Meanwhile In China, Echoes Of Lehman As Interbank Market Freezes

One month ago we wrote that in the aftermath of the shocking government May 24 seizure of Baoshang Bank – not shocking because the bank failed as most Chinese banks are insolvent if left to their own devices due to the real, and far higher levels of non-performing loans, but because the government allowed it to happen in the open, sparking fears of who comes next (and when) – the PBOC “finally panicked and injected a whopping net 250 billion yuan ($36 billion) into the financial system via open-market operations, as it fills what traders have dubbed a growing funding gap following the Baoshang failure.”

In retrospect, the PBOC failed to restore confidence in the stability of the Chinese banking system, and since then things have taken a turn for the far worse.

Yet with the world fixated on the U.S.-China (Mexico, Europe, etc) trade conflict, it is easy to understand why many have brushed aside the Baoshang harbinger and its consequences which have exposed giant fissures under China’s calm financial facade and are gradually freezing up the Chinese banking system.

As the WSJ writes, on Sunday, China’s securities regulator convened a meeting asking big brokerages and funds to support their smaller peers, according to a meeting summary circulated among industry participants Monday. The briefing cited rising risk aversion in money markets after defaults in the bond repurchase market.

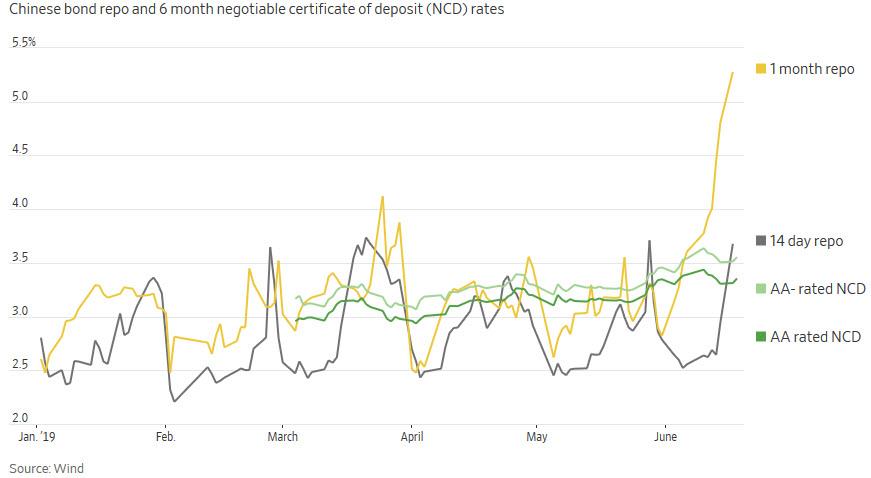

The immediate reaction, which we pointed out back in May, is that some of the key interbank lending rates – those which banks rely on to obtain critical short-term funds – have moved sharply higher in recent weeks, with the 1 month repo soaring, and almost doubling over the past month.

…click on the above link to read the rest of the article…