Sluggish Oil Demand To Keep A Lid On Oil Prices Amid Global Recession Fears

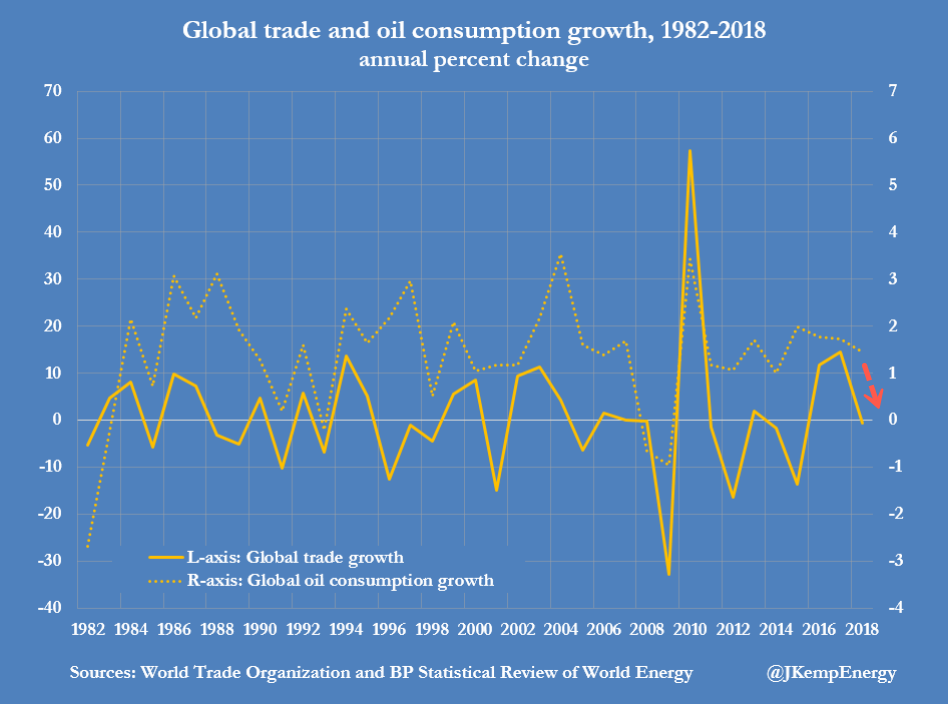

John Kemp, senior market analyst of commodities at Reuters, cites a new report via B.P.’s finance chief that indicates global oil consumption will be less than 1 million barrels per day this year, an ominous sign that the global economy is quickly deteriorating.

