BREAKING: Chinese stock market ends 3% lower, w/ 1,200+ stocks down 10% daily limit; Chinese media admit gov “failure to boost market” today

Home » Posts tagged 'gdp' (Page 20)

Tag Archives: gdp

The Curse Of The Euro: Money Corrupted, Democracy Busted

The Curse Of The Euro: Money Corrupted, Democracy Busted

The preposterous Gong Show in Brussels over the weekend was the financial “Ben Tre” moment for the Euro and ECB. That is, it was the moment when the Germans—–imitating the American military on that ghastly morning in February 1968——set fire to the Eurozone in order to save it.

Some day history will judge good riddance……..but that get’s ahead of the story.

According to an American soldier’s first hand recollection of the Vietnam event, it was a Major Booris who infamously told reporter Peter Arnett, “It became necessary to destroy the town to save it”.

After the massacre of Greek democracy in the wee hours Monday morning, Angela Merkel said the same thing—even if her language was a tad less graphic:

It reflects the basic principles which we’ve followed in rescuing the euro. It now hinges on step-by-step implementation of what we agreed tonight.”

Now no one in their right mind could think that lending another $96 billion to an utterly bankrupt country makes any sense whatsoever. After all, the Greek economy has shrunk by 30% since 2008 and is wreathing under what is objectively a $400 billion public debt already in place today.

That figure follows from the fact that on top of Greece’s acknowledged $360 billion of general government debt there’s at least another $25 billion loan embedded in the ELA advances to the Greek banking system. The latter is deeply insolvent, meaning that some considerable portion of the $100 billion ELA currently outstanding is not an advance against good collateral in any plausible banking sense of the word, but merely a backdoor fiscal transfer from the ECB to keep Greece’s financial shipwreck afloat.

Likewise, as I demonstrated Friday, given the even deeper deep hole into which the Greek economy has tumbled during the last six months, the fiscal targets extracted from Greece under this weekend’s demarche are utterly ridiculous. Indeed, even if the targeted primary surpluses of 1,2,3 and 3.5% of GDP are miraculously reached through 2018, upwards of $15 billion of budget deficits after interest accruals would be incurred anyway, and a lot more than that if there are material budget shortfalls, which is a virtual certainty.

…click on the above link to read the rest of the article…

Chinese Stock Plunge Resumes With 1200 Stocks Halted Limit Down; Yellen, Greek Elections On Deck

Chinese Stock Plunge Resumes With 1200 Stocks Halted Limit Down; Yellen, Greek Elections On Deck

Just when the Chinese plunge protection team (and “arrest shortie” task force) seemed to be finally getting “malicious selling” under control, first we saw a crack yesterday when the composite broke the surge of the past three days as a result of yet another spike in margin debt funded purchases, but it was last night’s reminder that “good news is bad news” that really confused the stock trading farmers and grandmas, which goalseeked Chinese economic “data” beat across the board, with Q2 GDP coming solidly above expectations at 7.0%, and retail sales and industrial production both beating, but in the process raising doubts that the PBOC will continue supporting stocks.

After all, the only purpose of the stock bubble was to deflect attention from the bursting of the housing bubble and the collapse elsewhere in the economy. So if Beijing is willing to telegraph that the worst is over for the economy, there is no further need for SHCOMP 5000 which can now be carefully deflated, as otherwise a violent bursting threatens China’s social stability.

As a result the Shanghai Comp tumbled -3.0% and Hang Seng slid -0.3% with markets showing a subdued reaction as the data does dampen calls for further actions by the PBoC. However that does not do justice to yet another day of Chinese stock insanity. This does:

When a Black Swan Flies Over Wall Street’s House of Cards

When a Black Swan Flies Over Wall Street’s House of Cards

A black swan is Wall Street lexicon for an unpredicted event. The author of that concept, Nassim Taleb, opines that most of the major moves in stock market history originated as black swan events coming out of nowhere, with a random, stochastic disorderliness that pushes markets into wild gyrations and implosion.

But subliminally, everyday, CNBC and Bloomberg market mavens reassure us that the market hovers only a few percentage points off all time highs, that unemployment is moderating, and projected GDP, if not robust, is certainly positive.

