Subprime Begins to Haunt Credit Card Balances

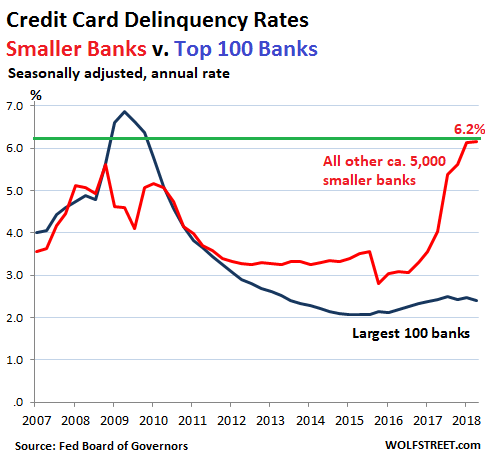

Delinquencies soar past Financial-Crisis peak at the ca. 5,000 smaller US banks, and these are the Good Times. What’s going on?

The delinquency rate on credit-card loan balances at commercial banks other than the largest 100 – so at the nearly 5,000 smaller banks in the US – rose to 6.2% in the second quarter. This exceeds the peak during the Financial Crisis by a full percentage point and was up from 4.0% a year ago.

But for the largest 100 banks – which carry the majority of the credit-card loan balances – the delinquency rate was 2.4% (seasonally adjusted), the Federal Reserve Board of Governors reported Tuesday afternoon. So what is going on here?

A bank classifies credit card balances as “delinquent” when they’re 30 days or more past due. The rate is figured as a percent of total credit card balances. In other words, among the smaller banks, 6.2% of the outstanding credit card balances are now delinquent.

Some customers are able to catch up with their minimum payments, and their credit card balances are removed from the delinquency basket. Others are not able to catch up, and the bank tries to collect what it can. It then moves the balance out of the delinquency basket into the charge-off basket – when the loan is “charged off” against loan loss reserves.

These charge-offs among the largest 100 banks in Q2 rose a fraction year-over-year to 3.6% (seasonally adjusted).

But among the nearly 5,000 remaining banks, the charge-off rate spiked three full percentage points year-over-year to 7.8%, the highest since Q1 2010. The rate among smaller banks had peaked during the Financial Crisis in Q1 2010 at 8.4%:

…click on the above link to read the rest of the article…