Albert Edwards On How It All Ends: “In The Next Recession, The S&P Will Drop Below 666”

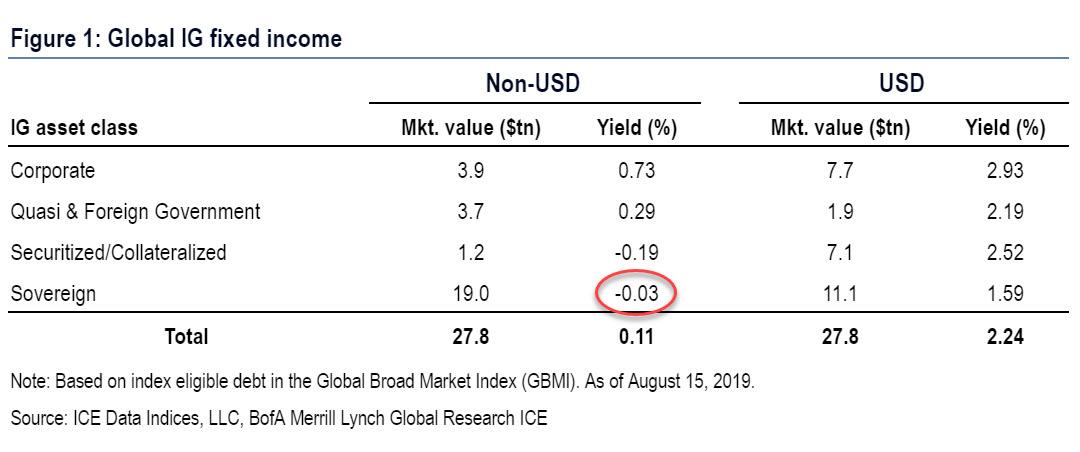

Back in August, we wrote that after decades of waiting, for Albert Edwards vindication was finally here – if only outside the US for now – because as per BofA calculations, average non-USD sovereign yields on $19 trillion in global debt had, as of Monday, turned negative for the first time ever at -3bps.

So now that virtually every rates strategist is rushing to out-“Ice Age” the SocGen strategist (who called the current move in rates years if not decades ago) by forecasting even lower yields (forgetting conveniently that just a year ago consensus called for the 10Y to rise well above 3% by… well, some time now), we reported what man who correctly called the unprecedented move in global yields – which has sent $17 trillion in sovereign debt negative – thinks happens next (for those who missed it, the summary was “There is a lot more to come.“)

Of course, it ain’t easy being a permabear – even when your global “Japanification” thesis, 30 years in the making, has been validated – for the simple reason that there are haters always and everywhere, and for some odd reason Edwards decided that responding to them in his latest letter is a prudent use of his time. In this particular case, Edwards takes umbrage at the criticism of a fellow “financial advisor” who inexplicably, spends more time on CNBC and on twitter than, well, providing financial advice, but that’s Albert’s prerogative (our advice: ignore them).

So instead of diluting Edward’s message with trivial tangents, we focus on several key points, the first of which is why if Edwards got the bond bull market so spectacularly right at a time when virtually everyone remains short bonds…

…click on the above link to read the rest of the article…