Home » Posts tagged 'of two minds' (Page 9)

Tag Archives: of two minds

Did Covid-19 Just Pop All the Global Financial Bubbles

Did Covid-19 Just Pop All the Global Financial Bubbles?

Once confidence and certainty are lost, the willingness to expand debt and leverage collapses.

Even though the first-order effects of the Covid-19 pandemic are still impossible to predict, it’s already possible to ask: did the pandemic pop all the global financial bubbles? The reason we can ask this question is the entire bull mania of the 21st century has been based on a permanently high rate of expansion of leverage and debt.

The lesson of the 2008-09 Global Financial meltdown was clear: any decline in the rate of debt/leverage expansion is enough to threaten financial bubbles, and any absolute decline in debt and leverage will unleash a cascade that collapses all the speculative bubbles in stocks, real estate, collectibles, etc.

What’s the connection between Covid-19 and the rate of debt/leverage expansion? Confidence and certainty: people will make bets on future growth and take on additional debt and leverage when they feel confident and have a high degree of certainty that the trends are running their way.

Over the past 20 years, the certainty that central banks would support markets has been high, as central banks stepped in at every wobble. Today’s 50 basis-points cut by the Fed sustains that certainty.

What’s now broken is the certainty that central bank interventions will lift risk assets and the real-world economy. Given the uncertainties of the eventual consequences of the pandemic globally, confidence in future trends has been either dented or destroyed, depending on your perspective and timeline.

Certainty that central bank interventions will push markets and real-world economies higher has also been dented. What happens if the market tanks after every 50 basis-points cut by the Fed?

We wouldn’t be in such a precariously brittle state if the global economy hadn’t been ruthlessly financialized to the point that market dependence on central bank intervention is now essentially 100%.

…click on the above link to read the rest of the article…

When Will We Admit Covid-19 Is Unstoppable and Global Depression Is Inevitable?

When Will We Admit Covid-19 Is Unstoppable and Global Depression Is Inevitable?

Given the exquisite precariousness of the global financial system and economy, hopes for a brief and mild downturn are wildly unrealistic.

If we asked a panel of epidemiologists to imagine a virus optimized for rapid spread globally and high lethality, they’d likely include these characteristics:

1. Highly contagious, with an R0 of 3 or higher.

2. A novel virus, so there’s no immunity via previous exposure.

3. Those carrying the pathogen can infect others while asymptomatic, i.e. having no symptoms, for a prolonged period of time, i.e. 14 to 24 days.

4. Some carriers never become ill and so they have no idea they are infecting others.

5. The virus is extremely lethal to vulnerable subpopulations but not so lethal to the entire populace that it kills its hosts before they can transmit the virus to others.

6. The virus can be spread by multiple pathways, including aerosols (droplets from sneezing/coughing), brief contact (with hotel desk clerks, taxi drivers, etc.) and contact with surfaces (credit cards, faucets, door handles, etc.). Ideally, the virus remains active on surfaces for prolonged periods, i.e. 7+ days.

7. Those infected who recover may catch the virus again, as acquired immunity is not 100%.

8. As a result of this and other features, it’s difficult to manufacture a vaccine that will reliably protect against infection.

9. The tests designed to detect the virus are inherently limited, as the virus may be present in tissue that isn’t being swabbed.

10. The symptoms of the illness are essentially identical with less contagious and lethal flu types, so people who catch the virus may not know they have the novel pathogen.

…click on the above link to read the rest of the article…

Covid-19: Global Retrenchment Will Obliterate Sales, Profits and Yes, Big Tech

Covid-19: Global Retrenchment Will Obliterate Sales, Profits and Yes, Big Tech

If you think global demand will rebound as global debt and confidence implode, you better not be making consequential decisions based on Euphorestra-addled magical thinking.

Even before the Covid-19 pandemic, the global economy was slowing for two reasons: 1) everybody who can afford it already has it and 2) overcapacity. One word captures the end-of-the-cycle stagnation: saturation.

Everyone who can afford a smartphone (or can borrow to buy one) already has one. Everyone who can afford an auto loan already has a car. Everyone who could afford an overpriced house already bought one. Everyone who can afford a tablet or laptop already has one. And so on.

