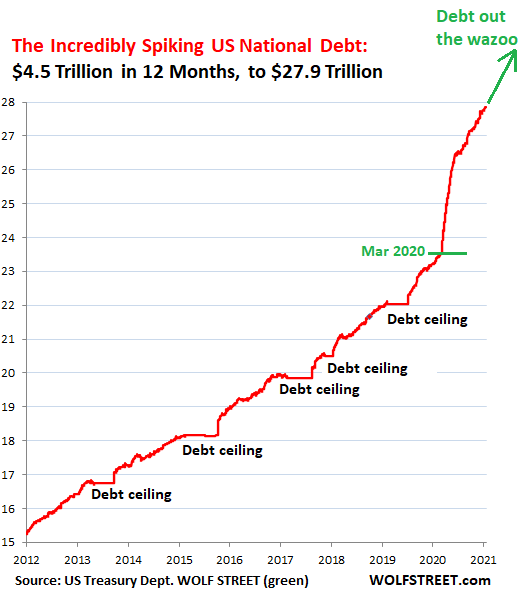

Borrowing a quarter of the nation’s entire economic output every year to prop up an ineffective, corrupt status quo is putting a Band-Aid over a tumor.

If we misdiagnose the disease, our treatment won’t work. We’re all familiar with medical misdiagnoses, which lead to procedures and prescriptions that can’t possibly fix the patient’s illness because the source has been missed or misinterpreted.

Medical diagnoses are often tricky, as many general symptoms can arise from a variety of sources.

Social and economic ills can also be tricky to diagnose, and the diagnosis is hindered by political polarization and sacrosanct orthodoxies which make it difficult to have a rational discussion in public about many difficult issues.

If we can’t even discuss a problem, then that creates another problem, because problems that can’t be discussed openly cannot be solved.

There’s also a human tendency to choose the diagnosis with the easiest-at-hand solution. This allows us to quickly apply an approved solution and then declare the problem solved.

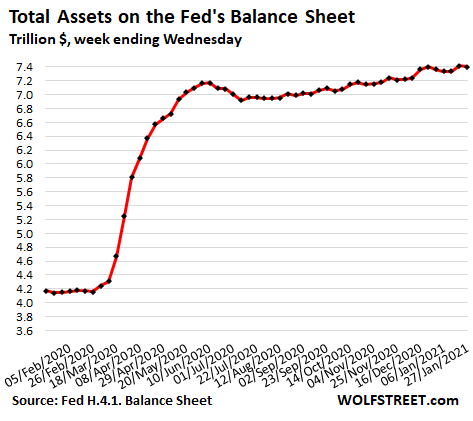

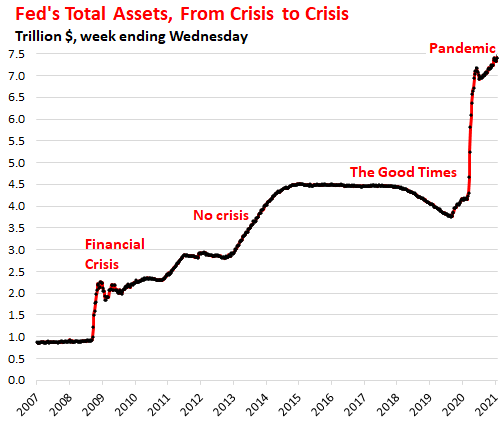

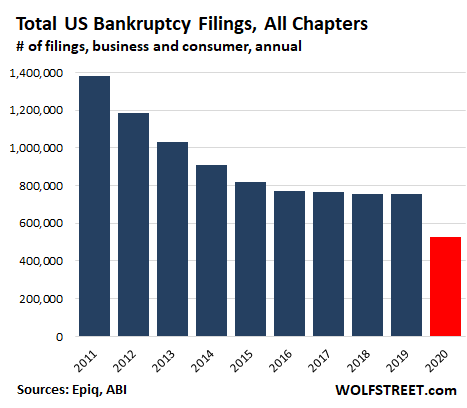

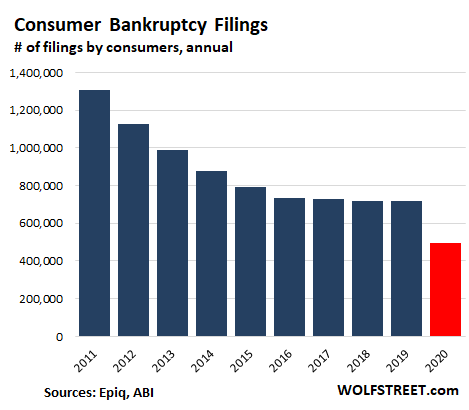

The current flood of financial stimulus is an example of this misdiagnosis and application of an easy solution which fails to address the underlying disorder.

The conventional diagnosis of the post-pandemic economy is that the only problem is people don’t have enough money, and so giving them money to spend will cure the financial damage the pandemic inflicted. (Never mind that the economy was rolling over in 2019 long before the pandemic, which served as a catalyst in a sick, unstable status quo.)

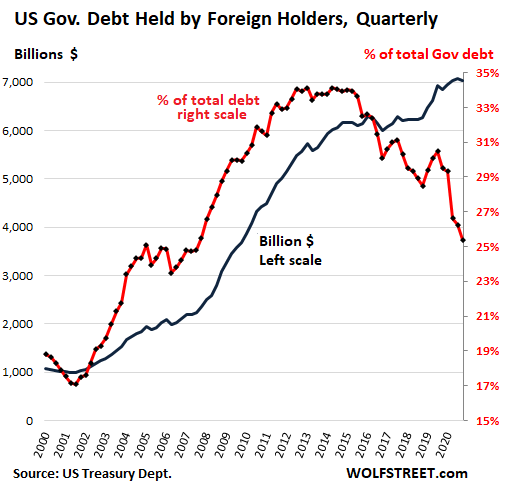

Creating $1.9 trillion out of thin air and distributing it is painless: who doesn’t like free money? But is a scarcity of cash the source of America’s economic malaise?

…click on the above link to read the rest of the article…