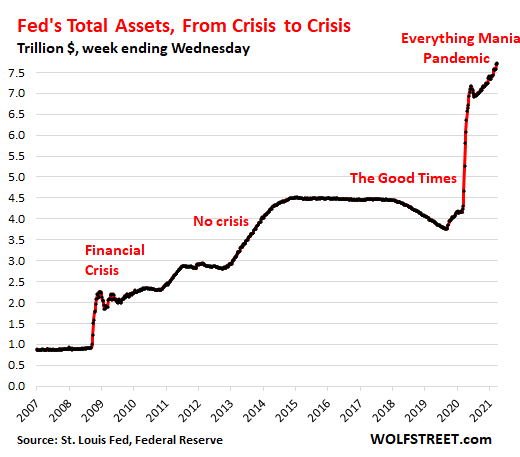

QE During the “Everything Mania”: Fed’s Assets at $7.7 Trillion, up $3.5 Trillion in 13 months

But long-term Treasury yields have surged, to the great consternation of our Wall Street Crybabies.

The Fed has shut down or put on ice nearly the entire alphabet soup of bailout programs designed to prop up the markets during their tantrum a year ago, including the Special Purpose Vehicles (SPVs) that bought corporate bonds, corporate bond ETFs, commercial mortgage-backed securities, asset-backed securities, municipal bonds, etc. Its repos faded into nothing last summer. And foreign central bank dollar swaps have nearly zeroed out.

What the Fed is still buying are large amounts of Treasury securities and residential MBS, though no one can figure out why the Fed is still buying them, given the crazy Everything Mania in the markets.

But for the week, total assets on the Fed’s weekly balance sheet through Wednesday, March 31, fell by $31 billion from the record level in the prior week, to $7.69 trillion. Over the past 13 months of this miracle money-printing show, the Fed has added $3.5 trillion in assets to its balance sheet:

One of the purposes of QE is to force down long-term interest rates and long-term mortgage rates. But long-term Treasury yields started rising last summer. The 10-year Treasury has more than tripled since then and closed today at 1.72%. Mortgage rates started rising in early January. Bond prices fall as yields rise, and the crybabies on Wall Street want the Fed to do something about those rising long-term yields and the bloodbath they have created in the prices of long-term Treasury securities and high-grade corporate bonds.

But instead, the Fed has said in monotonous uniformity that rising long-term yields despite $120 billion of QE a month are a welcome sign of rising inflation expectations and a growing economy:

…click on the above link to read the rest of the article…

wolf richter, wolfstreet, qe, quantitative easing, money printing, credit expansion, fed, us federal reserve, central bank, interest rates, wall street