List of 24 Points Pressing Hard toward Recession

- The US stock market is slightly overbought (which is not a positive in terms of head room for more of a rally).

- It’s massively built up on debt that is now more expensive to maintain and/or obtain.

- The Fed is still rapidly tightening money supply and says it will continue to do so for several more months.

- Interest rate increases and money tightening that already happened through this past December will continue to worsen economic conditions until summer because any changes by the Fed have about a half year lag time for the general economy.

- That also means all the tightening that continues between now and September, will continue to pile more and more weight on top of the economy until next February, which is why the Trump admin. is screaming the Fed went too far.

- 2019 Q1 US corporate earnings are coming in almost as poorly as economists said they would, and they don’t look set to start rising much in the next quarter … if at all.

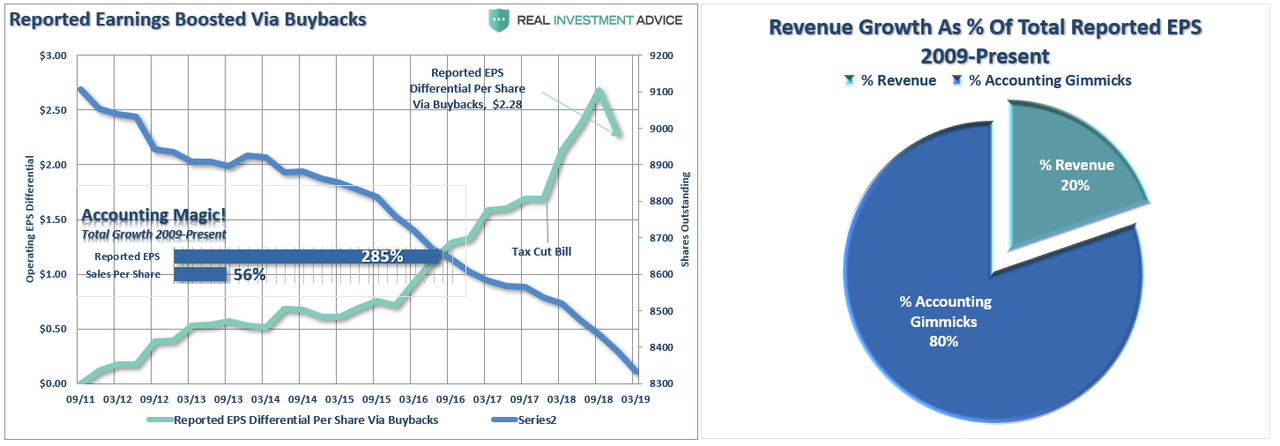

- Measures used to help earnings beat much lower expectations (and not by much) were mostly cost-saving measures, not revenue boosters, or they were mere accounting choices. Earnings are after-tax numbers, so they benefited hugely in 2018 from the Trump Tax Cuts in a way that had nothing at all to do with companies doing better business. They are also reported as a “per share” number, and the main thing that changed was the number of outstanding shares in the denominator as a result of stock buybacks. So, really, earnings were pathetic!

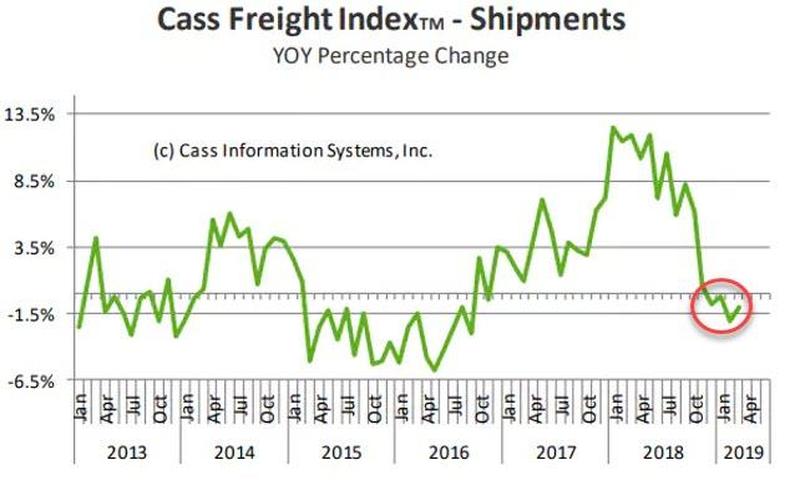

- Transportation is declining as product shipments decline. West-coast port imports plunged 19% from the previous quarter (3% YoY). Trucking lost ground four months in a row.

…click on the above link to read the rest of the article…