US Producer Prices Accelerating At Fastest Rate In 12 Months, Wall Street Reacts…

Ahead of tomorrow’s CPI, traders are eyeing this morning’s Producer Prices for any hints that the disinflation trend will return…or not.

The answer is “not!”

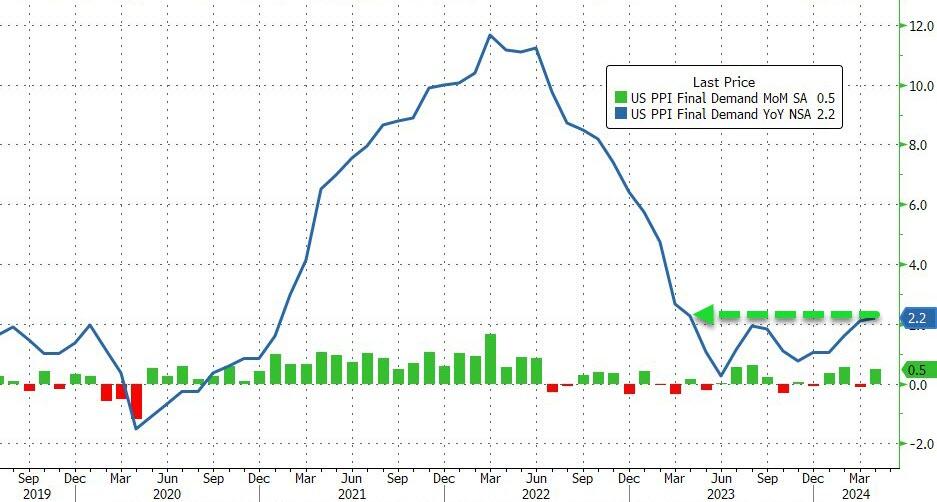

April Producer Prices rose 0.5% MoM (vs +0.3% exp), with March’s +0.2% MoM revised down to -0.1% MoM. The downward revision did not stop the YoY read rising to 2.2% (from +2.1% in March)…

Source: Bloomberg

This is the highest YoY read since April 2023 and is the fourth hotter than expected headline PPI print…

Source: Bloomberg

Producer Prices have been aggressively downwardly revised for 4 of the last 7 months…

Source: Bloomberg

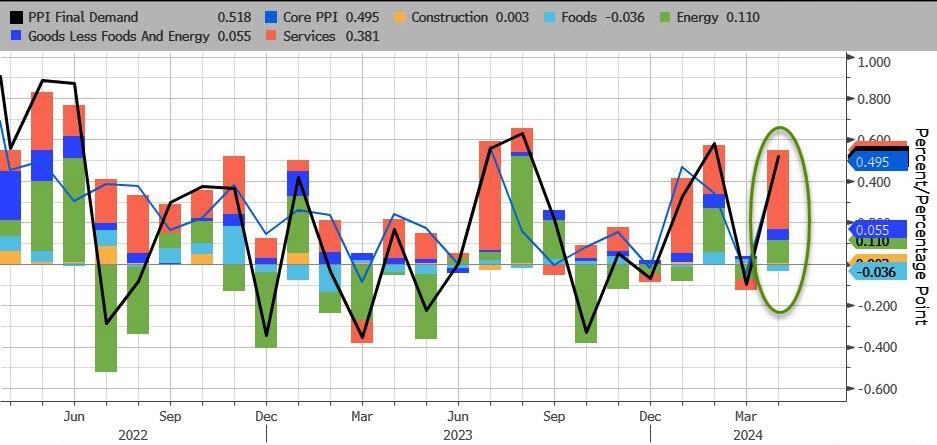

Services costs soared, dominating April’s PPI gains with Energy the second most important factor. Food prices actually declined on a MoM basis.

Source: Bloomberg

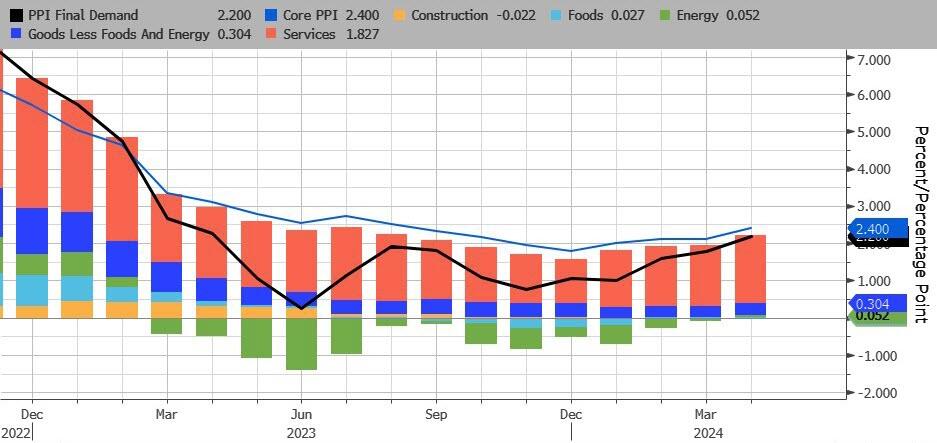

On a YoY basis, headline PPI’s rise was dominated by Services (rising at their hottest since July 2023). For the first time since Feb 2023, none of the underlying factors were negative on a YoY basis…