This saturation isn’t just in the consumer market–the corporate market is equally saturated. Corporations leased too much space, bought more cloud services than needed, increased headcount willy-nilly, and increased capacity just as the market for their goods and services stagnated from global saturation of markets and debt.

Paint-daubed members of the Keynesian Cargo Cult (paging Chief Humba-Humba Paul Krugman) love to claim that “debt doesn’t matter” but in their frenzied dance around the campfire they ignore one little feature of debt: interest. In a world in which money is borrowed into existence, all new money issuance and all new debt (the same thing) accrues interest.And as Japan has proven, even if the interest rate is near-zero, if you borrow relentlessly enough, the interest due even on near-zero interest rates soon dominates your entire income.

The Keynesian Cargo Cult, busy with their rock radios (the dials are painted on), ignore the sad reality that marginal borrowers default because they can’t afford to make the principal payments, never mind the interest, and the inevitable result is cascading defaults throughout the financial system.

It’s not just marginal borrowers who blow up; marginal lenders also blow up as all the loans they issued to marginal borrowers blow up.

Then there’s overcapacity. Yes there are shortages such as pork in China due to the spread of Swine Fever, but in one manufactured commodity after another, there is more capacity than customer demand.

…click on the above link to read the rest of the article…

The Violent Collision of Market Fantasy and Viral Reality

The Violent Collision of Market Fantasy and Viral Reality

When the stampede tumbles off the cliff, buyers vanish and markets go bidless.

The shock wave unleashed in China on January 23 is about to hit the U.S. economy and shatter everything that is fragile and fantasy, starting with the U.S. stock market. The shock wave is still reverberating through the vulnerable Chinese economy, toppling all that is fragile: auto sales, sales of empty flats in Ghost Cities, shadow banking loans that cannot be paid, workers’ wages that won’t be paid, businesses that won’t re-open, supply chains dependent on marginal enterprises and most saliently, the faith of the people in their hubris-soaked, self-serving leadership.

The fantasy in the U.S. is that the shock wave doesn’t exist. Since the shock wave has been hurtling with undimmed force toward the shores of all-mighty American complacency beneath the Pacific, unseen, America’s laughable fantasy has spread through the thundering stampede triggered by the fools in the Federal Reserve in early October.

Not only is America’s economy invulnerable, so is its stock market. This fantasy has fueled a blow-off-top bubble of such classic proportions that even the fools in the Fed recognize it as a bubble. And even the fools in the Fed know blow-off-top bubbles always burst, and with rough symmetry: if the bubble rocketed higher in six weeks, it will crash to Earth in about six weeks.

If we look at the Fed’s balance sheet, we can discern the Fed fools’ implicit attempt to engineer a “soft landing,” i.e. stocks will remain at a permanently high plateau.The Fed balance sheet has gone nowhere for six weeks while the stampede in stocks gathered momentum:12/25/19 $4.165 trillion

1/1/20 $4.173 trillion

1/8/20 $4.149 trillion

1/15/20 $4.175 trillion

1/22/20 $4.145 trillion

1/29/20 $4.151 trillion

2/5/20 $4.166 trillion

…click on the above link to read the rest of the article…

Controlling the Narrative Is Not the Same as Controlling the Virus

Controlling the Narrative Is Not the Same as Controlling the Virus

Are these claims even remotely plausible for a highly contagious virus that spreads easily between humans while carriers show no symptoms?

It’s clear that the narrative about the coronavirus is being carefully managed globally to minimize the impact on global sentiment and markets. Authorities are well aware of the global economy’s extreme fragility, and so Job One for authorities everywhere is to scrub the news flow of anything that doesn’t support the implicit official narrative:1. The coronavirus is only an issue in China; it’s contained outside China.2. The coronavirus will soon be contained in China, and global business will quickly return to normal.

In pushing this narrative, authorities around the world share the same goal: limit the damage to consumer confidence and markets, as the legitimacy of every regime from Beijing to Washington D.C. to Nairobi is based on maintaining these economic fictions:

1. Global growth will continue in an unbroken trend in the decades ahead.

2. This growth benefits everyone, not just elites.As I’ve noted in previous posts, the critical dynamic here is consumer confidence: consumers cannot be allowed to become hesitant or afraid lest they stop borrowing, borrowing, borrowing, buying, buying, buying and speculating, speculating, speculating.