Still, outliers like Ron Paul endlessly pontificate that we are living in a fairy tale house of cards.

The Fed has pumped about $4.6 trillion into our economy—“quantitative easing,” a term Ron feels is printing money out of thin air. What bothers the former Congressman is that the Fed won’t submit to a real audit, and he suspects it is hiding something far darker. “If the Fed has nothing to hide, it has nothing to fear.” [1]

So what is it hiding? The Fed may have surreptitiously lent $16 trillion to foreign banks completely under the radar and without any approval of anyone. Says Bernie Sanders “No agency of the United States government should be allowed to bailout a foreign bank or corporation without the direct approval of Congress and the President.”[2] The Fed may have done exactly that.

Just to keep these numbers in perspective, the total value of the entire U.S. economy, $17.4 trillion, is less than what the Fed may have been printing, unaudited, and all by its lonesome since 2008.

Why Greece Is The Precursor To The Next Global Debt Crisis

Why Greece Is The Precursor To The Next Global Debt Crisis

The one undeniable truth about the debt drama in Greece is that each of the conventional narratives—financial, political and historical—has some claim of legitimacy.

For example, spendthrift Greeks shunned fiscal discipline: here’s an account from 2011 that lays out the gory details: The Big Fat Greek Gravy Train: A special investigation into the EU-funded culture of greed, tax evasion and scandalous waste.

Or how about: Greek reformers want to fix the core structural problems but are being stymied by tyrannical European Union/Troika leaders: The Greek Debt Crisis and Crashing Markets.

Rather than get entangled in the arguments over which of the conventional narratives is the core narrative—a hopeless misadventure, given that each narrative has some validity—let’s start with the facts that are supported by data or public records.

The Greek Economy Is Small and Imbalanced

Here are the basics of Greece’s economy, via the CIA’s World Factbook:

Greece’s population is 10.8 million and its GDP (gross domestic product) is about $200 billion (This sourcestates the GDP is 182 billion euros or about $200 billion). Note that the euro fell sharply from $1.40 in 2014 to $1.10 currently, so any Eurozone GDP data stated in dollars has to be downsized accordingly. Many sources state Greek GDP was $240 billion in 2013; adjusted for the 20% decline in the euro, this is about $200 billion at today’s exchange rate.

Los Angeles County, with slightly more than 10 million residents, has a GDP of $554 billion, more than double that of Greece.

The European Union has over 500 million residents. Greece’s population represents 2.2% of the EU populace.

External debt (public and private debt owed to lenders outside Greece):

$568.7 billion (30 September 2013 est.)

National debt:

339 billion euros, $375 billion

Central Government Budget:

revenues: $119.5 billion

expenditures: $127.9 billion (2014 est.)

Budget surplus (+) or deficit (-):

-3.4% of GDP (2014 est.)

Public debt:

174.5% of GDP (2014 est.)

Labor force:

3.91 million (2013 est.)

GDP – per capita (Purchasing Power Parity):

$25,800 (2014 est.)

Unemployment rate:

26.8% (2014 est.)

Exports:

$35.8 billion (2014 est.)

Imports:

$62.8 billion (2014 est.)

…click on the above link to read the rest of the article…

The Big Picture

The Big Picture

Towards the end of the 1990’s, Greenspan worked hard to insulate the markets from some of the more negative developments in global finance. These included the Asian Debt Crisis of 1997 and the Russian debt default of 1998. But the most telling policy move of the Greenspan Fed in the late 1990’s was its response to the rapid demise of hedge fund Long term Capital Management (LTCM), whose strategy of heavily leveraged arbitrage backfired spectacularly in 1998.

…click on the above link to read the rest of the article…

Canada’s economy isn’t in recession, despite report, Joe Oliver says

Private sector economists warn of possibility of recession this year

Despite an economy that’s shrunk every month for which we have data this year, the federal finance minister says Canada is not in a recession and is poised for growth later in 2015.

At an event in Toronto on Friday, Finance Minister Joe Oliver told reporters that the economy will avoid recession this year, despite newdata from Statistics Canada earlier this week that shows GDP has contracted in each of the first four months of the year — two-thirds of the way toward the technical definition of a recession.

