Former Dallas Fed official Danielle DiMartino Booth joins the show just as Chairman Jay Powell faces his first major challenge: will he keep raising rates as promised now that autos, housing, employment, and even tech stocks look soft? And if not, will he effectively signal that the US economy is in big trouble?

“I’m most concerned about the bottom line evaluations in the corporate debt market…these bring back memories of the sub-prime credit crisis…”

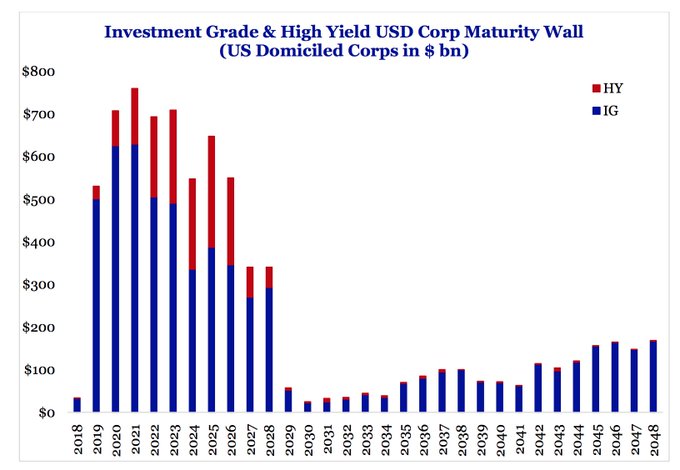

“The corporate bond market has doubled since 2007. It is over 9 $trillion. Subprime loans were 3 trillion… The Fed should be calling out potential financial stability risks. That is the unspoken third mandate.“

“Apparently in six weeks we have come “worlds apart from neutral” to “Just under” and that is when markets really, really took off.”

“The Fed could engineer a soft landing, but it is a rare occurrence and as Powell is learning, there is a lagged effect in terms of when those interest rate hikes are put in and when they show up in the economy.”

“Powell is trying to broadcast that he is truly data dependent…‘if the data change, I’m going to change with the data.'”

“…look across energy, manufacturing, real estate & construction, leisure & hospitality states…jobless claims across all of these sectors have turned up. It is a weakening economy…”

“If the economy is truly slowing, then top line growth will slow, earnings expectations will be ratcheted down going into 2019. Those are things that the stock market will not like.”

…click on the above link to read the rest of the article…