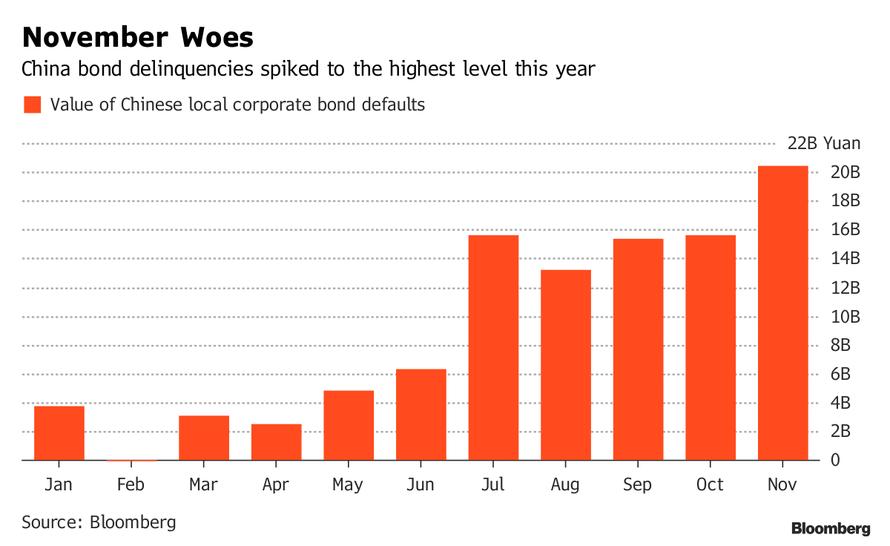

That China has had a problem with rising defaults is not news: as we reported back in October, 2018 was already set to be a record year for Chinese bankruptcies. Things only got worse in November and December when defaults spiked to 20.4 billion yuan ($3 billion) confirming that the supportive policies from the People’s Bank of China announced more than a month ago have yet to yield the intended effect.

“Defaults will stay elevated [in 2019] because the Chinese economy is expected to slow and off-balance-sheet lending has been shrinking,” said Yang Hao, analyst at Nanjing Securities. The funding environment has yet to improve significantly for certain corporations, he added.

Predictably, just like in the US, Chinese investors have shunned lower-rated notes, and only relatively stronger firms were able to access the local bond market in recent months. Non-finance companies rated below AA publicly sold 1.27 trillion yuan of notes for the first 11 months of 2018, the lowest in four years. In contrast, companies with above AA+ ratings sold almost 3.28 trillion yuan bonds, up about 40 percent from last year.

None of this is news.

What is surprising however, is what happened when the latest Chinese corporate default took place on Tuesday: that’s when Jiangsu-based Kangde Xin Composite Material Group, failed to pay a 1 billion yuan ($148 million) local note due Jan. 15 due to a liquidity crunch, according to the company. The shocking punchline: as research analyst Tim Yup caught earlier this week, as of end-September the company reported that it “had” 15.4 billion yuan in cash and equivalents, more than double the total amount of its short-term debt, and more than 15 times the amount of debt that it just defaulted on!

…click on the above link to read the rest of the article…