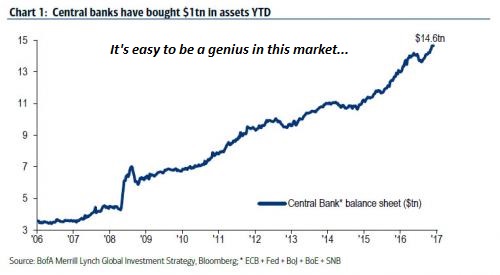

Is the stock market bubble about to burst? I know that I have been touching on this theme over and over and over again in recent weeks, but I can’t help it. Red flags are popping up all over the place, and the last time so many respected experts were warning about an imminent stock market crash was just before the last major financial crisis. Of course nobody can guarantee that global central banks won’t find a way to prolong this bubble just a little bit longer, but at this point they are all removing the artificial support from the markets in coordinated fashion. Without that artificial support, it is inevitable that financial markets will experience a correction, and the only real question is what the exact timing will be.

Is the stock market bubble about to burst? I know that I have been touching on this theme over and over and over again in recent weeks, but I can’t help it. Red flags are popping up all over the place, and the last time so many respected experts were warning about an imminent stock market crash was just before the last major financial crisis. Of course nobody can guarantee that global central banks won’t find a way to prolong this bubble just a little bit longer, but at this point they are all removing the artificial support from the markets in coordinated fashion. Without that artificial support, it is inevitable that financial markets will experience a correction, and the only real question is what the exact timing will be.

For example, Bank of America’s Michael Hartnett originally thought that the coming correction would come a bit sooner, but now he is warning of a “flash crash” during the first half of 2018…

Having predicted back in July that the “most dangerous moment for markets will come in 3 or 4 months“, i.e., now, BofA’s Michael Hartnett was – in retrospect – wrong (unless of course the S&P plunges in the next few days). However, having stuck to his underlying logic – which was as sound then as it is now – Hartnett has not given up on his “bad cop” forecast (not to be mistaken with the S&P target to be unveiled shortly by BofA’s equity team and which will probably be around 2,800), and in a note released overnight, the Chief Investment Strategist not only once again dares to time his market peak forecast, which he now thinks will take place in the first half of 2018, but goes so far as to predict that there will be a flash crash “a la 1987/1994/1998” in just a few months.

That certainly sounds quite ominous.

…click on the above link to read the rest of the article…