Liquidity Stress Fractures Begin to Show in the Federal Reserve System

In my January Premium Post, “An Interesting Interest Conundrum,” I laid out how the Federal Reserve was losing control over the Fed funds rate — a loss of control over its bedrock interest rate that indicates financial stresses are building in the banking system that increase the risks from runs on the banks:

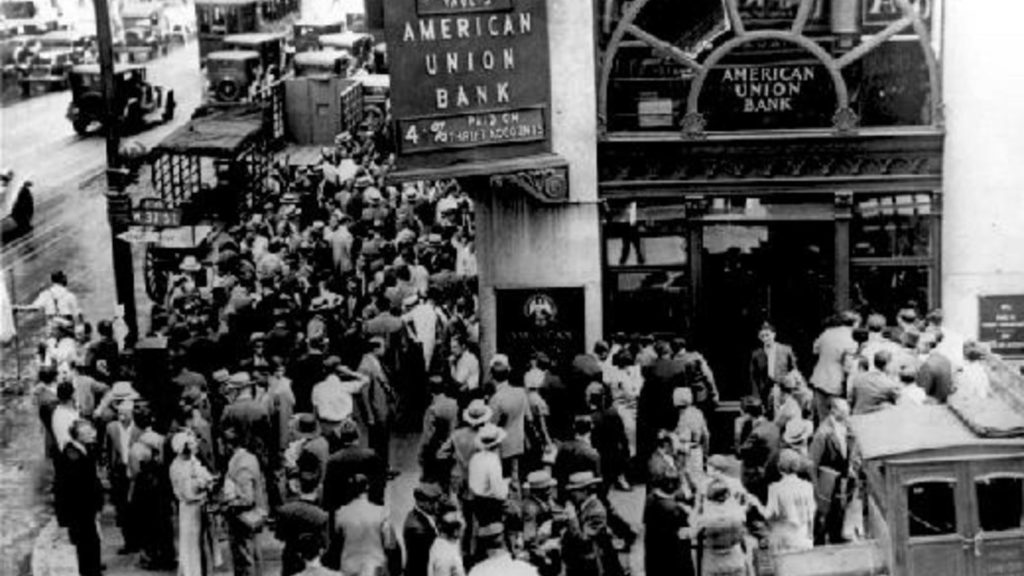

After the financial crisis, when there was a risk of runs on banks, the Fed … require[d] the banks to hold more money in reserves … as a regulation safeguard when the Fed was trying to avoid total economic collapse. Deposits, after all, are liabilities because depositors are guaranteed they can demand instant cash at will. Depositors get extremely unhappy if this guarantee is not fulfilled. That looks something like this:

And you don’t want that.

The Fed funds rate is the Fed’s target rate for the amount of interest banks charge each other to make overnight loans to each other from their reserves. In a crisis, when banks need their reserves, the interest they charge each other will naturally skyrocket. To keep the monetary system from freezing up because banks won’t loan to each other, the Fed tries to push that rate down.

During the Fed’s Great-Recovery bond-buying program (quantitative easing), aimed at pushing that rate down, the Fed deposited huge amounts of money created out of thin air into bank reserve accounts to make sure they remained flush so there would be no panic runs on banks, but banks don’t like just sitting on huge piles of money, instead of making even more loans with those piles, especially after the crisis abates. The Fed, however, wanted them to continue to maintain those reserves in case crisis returned.

…click on the above link to read the rest of the article…