“Just Close The Whole Thing Up”: CNBC Anchors Melt Down, Beg For Market Closures On Twitter

Few are dealing with the economic and market turmoil with more chaos and less class and resolve than the expert “buy and hold” class over at CNBC, who shockingly never said one word of warning to their retail viewers when the market was doing nothing but going straight up for more than a decade, and instead were dragging mom and pop investors into massively overvalued stocks urging them to buy at all time highs, and who are now melting down before our eyes at the first sight of a substantial market pullback.

Their solution: own the shorts by shutting down the market entirely. Because if one can’t BTFD, is it even a market?

As recently as Friday, when the Dow Jones posted a 2000 point gain on the back of a short squeeze that nearly doubled the indexes gains in the last 15 minutes of the day, there was no talk about markets being defective or needing to close. That was, of course, until the Fed’s $700 billion “quarantative easing” bazooka bailout of markets fizzled spectacularly on Sunday nights and futures promptly went limit down. When it appeared that this plan was failing, some of the industry’s finest began to panic visibly.

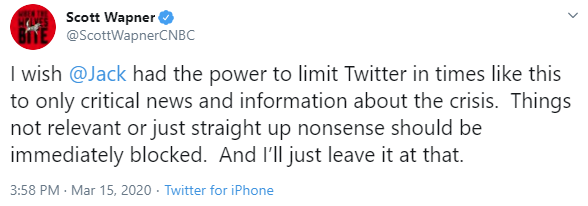

Prior to the Fed news, Halftime Report’s Scott Wapner had already called for blanket censorship of Twitter…

Then, after the Fed bazooka failed to calm markets, it sent the popular talking heads into a typing panic, as Wapner started tweeting wildly, criticizing NFL players for signing contracts, prodding the NYSE to “close the floor” and then begging for them to “close the whole thing up” so the market could “start again later”. Perhaps because when things don’t go your way, you can always beg for a reset in some imaginary world where the Fed still runs everything.

…click on the above link to read the rest of the article…