Warn More QE May Be Response To Chinese Currency War

Minutes from the ECB’s most recent policy meeting reveal that Mario Draghi and company have a number of concerns about the pace of economic growth in the euroarea and about the outlook for inflation which, much to the governing council’s surprise, “remains unusually low.”

Board members also took note of increasingly volatile EGB markets and made special mention of the second bund VaR shock which took place at the first of June, something the central bank attributes to “overvaluation [and] one?way market positioning related to the public sector purchase programme.” In other words: “our bad.”

The bank gave itself the now customary pat on the back for the “success” of PSPP noting that the “moderate frontloading of purchases” (a reference to the effective expansion of QE that was leaked to a room full of hedge funds at an event in May) was going smoothly, other than the above-mentioned nasty bout of extreme volatility.

As for the economy and inflation, well, that’s not going so hot. “Overall, the recovery in the euro area was expected to remain moderate and gradual, which was considered disappointing from both a longer-term and an international perspective [while] consumer price inflation had remained unusually low.”

Between that rather grim assessment and the comments cited above regarding volatility, one is certainly left to wonder what it is exactly about PSPP that’s going so “smoothly.”

But as interesting as all of that is (or isn’t), the most compelling comments were related to China. Here’s the excerpt:

In particular, financial developments in China could have a larger than expected adverse impact, given this country’s prominent role in global trade.

Consider that, and consider the following statement sent to Bloomberg by an adviser to Japanese PM Shinzo Abe:

…click on the above link to read the rest of the article…

The US-China “Currency War”: Winners and Losers

The US-China “Currency War”: Winners and Losers

American politicians aren’t congratulating the Communist Party in Beijing for its success in following the capitalist proverb “enrich yourself,” but screaming foul play: China falsifies the exchange rate of the yuan so that it can make more money off the USA than vice versa. The accusation, made by everybody from Donald Trump to Bernie Sanders, is that China’s policy is killing good-paying American jobs – and a lot else besides. What’s bad for America can’t be caused by anything done by America, but by Chinese trickery!

America’s right to success

The remedy for the problem is just as obvious as the blame: China must get on board with America’s approved rules for international trade and commerce. If China allows its currency to free-float, then the value of the yuan will adjust, China’s exports to the USA will become more expensive, China and the rest of the world will buy more products from the USA, and jobs will return to the USA.

The assumption is that the global money traders, in their infinite wisdom, would find the “correct” exchange rate between the yuan and the dollar once they have free access to the supply and demand for China’s currency. What would the correct exchange rate be? One that guarantees the success of US firms.

Before this week’s turnaround in response to its slump, China had been moving towards free market convertibility of the yuan. Since 2005, it had allowed its currency to gain almost 30 percent in relation to the dollar, while trying to moderate its increase. Yet the results for the trade balance with the US were exactly the same. What was inferred from this? China hadn’t gone far enough. So how will we know when it’s gone far enough? When America is the winner.

…click on the above link to read the rest of the article…

China Black Swans Not So Rare Anymore as PBOC Shocks Markets

China Black Swans Not So Rare Anymore as PBOC Shocks Markets

Investors should prepare for more surprises out of China after the yuan’s devaluation became the country’s latest unexpected policy move to roil global markets.

That’s the advice from Fraser Howie, co-author of “Red Capitalism: The Fragile Financial Foundation of China’s Extraordinary Rise.” He says Chinese policy decisions are becoming “erratic” as authorities struggle to combat the nation’s deepest economic slowdown in more than two decades.

This week’s tumble in the yuan — the biggest devaluation since 1994 — comes just a month after unprecedented state intervention in the stock market deepened a $4 trillion sell-off. Two years ago, authorities triggered the country’s worst modern-day cash squeeze by restricting the supply of funds to the banking system. The failure of China’s decision makers to telegraph and explain those policy changes has increased volatility worldwide as traders struggle to forecast what happens next in Asia’s biggest economy, Howie said.

While investors parse every word in Federal Reserve statements for clues on future U.S. monetary policy, the People’s Bank of China provides few such details, while decisions are often the result of political wrangling, according to Howie.

“We don’t know what their policy is,” he said. “We don’t see minutes of meetings. We don’t get regular announcements, so we get a tremendous lack of transparency.”

Yuan Plunge

The PBOC took markets by surprise when it cut the daily fixing for the yuan by 1.9 percent on Tuesday, ending a four-month peg against the dollar. The currency tumbled 2.9 percent in two days, the most since the country ended a dual-currency system in 1994, while it now trades at the biggest discount to the offshore yuan since 2010.

…click on the above link to read the rest of the article…

A Death Cross, Wild Market Swings And A Currency War – And We Haven’t Even Gotten To September Yet

A Death Cross, Wild Market Swings And A Currency War – And We Haven’t Even Gotten To September Yet

Things continue to line up in textbook fashion for a major financial crisis by the end of 2015. This week, Wall Street has been buzzing about the first “death cross” that we have seen for the Dow since 2011. When the 50-day moving average moves below the 200-day moving average, that is a very important psychological moment for the market. And just like during the run up to the stock market crash of 2008, we are starting to witness lots of wild swings up and down. The Dow was up more than 200 points on Monday, the Dow was down more than 200 points on Tuesday, and it took a nearly 700 point roundtrip on Wednesday. This is exactly the type of behavior that we would expect to see during the weeks or months leading up to a crash. As any good sailor will tell you, when the waters start getting very choppy that is not a good sign. Of course what China is doing is certainly not helping matters. On Wednesday, the Chinese devalued the yuan for a second day in a row, and many believe that a new “currency war” has now begun.

