The Fed’s Visible Hand: Powell Buys $305 Million In ETFs In Two Days

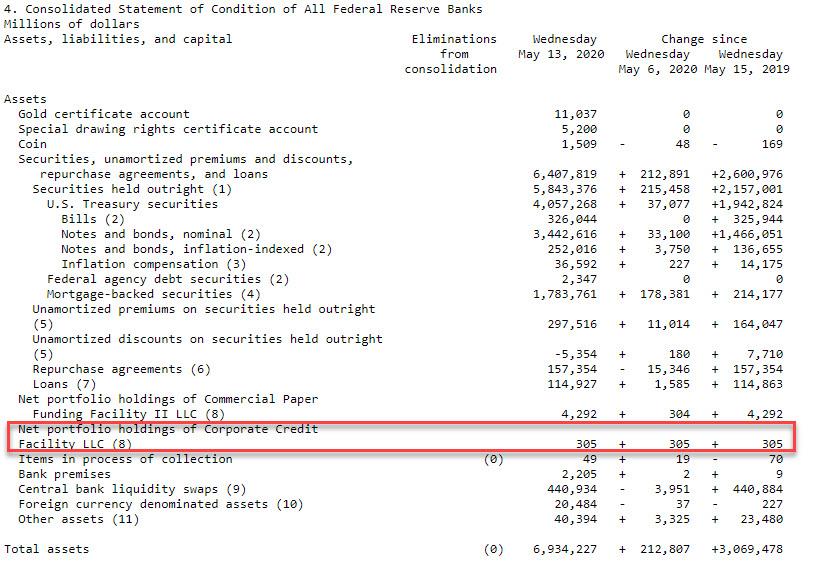

On Tuesday, the US officially crossed over into some bizarro version of a crony, centrally-planned mandated pricing model that is anything but a market when the Fed started buying corporate bond ETFs for the first time ever. Then, moments ago in its latest H.4.1 statement, the Fed – which disclosed that its balance sheet is now a record $6.934 trillion and well on its way to $12 or more than half of US GDP…

… also revealed that in the first two days the program was operational, the Fed purchased $305 million under the Corporate Credit Facility, i.e., the corporate bond ETF buying program, as of EOD May 13, or just two days after the Fed officially gave Blackrock the green light to start waving it in.

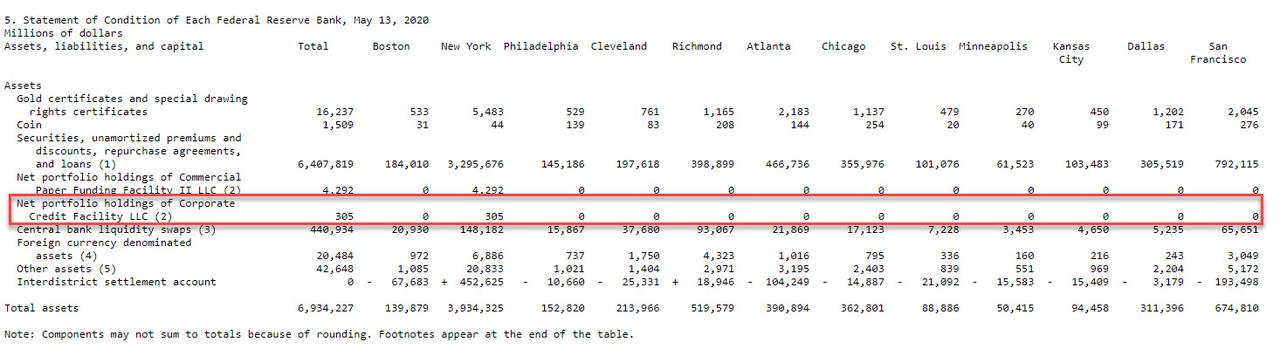

Of course, since the transactions were organized by the NY Fed which used Blackrock as agent for the buying, all of the ETFs were parked at the New York Fed.

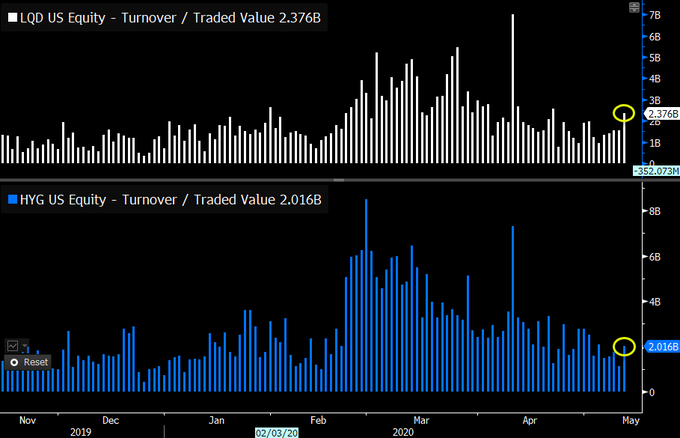

Bloomberg’s ETF expert, Eric Blachunas, was sure he had observed the Fed in action two days ago when he noticed a jump in both LQD and HYG volumes around mid-day, which appears to be the time Blackrock will be active in the market for all those who feel like frontrunning the world’s largest asset manager, which in turn is frontrunning the world’s largest central bank.

HISTORY MADE: Looks like Fed made good on word as $LQD & $HYG both saw volume jumps today (via some sizable trades mid-day). No way to know for sure it was them, but given what they said yest & non-corp bond ETFs like $AGG, $TLT didn’t see similar jump, there’s good chance IMO.

What is a bit concerning is that even after the Fed bought millions in LQD on the 12th, the ETF closed red. However, Blackrock redeemed itself on the next two days when LQD posted a solid rebound, rising above 128 for the first time since May 5.