Authorities outside China have no more interest in accurate death totals being released than Chinese authorities, and so official agencies and the corporate media dutifully parrot the implausibly low Chinese statistics as if they reflected reality.

But controlling the narrative is not the same as controlling the virus. The narrative is intangible but the virus is real-world. Authorities are betting that controlling the narrative about the virus is equivalent to controlling the actual virus.

…click on the above link to read the rest of the article…

The Pandemic Isn’t Ending, It’s Just the Beginning of Global Disorder and Depression

The Pandemic Isn’t Ending, It’s Just the Beginning of Global Disorder and Depression

When you’ve been lied to, you’ve been betrayed. Betrayal has consequences.

Unsurprisingly, denying the pandemic is unstoppable and consequential is the order of the day: authorities everywhere are terrified these realities might leak through all their oh-so-obviously desperate firewalls and filters. Why are they terrified? Because they know the entire global economy, including the linchpin Chinese and U.S. economies, was extremely fragile before the pandemic arose: why else the panic-stimulus and panic-repo policies of the Federal Reserve and the People’s Bank of China in the pre-pandemic months of Q4 2019?

And so everything is covered up, and if that doesn’t work, then outright denial is the default policy. The number of cases globally is absurdly understated, the number of deaths in China is absurdly under-reported, and so on.

But the biggest denial campaign is aimed at masking the fragility of the global economy, as the only thing keeping the rickety, speculative-bubble, insolvent global economy from imploding is the belief and confidence of the masses that everything is going swimmingly, so keep on borrowing, borrowing, borrowing, buying, buying, buying and speculating, speculating, speculating.

While the real-world battle to limit the spread of the virus in China gets the headlines, the battle inside your head to maintain your confidence in the system is just as important. Economists talk about recession and depression in quantitative terms: deflation, sales, profits, employment and so on.

The key dynamic in recessions and depressions is confidence: confidence that the condo you buy today will be worth a lot more tomorrow, the business investment you make today will generate higher profits tomorrow, your job benefits will increase tomorrow, your house value will rise tomorrow, and so on.

…click on the above link to read the rest of the article…

When China’s Supply Chains Break, so Will the Delusion the U.S. Economy Is Invulnerable

When China’s Supply Chains Break, so Will the Delusion the U.S. Economy Is Invulnerable

Was it ever plausible that China’s economy could grind to a halt and there wouldn’t be any consequences for the U.S. economy? No.

Many commentators talk about supply chains in China, but how many have actually visited factories in China, other than carefully choreographed PR visits to suitably high-tech facilities? I’ve visited many factories in China, and not with a staff of minders who swiftly guide the visitors through the happy story of high-tech wonderland.

I’ve visited some high-tech facilities but also many low-tech factories, where most of the supply chain originates, usually with one or two bored local government functionaries. You get a much less distorted view of the supply chain on the ground, away from the carefully guided tours.Since we weren’t important visitors, nothing was staged. Workers glanced at us, as in what are they doing here?, but otherwise we simply observed everyday operations.

As I’ve reported here for a decade, profit margins in the vast majority of these supply chain companies are wafer-thin, with 1% being bandied about as a typical profit margin. Due to the extremely distorting way imports and exports are recorded, as little as $10 of every $400 iPhone “imported” from China actually stays in China as wages, overhead and profit. We estimate China only makes $8.46 from an iPhone.

Most of the high-value components are manufactured elsewhere in the world, and all the profit and overhead flows to Apple HQ in Cupertino, California.

The reality is that much of the supply chain is at risk of financial collapse. Many if not most of the thousands of spontaneous protests in recent years in China are not political; they’re workers demanding back pay or promised bonuses from shuttered supply-chain companies.Here’s how bankrupt supply-chain factory owners deal with bankruptcy: they leave in the middle of the night and vanish.

…click on the above link to read the rest of the article…

Brace for Impact: Global Pandemic Already Baked In

Brace for Impact: Global Pandemic Already Baked In

If we accept what is known about the virus, then logic, science and probabilities all suggest we brace for impact.

