Update on the Most Splendid Housing Bubbles in the US

Everything spikes.

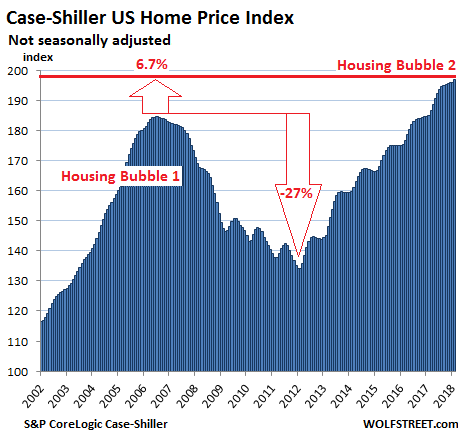

Prices of houses and condos across the US surged 6.3% from a year earlier (not seasonally-adjusted), according to the S&P CoreLogic Case-Shiller National Home Price Index for February, released this morning. The index is now 6.7% above the crazy peak of “Housing Bubble 1” in July 2006 just before the hot air hissed out, and 47% above the bottom of “Housing Bust 1”:

Real estate is local though prices are also impacted by national and global factors — such as monetary policies and offshore investors who consider US housing as an asset class and escape route — as well as by local factors. Together they create local housing bubbles. As local housing bubbles accumulate, even as some housing markets remain in the doldrums, they turn into a national housing bubble, as depicted in the chart above.

The Case-Shiller Index is based on a rolling three-month average; today’s release is for December, January, and February. The index, based on “home price sales pairs,” compares the sales price of a house in the current month to the last transaction of the same house years earlier. The index then incorporates other factors and uses algorithms to arrive at a data point. The index was set at 100 for January 2000; so an index value of 200 means prices as figured by the index have doubled.

So here are the most splendid housing bubbles in major metro areas in the US:

Boston:

The Case-Shiller home price index for the Boston metro jumped 0.7% on a monthly basis, to a new record, after two months of increases that followed three declines in a row, that had followed a 22-month surge during which the index defied not only gravity but also normal seasonal variations. The index is up 5.7% from a year ago. During Housing Bubble 1, from January 2000 to October 2005, the index had skyrocketed 82% before dropping. It now tops that crazy peak by 13%:

…click on the above link to read the rest of the article…