“First off, we’re not in a recession,” Oliver was quoted by Bloomberg as saying. “We don’t believe we will be in a recession.”

Technically, economists define a recession as two consecutive quarters with negative GDP growth. Oliver said it’s too early to say the country is in a recession because we don’t have economic data for the entire January to June period.

“We expect solid growth for the year, following a weak first quarter.”

Economic slowdown

Finance Minister Joe Oliver’s April budget projected an economy that would grow by about two per cent this year. (Darren Calabrese/Canadian Press)

April’s federal budget assumed an economy that would grow by about two per cent this year. So far, the numbers show the economy shrank by 0.6 per cent in the first three months of the year, and another 0.1 per cent in April.

The Finance Department’s optimism is far from a universal view. Bank of America economist Emanuella Enenajor raised eyebrows with a report on Thursday, in which she said the GDP report for April, which showed the economy shrank by 0.1 per cent, caused her to revise her expectations downward for the entire April to June quarter.

That would be enough to bring a dirty economic word into the discussion: recession.

…click on the above link to read the rest of the article…

Europe is blowing itself apart over Greece – and nobody seems able to stop it

Europe is blowing itself apart over Greece – and nobody seems able to stop it

Prime Minister Alexis Tsipras never expected to win Sunday’s referendum. He is now trapped and hurtling towards Grexit

Like a tragedy from Euripides, the long struggle between Greece and Europe’s creditor powers is reaching a cataclysmic end that nobody planned, nobody seems able to escape, and that threatens to shatter the greater European order in the process.

Greek premier Alexis Tsipras never expected to win Sunday’s referendum on EMU bail-out terms, let alone to preside over a blazing national revolt against foreign control.

He called the snap vote with the expectation – and intention – of losing it. The plan was to put up a good fight, accept honourable defeat, and hand over the keys of the Maximos Mansion, leaving it to others to implement the June 25 “ultimatum” and suffer the opprobrium.

This ultimatum came as a shock to the Greek cabinet. They thought they were on the cusp of a deal, bad though it was. Mr Tsipras had already made the decision to acquiesce to austerity demands, recognizing that Syriza had failed to bring about a debtors’ cartel of southern EMU states and had seriously misjudged the mood across the eurozone.

Instead they were confronted with a text from the creditors that upped the ante, demanding a rise in VAT on tourist hotels from 7pc (de facto) to 23pc at a single stroke.

Creditors insisted on further pension cuts of 1pc of GDP by next year and a phase out of welfare assistance (EKAS) for poorer pensioners, even though pensions have already been cut by 44pc.

They insisted on fiscal tightening equal to 2pc of GDP in an economy reeling from six years of depression and devastating hysteresis. They offered no debt relief. The Europeans intervened behind the scenes to suppress a report by the International Monetary Fund validating Greece’s claim that its debt is “unsustainable”. The IMF concluded that the country not only needs a 30pc haircut to restore viability, but also €52bn of fresh money to claw its way out of crisis.

…click on the above link to read the rest of the article…

Bearish News For Oil Growing By The Day

Bearish News For Oil Growing By The Day

Oil hit its lowest point in two months on July 1, falling on a combination of market turmoil and bearish oil figures.

WTI dipped below $57 and Brent dropped to around $62 per barrel, breaking out of a narrow range within which the two benchmarks have been trading for several months.

The ongoing crisis in Greece is weighing on global markets. The Greek government has called a referendum set for July 5th that will largely test the Greek public’s desire to endure more austerity or else risk a more uncertain path. Greece’s creditors have declined to negotiate an extension of the bailout package until after the referendum, and EU member states led by Germany have suggested the vote would be tantamount to a decision on whether or not Greece would remain in the Eurozone. Meanwhile, Greece’s banks are closed for the week, and tempers will likely flare as the days pass with people unable to withdraw cash.

Related: BP Agrees To Pay $18.7 Billion To Settle Deepwater Horizon Spill

The crisis is causing broader worries over the stability of global markets. Although Greece is a small country, and makes up only a fraction of the Eurozone’s GDP, the markets are keeping a wary eye on the ongoing predicament, watching for any signs that the euro itself could be affected. All of this is dragging down stock markets and oil prices.