Source: Bloomberg

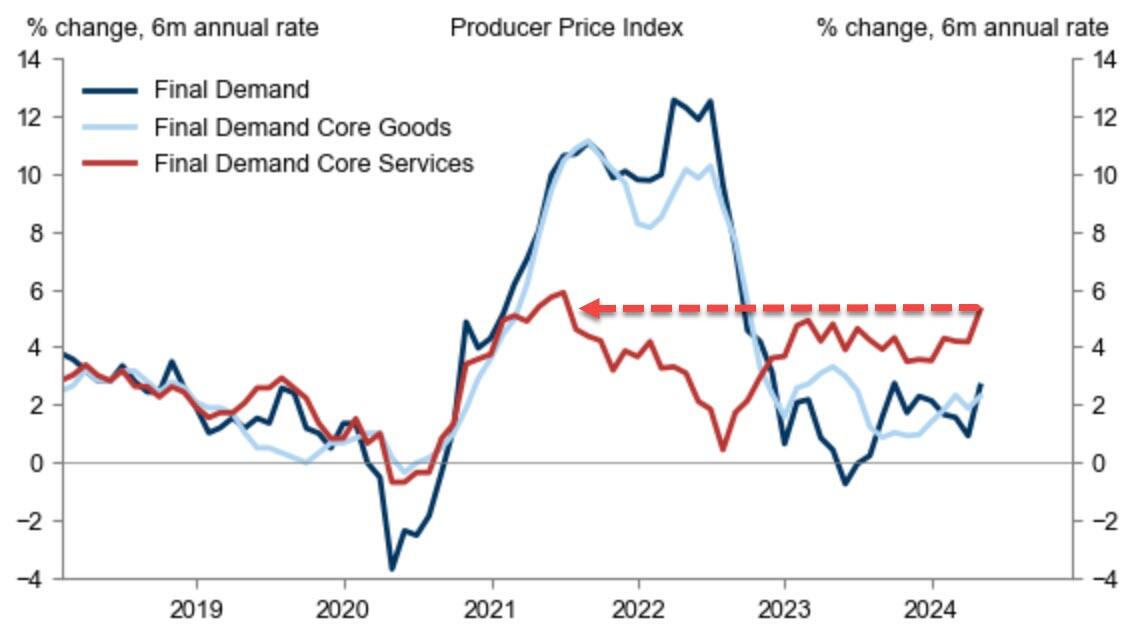

On a 6-month annualized rate, Final Demand Core Services PPI is rising at its highest since Q3 2021…

Source: Goldman Sachs

After last month’s farcical ‘seasonally adjusted’ gasoline price, April saw the PPI Gasoline index rise (with actual prices at the pump) but still has a long way to go…

Source: Bloomberg

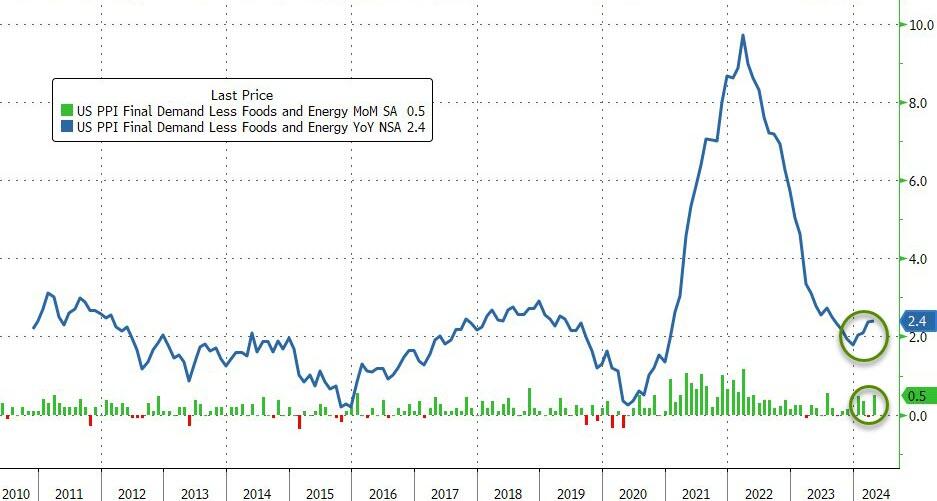

Core PPI was worse – rising 0.5% MoM (more than double the +0.2% MoM expected) – which pushed the Core PPI YoY up to +2.4%…

Source: Bloomberg

And finally US PPI Final Demand Less Foods Energy and Trade Services rose by 0.4% MoM and 3.1% YoY (the highest in 12 months).

Worse still the pipeline for primary PPI is not good as intermediate demand is starting to accelerate…

Source: Bloomberg

Here are Wall Street’s reactions to PPI:

Chris Larkin at E*Trade from Morgan Stanley:

…click on the above link to read the rest of the article…