Get Ready for a Wild “Base Effect”: Highlighted Forcefully when it Suits Them, as with Inflation; Silenced Forcefully When it’s Awkward, as with Corporate Earnings

We’re going to be awash in huge and even absurd percentage-growth numbers.

The numbers are starting to crop up everywhere: For example, new vehicle sales in March jumped nearly 60% from March a year ago. But last March was the beginning of the lockdowns. Compared to two years ago, March 2019, new vehicle sales were down 1.2%. In the first quarter, new vehicle sales were up 11% year-over-year, but were down 2.9% from Q1 2019.

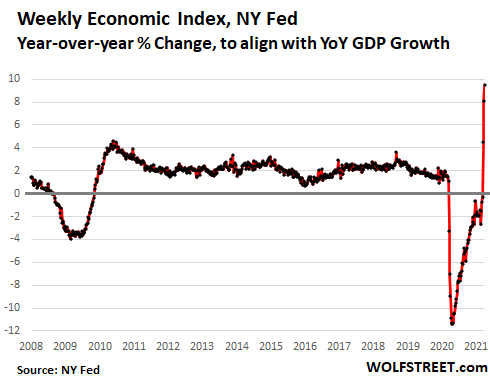

Today, the New York Fed released its latest Weekly Economic Index (WEI), one of the high-frequency measures that came out of the crisis. The index is based on ten daily and weekly indicators of real economic activity, compared to the same time last year, and is scaled to line up with year-over-year GDP growth. Last year, it fairly accurately predicted GDP growth, I mean plunge.

In Q1 2020, GDP had dropped sharply, and in Q2 2020, it plunged. The year-over-year growth rate of the upcoming GDP report compares the dollar GDP in Q1 2021 to that of Q1 2020. Given the sharply lower dollar GDP in Q1 2020, and the plunge in Q2 2020, the year-over-year growth rates for Q1 and Q2 this year will be massive, even as GDP in dollars will likely remain below where it had been in Q4 2019. But these are the kinds of year-over-year percentage spikes we’re going to see, even as dollar figures have not reached back to 2019 levels:

Another example, to dip into absurdity: The TSA reports daily checkpoint screenings, a measure of how many people entered into airports. Airlines were essentially shutting down last April and the number of passengers collapsed by over 90%, to just a trickle. Compared to 2019, the current 7-day moving average of daily checkpoint screenings is still down 37%, but compared to a year ago, it spiked by 1,168%.

…click on the above link to read the rest of the article…