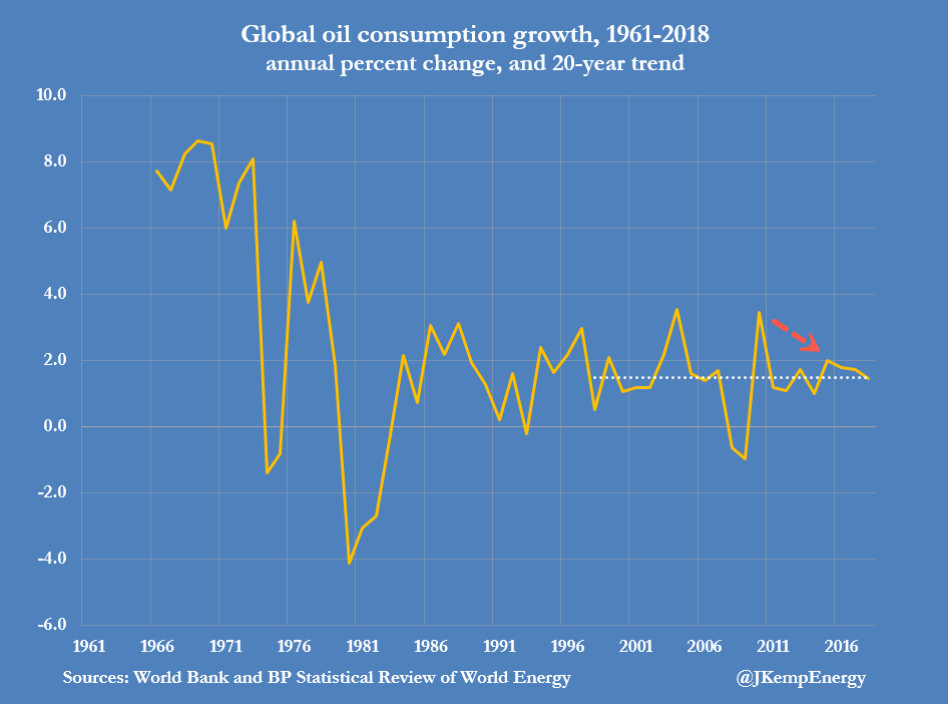

Kemp said growth is expected to be less than one million barrels per day (bpd) would represent an increase of less than 1% in global oil consumption and the lowest level of growth since 2014 and before that 2012.

Back then, declining demand was due to elevated oil prices averaging above $100 per barrel in real terms. Now prices trend in the $50-$60 range for WTI, confirming that even with low oil prices, demand is nowhere to be seen.

B.P.’s global oil consumption is the most bearish among other predictions from the International Energy Agency (+1.1 million bpd), OPEC (+1.1 million) and the U.S. Energy Information Administration (+1.0 million).

Waning demand for oil across the world is the result of a global manufacturing recession festering underneath the surface. The global synchronized decline is structural and started in 4Q17, several months later, the trade war between the U.S. and China erupted in 1Q18.

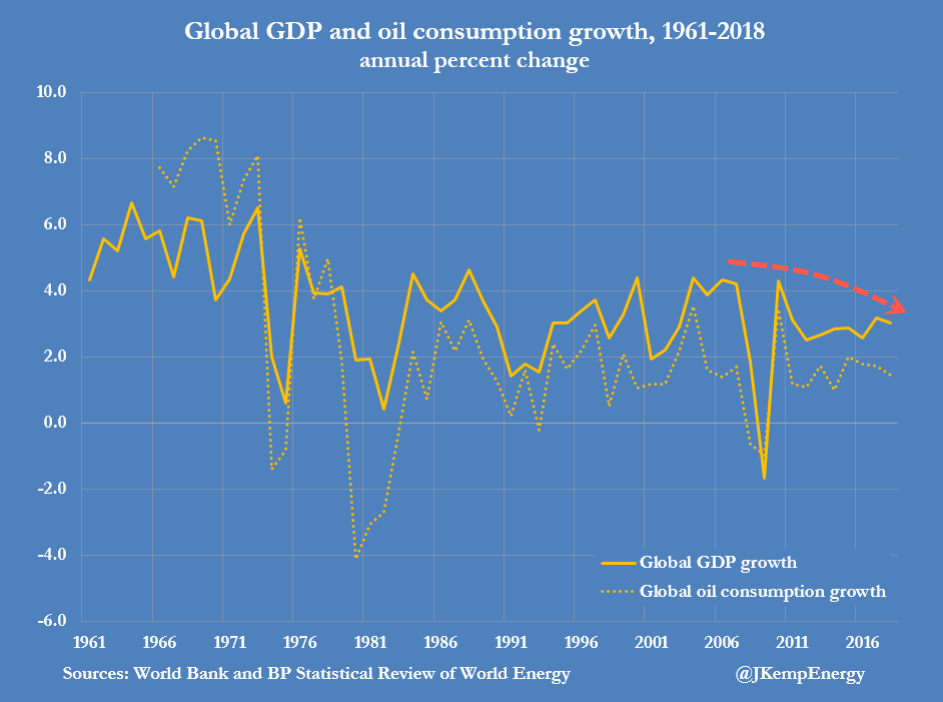

Since global GDP drives oil consumption. Kemp shows that the World Bank (“Global economic prospects,” June 2019) data is indicating world growth will be in a slump this year. Estimates show global GDP has been revised lower from 3.0% in 2018 to just 2.6% in 2019.

Global GDP growth is at the same level as 2014 and before that 2012. So it makes sense why oil consumption has dropped to a five year low, it’s because the global economy has lost tremendous amounts of momentum, now reversing into a vicious downturn.

…click on the above link to read the rest of the article…