A second major factor that suddenly pushed down oil prices is the latest EIA figures released on July 1, which showed a very surprising uptick in the level of crude oil storage. Oil inventories climbed by 2.4 million barrels, the first increase in two months. Since mid-April, the U.S. has begun drawing down its record high inventory levels, with refineries working their way through the glut and producers leveling off their production.

…click on the above link to read the rest of the article…

Bond Insurers Crash, Hit by Puerto Rico’s Default Shrapnel

Bond Insurers Crash, Hit by Puerto Rico’s Default Shrapnel

On Monday, Puerto Rico’s government released a report that gave the municipal bond market the willies.

Written by former World Bank and IMF economists, it vivisects Puerto Rico’s finances, lays out the basic fact that the nearly $73 billion in bonds that the US commonwealth has outstanding, amounting to nearly 70% of its GDP, are of dubious value, and offers a debt restructuring strategy.

The report is decorated with financial doom and gloom: Outmigration has caused the population to drop nearly 8% since 2006 to 3.5 million today, even while the debt kept ballooning. It contained this choice passage:

The single most telling statistic in Puerto Rico is that only 40% of the adult population – versus 63% on the US mainland – is employed or looking for work; the rest are economically idle or working in the grey economy. In an economy with an abundance of unskilled labor, the reasons boil down to two.

– Employers are disinclined to hire workers because (a) the US federal minimum wage is very high relative to the local average (full-time employment at the minimum wage is equivalent to 77% of per capita income, versus 28% on the mainland) and a more binding constraint on employment (28% of hourly workers in Puerto Rico earn $8.50 or less versus only 3% on the mainland); and (b) local regulations pertaining to overtime, paid vacation, and dismissal are costly and more onerous than on the US mainland.

– Workers are disinclined to take up jobs because the welfare system provides generous benefits that often exceed what minimum wage employment yields; one estimate shows that a household of three eligible for food stamps, AFDC, Medicaid and utilities subsidies could receive $1,743 per month – as compared to a minimum wage earner’s take-home earnings of $1,159. The result of all of the above is massive underutilization of labor, foregone output, and waning competitiveness.

To fix this situation, bondholders are now asked to step up to the plate.

…click on the above link to read the rest of the article…

THE GREAT TPP DEATHTRAP FOR INDIA, CHINA & 10 OTHER MEMBER-NATIONS

The Great TPP Deathtrap for India, China & 10 Other Member-Nations

The Terms of Destruction. The Clues are all there in Obamatrade and Obamacare.

The truth emerges out of the shadows of secrecy…

Let’s start here. The Trans-Pacific Partnership (TPP) is a trade treaty, coming down the homestretch toward ratification, involving 12 nations which account for a staggering 40% of the world’s GDP. The TPP encompasses 775 million consumers.

Waiting in the wings is something much larger. It is the intention, up the road, to fold India and China into the treaty.

China is the most populous nation in the world. 1.4 billion people. India is the second most populous. 1.28 billion people. India is projected to overtake and pass China by 2025.

During his seven years in office, the most publicly recognizable PR man in the world, Barack Obama, has sweated and hammered on two policies. Just two. He is now in a panic over forcing one of those: the TPP. The other one was Obamacare. That’s it. Everything else was a Sunday picnic in the park.

Obamacare, the US national health insurance plan, when you strip it down to basics, was about one thing: bowing to drug companies.

It brought huge numbers of new people, previously uninsured, into the game. Meaning those people would be able to take the drugs—and the prices for those drugs would remain high.

So it is with the TPP, as it turns out. One of the major priorities is forcing member countries to accept higher pricing on medical drugs. Which was exactly the deal in Obamacare. Big Pharma backed Obamacare for the express purpose of cutting out debates about lowering costs on drugs.

In that respect, Obamacare and the TPP are mirror images of each other.

One other vital detail: the TPP will also allow pharmaceutical companies to push drugs and force them into markets where, ordinarily, they could be rejected as unsafe.