Things continue to line up in textbook fashion for a major financial crisis by the end of 2015. This week, Wall Street has been buzzing about the first “death cross” that we have seen for the Dow since 2011. When the 50-day moving average moves below the 200-day moving average, that is a very important psychological moment for the market. And just like during the run up to the stock market crash of 2008, we are starting to witness lots of wild swings up and down. The Dow was up more than 200 points on Monday, the Dow was down more than 200 points on Tuesday, and it took a nearly 700 point roundtrip on Wednesday. This is exactly the type of behavior that we would expect to see during the weeks or months leading up to a crash. As any good sailor will tell you, when the waters start getting very choppy that is not a good sign. Of course what China is doing is certainly not helping matters. On Wednesday, the Chinese devalued the yuan for a second day in a row, and many believe that a new “currency war” has now begun.

So what does all of this mean?

Does this mean that the time of financial “shaking” has now arrived?

Let’s start with what is happening to the Dow. When the 50-day moving average crosses over the 200-day moving average, it is a very powerful signal. For example, as Business Insider has pointed out, if you would have got into stocks when the 50-day moving average moved above the 200-day moving average in December 2011, you would have experienced a gain of 43 percent by now…

The Dow Jones Industrial Average has been on an unrelenting upward trajectory since its October 2011 low.

…click on the above link to read the rest of the article…

China Provides Another Threat to Oil Prices

China Provides Another Threat to Oil Prices

First it was a stock market meltdown, now it’s a weakening currency.

China continues to present significant risks to the oil market. On August 11, China decided to devalue its currency in an effort to keep its export-driven economy competitive. The yuan fell 1.9 percent on Tuesday, the second largest single-day decline in over 20 years. The yuan dropped by another 1 percent on Wednesday.

Related: Bullish Bets On Oil Go Sour

The currency move followed shocking data that revealed that China’s exportsplummeted by 8 percent in July. A depreciation of the currency of 3 percent will provide a jolt to Chinese exporters, but will slam companies and countries that export to China.

China insisted that the devaluation was a “one-off” event. “Looking at the international and domestic economic situation, currently there is no basis for a sustained depreciation trend for the yuan,” the People’s Bank of China said in a statement.

Related: When Will Oil Prices Turn Around?

But it also appears to be a move to allow the currency to float more freely according to market principles, something that the IMF has welcomed. “Greater exchange rate flexibility is important for China as it strives to give market-forces a decisive role in the economy and is rapidly integrating into global financial markets,” the IMF said. Although there is still quite a ways to go, the move is also seen as a prerequisite for the yuan to achieve reserve-currency status.

For oil, the move has raised concerns that oil demand will take a hit. China is the world’s largest importer of crude, and a devalued currency will make oil more expensive. On August 11, oil prices dropped to fresh six-year lows, surpassing oil’s low point from earlier this year. But with China’s economy – once the engine of global growth – suddenly looking fragile, it would be difficult to argue with any certainty that oil has hit a bottom.

…click on the above link to read the rest of the article…

Emerging Market Currencies To Crash 30-50%, Jen Says

Emerging Market Currencies To Crash 30-50%, Jen Says

Less than 24 hours ago, we argued that although it might have seemed as though Brazil hit rock bottom in Q2 when it suffered through the worst inflation-growth mix in over a decade, things were likely to get worse still.

The country, which is also coping with twin deficits and a terribly fractious political environment, is at the center of what Morgan Stanley recently called “a triple unwind of EM credit, China’s leverage, and US monetary easing” and now that its most critical trading partner has officially entered the global currency war, all roads lead to further devaluation of the faltering BRL.

And it’s not just the BRL. As Bloomberg reports, former IMF economist Stephen Jen (who called the 1997 Asian crisis while at Morgan Stanley) thinks EM currencies could fall by an average of 30% going forward on the back of the PBoC’s move to devalue the yuan. Here’s more:

[The] devaluation of the yuan risks a new round of competitive easing that may send currencies from Brazil’s real to Indonesia’s rupiah tumbling by an average 30 percent to 50 percent in the next nine months, according to investor and former International Monetary Fund economist Stephen Jen.

Volatility measures were already signaling rising distress in emerging markets even before China’s shock move. An index of anticipated price swings climbed above a rich-world gauge at the end of July, reversing the trend seen for most of the past six months.

“If this is the beginning of a new phase in Beijing’s currency policy, it would be the biggest development in the currency world this year,” said Jen, founder of London-based hedge fund SLJ Macro Partners LLP. “The emerging-market currency weakening trend is now going global.”

Latin America is a particular concern because of the region’s high levels of corporate debt, said Jen

…click on the above link to read the rest of the article…