Amassing Unproductive Debt

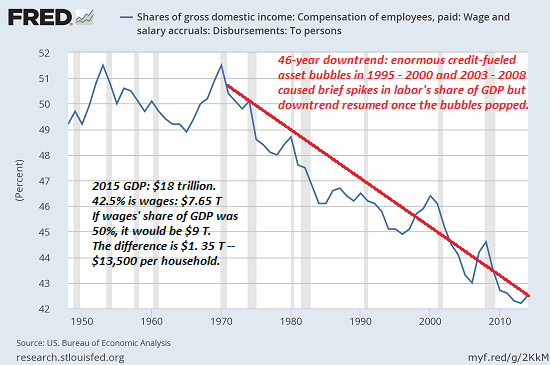

Last week, we discussed the marginal productivity of debt. This is how much each newly-borrowed dollar adds to GDP. And ever since the interest rate began its falling trend in 1981, marginal productivity of debt has tightly correlated with interest. The lower the interest rate, the less productive additional borrowing has in fact become.

Left: the first IKEA store located in Älmhult in Sweden, near the residence of the company’s founder (nowadays the store is a museum); right: a Task Rabbit car. Given the valuations at which TaskRabbit was able to raise funds recently, it is a good bet IKEA paid a small fortune to take it over (waiting for the QE-induced bubble to burst may have been cheaper). [PT]

Left: the first IKEA store located in Älmhult in Sweden, near the residence of the company’s founder (nowadays the store is a museum); right: a Task Rabbit car. Given the valuations at which TaskRabbit was able to raise funds recently, it is a good bet IKEA paid a small fortune to take it over (waiting for the QE-induced bubble to burst may have been cheaper). [PT]

Let’s look at a recent event: the Ikea acquisition of TaskRabbit. You might wonder, why does a home goods company need to own a freelance labor company? Superficially, it seems to makes sense. Ikea products notoriously come in flat packs, but consumers don’t want to fuss with all the little parts. They just want finished furniture. Ikea has been using TaskRabbit to hire people to assemble it in their homes.

Isn’t this like that caricature of the billionaire who buys, say, the Planters Peanut company because he likes to eat salted nuts? Ikea could be a customer of TaskRabbit, hiring its temporary workers as needed, without owning the company. In fact, it had been doing that for years.

The acquisition price was not disclosed, however, we can guess that it was high. TaskRabbit was a Silicon Valley darling with a bright future. Its value proposition is right for this economy. It had raised $50 million, presumably at rich valuation multiples.

…click on the above link to read the rest of the article…

REUTERS/Adrees Latif

REUTERS/Adrees Latif