“We Have Never Seen This Before”: The Last Time The Market Did This, FDR Confiscated All The Gold

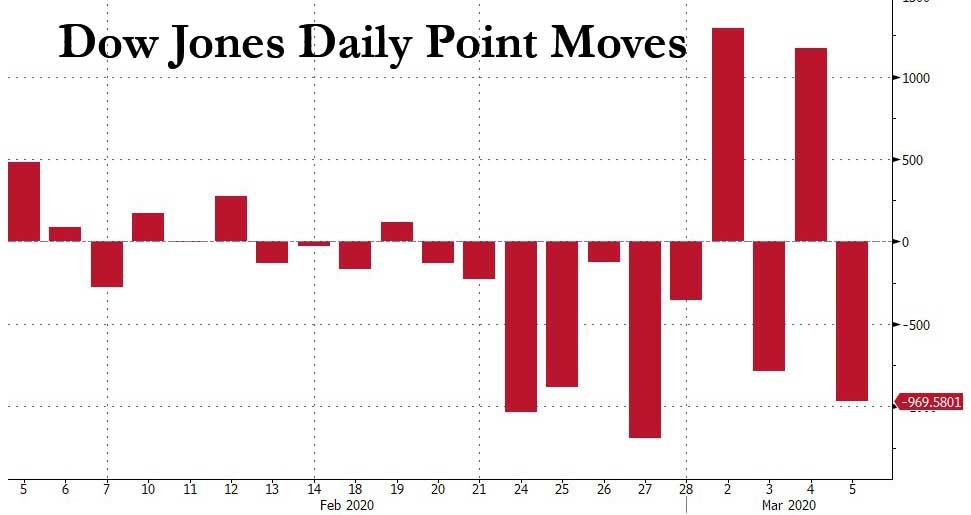

To say that moves in the US stock market have been erratic in the past two weeks would be a prodigious understatement: with the Dow Jones swinging by over 1,000 points on nearly 5 occasions in the past two weeks (today’s 970 point move would have been the fifth)…

… traders – holding on for dear life in a market rollercoaster the likes of which have not been seen in years – have given up trying to make sense, and are just praying they don’t lose all their money. “When you have a 4.5% up day in the market and a 2% down day – what does that mean?” Kathryn Kaminski of AlphaSimplex Group told Bloomberg. “It just means we don’t know what’s going on.”

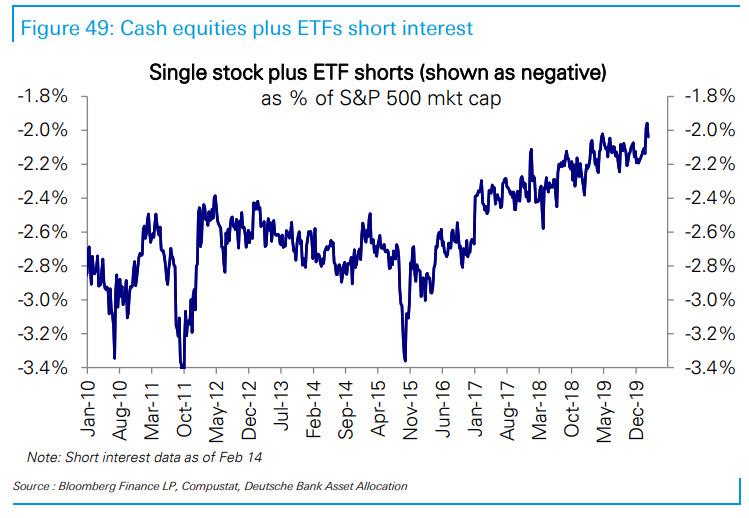

And while futures continue to slide amid a surge in US coronavirus cases late on Thursday with over 2,000 New Yorkers now having self-quarantined, and emboldening what little is left of the bears – recall that heading into this week, single stock/ETF short interest was at all time lows…

… the bulls, who are rapidly losing faith that even the Fed can prop up this market, are pointing to the recent dramatic rebounds in the stocks most recently on Wednesday when the S&P500 surged back above 3,124 (it is now trading well below 2,990), yet which nobody can fully explain because even though there are several catalysts for the rebound that one could point to, historically speaking none of them are entirely satisfying as explanations, and as Nomura’s Masanari Takada writes in his daily Nomura quant note, “we suspect that more than a few investors (whether bearish or bullish) are feeling paralyzed in the face of such unusual swings in the market.”

…click on the above link to read the rest of the article…