Look to consumer prices to see where gold and silver are headed

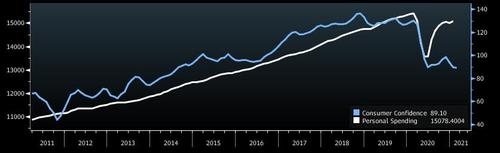

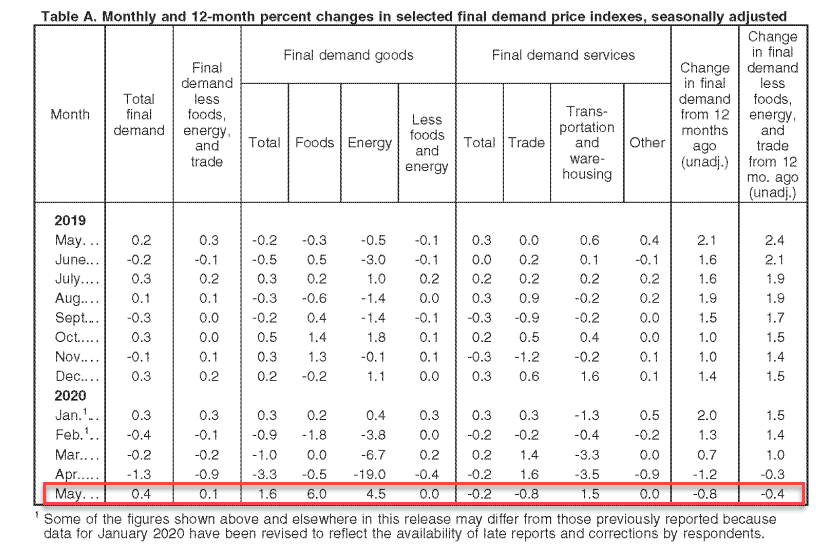

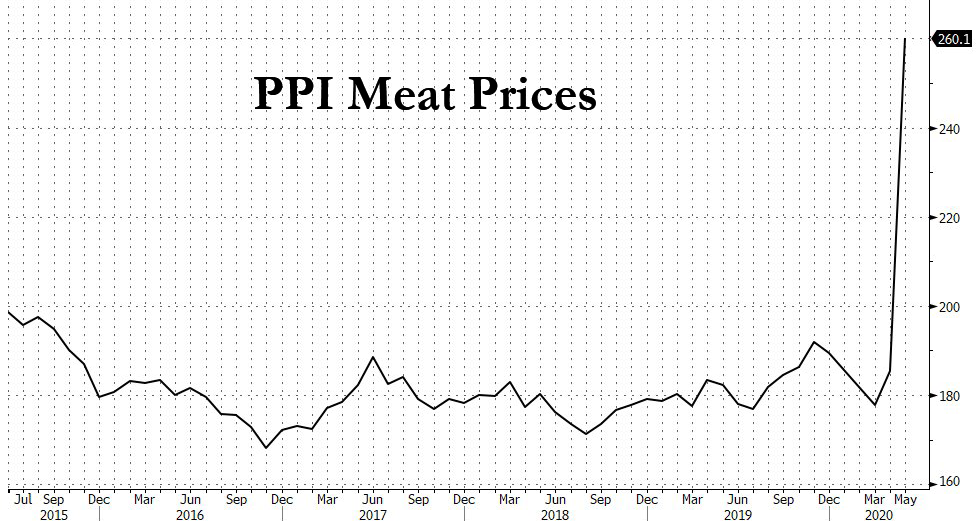

As worries about currency erosion and inflation abound, the question of how to measure these crucial benchmarks has become a cornerstone of the debate. The Federal Reserve’s insistence that inflation is being kept in check and below its annual targeted rate of 2% seems impossible considering the oceans of money poured into the economy. Economics 101 teaches us that, when money supply goes up without a corresponding increase in goods for sale, prices must rise. It’s virtually a law of nature.

Statements by officials have given rise to even more red flags, whether one refers to the Fed’s willingness to let inflation run rampant or former U.S. Treasury Secretary Lawrence Summers’s warning that the Fed would “set off inflationary pressures of a kind we have not seen in a generation.”

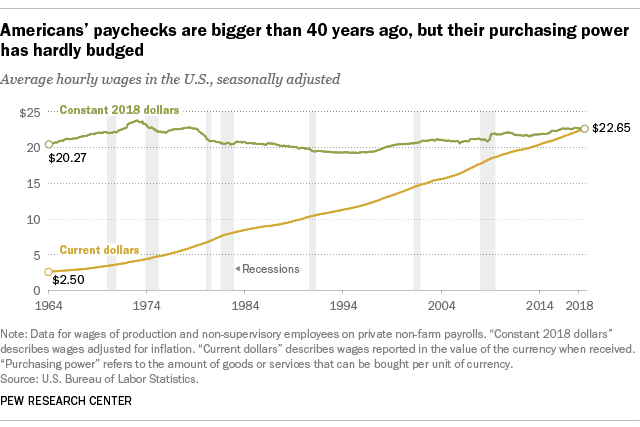

But how can the average citizen know whether there has been a sudden spike in inflation, and just how quickly their purchasing power is wasting away?

The FAO Food Price Index (FFPI) averaged 116.0 points in February 2021, 2.8 points (2.4 percent) higher than in January, marking the ninth month of consecutive rise and reaching its highest level since July 2014. source

…click on the above link to read the rest of the article…

birch gold group, inflation, price inflation, food price inflation, fed, us federal reserve, consumer prices