Here’s a summary of what is known or credibly estimated about the 2019-nCoV virus as of January 31, 2019:1. A statistical study from highly credentialed Chinese academics estimates the virus has an RO (R-naught) of slightly over 4, meaning every carrier infects four other people on average.

This is very high. Run-of-the-mill flu viruses average about 1.3 (i.e. each carrier infects 1.3 other people while contagious). Chris Martenson (PhD) goes over the study in some detail in this video.

Let’s say the study over-estimates the contagiousness due to insufficient data, etc. Even an RO of 3 means the number of infected people rises geometrically (parabolically).

This matters because it negates any plan to track every potentially infected person who came in contact with a carrier.

Coronaviruses tend to be contagious in relatively close contact (within two meters / six feet) but masks may not be enough protection, as it may spread by contact with surfaces and through the eyes.

All available evidence supports the conclusion that this virus is highly contagious, i.e. it isn’t that difficult to catch.

2. Along with its contagiousness, the most consequential feature of this virus is that asymptomatic carriers can transmit it to other people, who will also be unaware they’ve been infected with the pathogen.

This means carriers have no reason to self-quarantine until they develop symptoms, which may be a week or more after they’ve begun spreading the virus to others.

It’s easy to imagine a situation where an asymptomatic carrier from Wuhan took a flight to Beijing, infecting passengers and people in the airport, who then got on flights going to international destinations, where a few days later they become asymptomatic transmitters of the virus.

…click on the above link to read the rest of the article…

Has the Global Economy Finally Exhausted its Good Luck?

Has the Global Economy Finally Exhausted its Good Luck?

All of these guarantees and redundancies are as illusory as the “unsinkable” technologies of the Titanic.

The past three decades of global growth are rarely attributed to luck: it’s all the result of our brilliant fiscal, monetary and trade policies. Those in positions of wealth and power are delighted to take credit for this tremendous success, but as a general rule, the more knowledgeable you are and the higher up the food chain you are, the greater your awareness of the role of luck in any unbroken chain of success.

There are various moving parts in what we call luck. One is what we don’t know but think we know, or put another way, we know enough to be confident everything will work as intended and expected.I described how this worked in the Titanic disaster in Why Our Financial System Is Like the Titanic (March 15, 2016).

The technologies of the early 1900s enabled shipbuilders to construct enormous steel-hulled ships almost 900 feet in length capable of steaming at 24 knots, transporting passengers across the Atlantic in comfort. The technologies that made such ships and transits low risk were largely already present but in forms that were deeply flawed in ways that were not readily visible or understood.

Unbeknownst to the era’s designers and shipbuilders, the Titanic’s hull plates were brittle due to high sulfur content in the steel, especially at cold temperatures (the water was near freezing at the time of the collision with the iceberg).

Rather than deform as the iceberg scraped against the hull, the plates and rivets fractured, opening the irregular gash that sank the ship.

The watertight bulkheads appeared to make the ship “unsinkable,” but this was only true if the hull was compromised across no more than four watertight compartments. The bulkheads may have actually accelerated the sinking, as later studies found the ship would have stayed afloat an additional six hours without any watertight bulkheads, as the ship would have settled evenly rather than sinking bow-first as the forward compartments filled.

The presence of lifeboats seemed to offer a guarantee of safety, yet outdated regulations only required enough lifeboats for half the crew and passengers.

…click on the above link to read the rest of the article…

Coronavirus and the “Unsinkable” Titanic Analogy

Coronavirus and the “Unsinkable” Titanic Analogy

Unthinkable doesn’t mean unsinkable.

As we all know, the “unsinkable” Titanic suffered a glancing collision with an iceberg on the night of April 14, 1912. A half-hour after the iceberg had opened six of the ship’s 16 watertight compartments, it was not at all apparent that the mighty vessel had been fatally wounded, as there was no evidence of damage topside. Indeed, some eyewitnesses reported that passengers playfully scattered the ice left on the foredeck by the encounter.

But some rudimentary calculations soon revealed the truth to the officers: the ship would sink and there was no way to stop it. The ship was designed to survive four watertight compartments being compromised, and could likely stay afloat if five were opened to the sea, but not if six compartments were flooded. Water would inevitably spill over into adjacent compartments in a domino-like fashion until the ship sank.