…click on the above link to read the rest of the article…

There’s Something Wrong With The World Today and It’s 1995

There’s Something Wrong With The World Today and It’s 1995

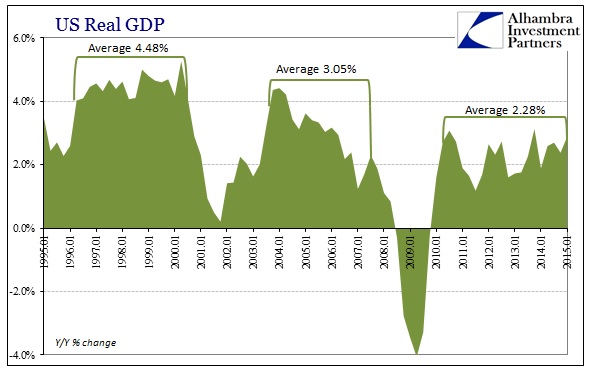

There weren’t any surprises in the “final” GDP update for Q1. Going back to -0.2%, the same interpretations still apply, especially and including the inventory contribution. Economists and policymakers want to talk particularly about how Q1 is prone to “residual seasonality” but that is missing the bigger part of the problem. Whether Q1 was -0.2% or +2% doesn’t really matter, as what truly makes this a dangerous economic situation is that Q1 and all the prior quarters were not a steady +4%.

To listen to economists today is to suggest that such an expectation amounts to wishful thinking, and that such “normal” growth is no longer. That sentiment may apply, but only to the narrow manner in which orthodox economics can integrate real world factors. In other words, “they” accept that there is something wrong but cannot answer the relevant and primary question as to what that might be.

This problem is obvious in every economic account, including GDP. Using year-over-year figures to harmonize among other economic systems, the lack of growth is striking post-crisis – made all the more so by the size of the huge hole left in the wake of the Great Recession itself. That means, even by this count, the opportunity cost of this non-recovery is severely understated.

I picked 1995 as a starting point for a reason, which I’ll get back to below. Suffice to say, in isolating only the growth periods of each economic cycle the current version is by comparison about half that of the late 1990’s. The middle cycle, the housing bubble age, shows what is plainly a transition from the first to the third. The primary opportunity cost is not simply the difference between them, but rather far more importantly the compounding nature of time. In other words, the longer these deficiencies drag the more costly in very real economic distortions that cannot be measured.

…click on the above link to read the rest of the article…

How Venture Capitalists Came to Rule the World

How Venture Capitalists Came to Rule the World

This was no utopian idea. After World War II, a number of European governments invested heavily in key sectors — electricity, steel — toclose the technology gap with the United States. Similarly, the South Korean government built up a shipbuilding industry in the 1970s from nothing into the largest and more successful in the world. To a certain extent, the Pentagon accomplished something similar with the Internet (though no American would dare call such a thing “socialism”).

Industrial policy has never really gone away. Many governments, including China and the United States, have focused funds on the clean energy sector (wind turbines, solar cells). But the prevailing economic orthodoxy since the creative destruction unleashed by Reaganomics has been that the invisible hand of the market, not the state, should determine winners and losers.

It turns out, however, that the market’s hand is very often not invisible at all. Actual people, with very visible hands, are picking the winners and losers in the marketplace. Consider the impact of venture capitalists.

Although they’re responsible for only 0.3 percent of U.S. GDP, the influence of these elite investors is disproportionate. Their decisions determine how you communicate, how you shop, how you organize your life. Venture capital has been instrumental in launching companies that today make up over 20 percent of America’s GDP.

Bank Of America Begins 66-Day Countdown Until The Terrible Ghost Of 1937 Returns

Bank Of America Begins 66-Day Countdown Until The Terrible Ghost Of 1937 Returns

In 66 trading days on September 17, 2015, the Federal Reserve will, according to Bank of America, hike rates for the first time since 2006, which according to BofA will “end the era of excess liquidity.”

