Zimbabwe has a history of economic chaos and misery. In 2008, Zimbabwe had the second-highest incidence of hyperinflation in recorded history. The estimated inflation rate from November 2008 was 79,600,000,000%.

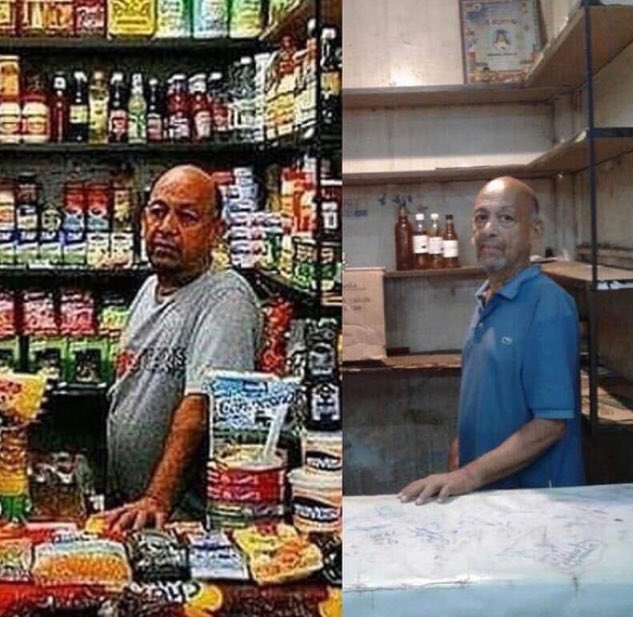

Currently, citizens of Zimbabwe are stocking up on essentials such as bread, beef, cooking oil and other necessities in anticipation of a looming economic disaster. It has reached a point where certain items are beginning to be rationed such as bottled water and beer.

In addition to the panic buying when it comes to food, the country has been running out of essential medical supplies as the country’s health system seems to be on the verge of a complete collapse.

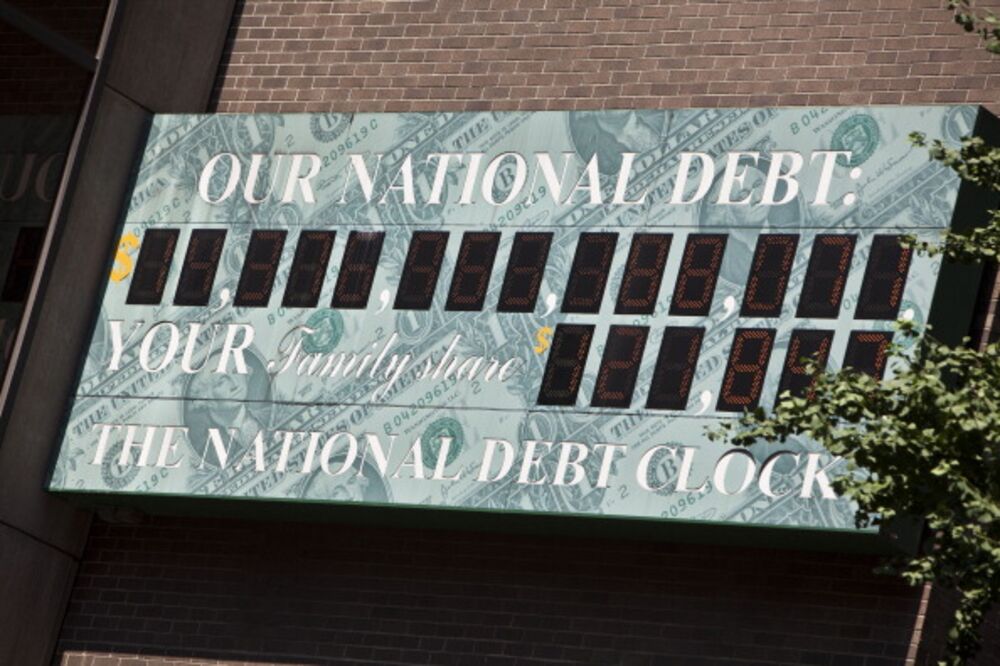

Since 2008 the country has relied on US dollars to conduct daily transactions. However, today the country faces foreign-currency shortages and a mountain of debt which many fear could spark the type of collapse that took place a decade ago when hyperinflation left the country devastated.

With a lack of supply of foreign currency, the citizens of Zimbabwe have been forced to use a currency called bond notes, bank cards and mobile money which are all beginning to deteriorate against the US dollar on the black market.

With soaring US dollar rates on the black market, businesses in Zimbabwe are having a hard time restocking inventory, which is even forcing some businesses to close.

“The parallel market is unsustainably high and has decimated confidence. Prices have been going up while margins are eroded,” Denford Mutashu, president of the Retailers Association of Zimbabwe, said.

On Wednesday, finance and economic development Minister Prof Mthuli Ncube attempted to reassure the public that their money would be safe in the banks, saying a legal instrument would be put in place to ensure that the government does not raid their accounts like it did in 2008.

Let’s hope history does not repeat itself for the sake of Zimbabwe.