“Minsky Moments Almost Certainly Await”: Nomura Fears ‘Collateral’ Damage From The QE-to-QT Transition

“Minsky Moments” almost certainly await, warns Nomura’s Charlie McElligott in his latest note as he reflects on a massive week ahead for markets.

With Powell testimony and bunches of Fed speakers, along with US economic releases headlined by the market’s most important datapoint in the CPI release Wednesday, in addition to PPI, Retail Sales and Consumer Sentiment over the course of the week, plus two Duration-heavy auctions ($36B of 10Y and $22B 30Y, on top of tomorrow’s $52B 3Y),… and finally, US corporate earnings season kickoff (highlighted by JPM, C and WFC this upcoming Friday), it is no wonder that investors are degrossing still…

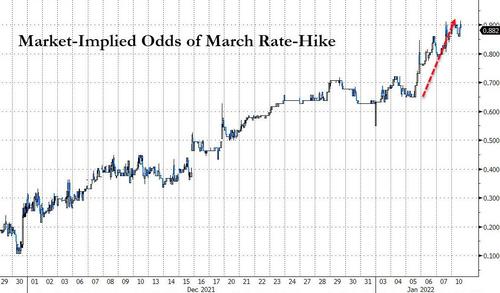

While the long-end of the curve is reversing modestly – after some more ugliness overnight – STIRs continue to grind hawkishly higher with March now consolidating around a 90% chance of a rate-hike…

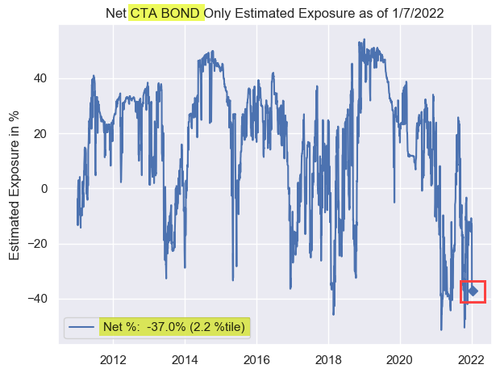

McElligott raises some worries of a rapid ‘reversal’ risk in bonds – via “market tantrum” forcing the Fed to yet-again “Bend the Knee” – as market positioning in bonds is extreme to say the least.

Looking at the QIS CTA Trend model to get a sense of the “bearish momentum” and asymmetry within Fixed-Income positioning, we currently see the net exposure across G10 Bonds is back to 10 year historical “extreme Short” at just 2.2%ile overall exposure since 2011; further, the aggregate $notional position across the agg G10 Bond positions is now greater that -2 SD rank (i.e. very “net Short”) dating all the way back to 2002.

Similarly, the Nomura MD notes that eventually, the more this selloff in legacy long / crowded hyper Growth Tech extends, there is ultimately a mounting risk of a sharp counter-trend rally in beaten-down Nasdaq, particularly considering the extremely magnitude of the Dealer “short Gamma” profile in QQQ ($Gamma -$476mm, 3.4%ile since 2013…

…click on the above link to read the rest of the article…