We disagree entirely, but let’s hear what BofA’s Michael Hartnett has to say:

On September 17th the Fed will hike the Fed funds rate by 25bps according to Ethan Harris & our US economics team, the first hike since June 2006.Recent US economic data support this view, in particular the solid May payroll & retail sales reports. Note that after a Q1 wobble, one of our favorite cyclical indicators, US small business confidence, has also bounced back into expansionary territory. Ethan Harris forecasts 3.4% US GDP growth in Q2, after 0.2% in Q1, and US rates strategist Priya Misra forecasts a Fed funds rate of 0.5% by year-end, and 1.5% by end-2016. Like Ethan & Priya, the futures market also looks for a modest Fed tightening cycle: Eurodollar futures contracts are currently pricing in 3-month rates in the US rising from 0.01% today to 0.65% by year-end, and to 1.54% by end-2016.

Yes, the US economy is so strong the Bureau of Economic Analysis has tofabricate double seasonal adjustments to goalseek GDP data that is non-compliant with the narrative. As for economists being wrong about a rate hike, or overestimating future US growth, let’s just say it won’t be the first time they are wrong…

Still, one thing BofA is right about: this time the normalization process will be different.

…click on the above link to read the rest of the article…

End of the Line! China and Germany Look Ready to Pop

End of the Line! China and Germany Look Ready to Pop

The U.S. stock market has finally hit a speed bump after more than six years of a Fed- and QE-driven rally. The S&P 500 is up 232% since March of 2009 despite this unprecedented stimulus in the feeblest economic recovery in history.

But since late December 2014, U.S. stocks have gone nowhere as investors face some growing realities.

GDP, retail sales, production and exports are slowing.

The dollar’s sharp rise in recent years has crushed global exports.

Long term interest rates are rising consistently… what I call the beginning of the end of stimulus policies designed to keep rates low forever.

Meanwhile, in just six months Germany saw its key stock market, the DAX, rise nearly 50% from mid-October into early April.

Germany’s bubble has shot up 245% since March 2009 — greater than the U.S., despite its slower economy.

It won’t last!

As I’ve explained many times, starting last year Germany has the worst demographic trends of any country in the world lasting through 2022. It’s even worse than Japan’s demographic cliff in the 1990s!

There’s one reason Germany has held up as well as it has in the last year: the euro.

When the euro falls, German exports soar. Between April 2014 and March 2015 the euro fell 25%. Its long-term peak was in July 2008 at 1.60 dollars. It hit 1.05 in March — 34.5% lower!

Consider that Germany exports 50% of its GDP. That’s one of the highest ratios in the world.

…click on the above link to read the rest of the article…

Is Canada Next?

Is Canada Next?

“All of that negative news has kind of put a downer on consumer sentiment,” is how Jharonne Martis, director of consumer research at Thomson Reuters, explained the crummy consumer confidence reading on Friday.

The Thomson Reuters/Ipsos Canada Primary Consumer Sentiment Index haddropped to 51.6, the lowest so far this year and well below the 56.4 of last August before the oil-price crash soured the mood. By comparison, since 2010, the index has mostly been in the mid-50 range.

The “negative news” has extended beyond the price of oil. She pointed at some well-known retailer chains that have shut their stores in Canada recently, including Target, Future Shop, and photography retailer Black’s.

Already on March 30, Bank of Canada governor Stephen Poloz had warned that economic growth would be “atrocious” in the first quarter “because the oil shock is a big deal for us.” And he was right, with GDP dropping 0.6% annualized, the first quarterly decline since 2011.

It didn’t help that the Bank of Canada, in its Financial System Review released on Friday, pointed out that household indebtedness and the housing bubble were the top two vulnerabilities that threatened Canada’s financial stability. The top vulnerability:

“Elevated” – actually dizzying – “level of household indebtedness”:

The vulnerability associated with household indebtedness remains important and is edging higher, owing to an increase in the level of household debt and the ongoing negative impact on incomes from the sharp decline in oil prices. In addition, the quality of household debt may be decreasing at the margin….

Household leverage has been pushing relentlessly higher. In the first quarter,according to Statistics Canada, the household-debt-to-disposable-income ratio edged down a smidgen for the first time in four quarters, from its all-time high, to 163.3%. Debt increased once again, but this time slightly less than income.

…click on the above link to read the rest of the article…