We can sympathize with the disbelief of the officers, and with their contradictory duty to simultaneously reassure passengers and attempt to goad them into the lifeboats. Passengers were reluctant to heed the warning because it was at odds with their own perceptions. With the interior still warm and bright with lights, it seemed far more dangerous to clamber into an open lifeboat and drift off into the icy Atlantic than it did to stay onboard.

The evidence was undeniable, but humanity’s first response is denial, regardless of the evidence. The evidence that the coronavirus is contagious is undeniable, as is the evidence that carriers who have no symptoms can transmit the virus to others.

Just as the eventual sinking of Titanic could be extrapolated from the basic facts (six watertight compartments were flooding), so the eventual spread of the coronavirus can be extrapolated from these basic facts.

…click on the above link to read the rest of the article…

Could the Coronavirus Epidemic Be the Tipping Point in the Supply Chain Leaving China?

Could the Coronavirus Epidemic Be the Tipping Point in the Supply Chain Leaving China?

Everyone expecting a quick resolution to the epidemic and a rapid return to pre-epidemic conditions would be well-served by looking beyond first-order effects.

While the media naturally focuses on the immediate effects of the coronavirus epidemic, the possible second-order effects receive little attention:

first order, every action has a consequence. Second order, every consequence has its own consequence.

So the media’s focus is the first-order consequences: the number of infected people and fatalities, government responses such as quarantines, and so on. The general expectation is these first-order consequences will dissipate shortly and life will return to its pre-epidemic status with virtually no significant changes.

Second-order effects caution: not so fast. Second-order consequences may play out for months or even years even if the epidemic ends as quickly as the consensus expects.

The under-appreciated dynamic here is the tipping point, the imprecise point at which a decision to make fundamental changes tips from “maybe” to “yes.

“These tipping points are often influenced by exhaustion or frustration. Take a small business that’s been hit with tax increases, additional fees, more regulatory compliance requirements, etc. When the next fee increase arrives, the onlooker might declare that the sum is relatively modest and the business owner can afford to pay it, but the onlooker is only considering first-order effects: the size of the fee and and the owner’s ability to pay it.

To the surprise of the onlooker focusing only on first-order effects, the second-order effect is the owner closes the business and moves away. Invisible to everyone focusing solely on first-order effects, the owner’s sense of powerlessness and weakening resolve to continue despite soaring costs and declining profits has slowly been moving up to a tipping point.

…click on the above link to read the rest of the article…

Some Practical Questions about the Coronavirus Epidemic

Some Practical Questions about the Coronavirus Epidemic

Restrictions that allow a significant number of people to move about, either with official approval or unsanctioned “black market” activity, cannot stop the spread of contagious diseases.

Like everyone else, I’ve been reading the mainstream media reports on the Coronavirus epidemic. I haven’t found any information about the practicalities that immediately occur to me, such as:

1. When public transportation is halted and commerce grinds to a halt as people avoid public places and gatherings, thousands of employees no longer go to work. Who pays their wages while the city is locked down? The employers? Then who compensates the employers, since their income has also gone to zero?

Does China have a universal unemployment insurance system that can quickly issue payments to all people who are no longer going to work and getting a paycheck from an employer?

What about the thousands of migrant workers who don’t have regular employers? Who pays them? If they’re technically not officially sanctioned residents of the city, they don’t exist in government records.

2. If people idled by the lockdown are supposed to live off savings, what about all the marginal workers with few resources? What are they going to live on once their meager savings are gone?

3. Given the choice of obeying the lockdown rules and starving or slipping out of the city to find paid work somewhere else, how many migrant workers will choose to slip away?

4. Unlike the developed West, many people in China still have ancestral villages to return to, rural towns where their grandparents or or other close relatives live. If work has dried up and you’re fearful of catching a potentially lethal virus, wouldn’t it make sense to slip out of the city and make your way back to the village where you can hunker down until the epidemic blows over?

Since people who caught the virus may not know they’re a carrier, how will this migration not spread the disease to rural areas with few medical resources?

…click on the above link to read the rest of the article…

Welcome to the Era of Intensifying Chaos and New Weapons of Conflict

Welcome to the Era of Intensifying Chaos and New Weapons of Conflict

Geopolitics has moved from a slow-moving, relatively predictable chess match to rapidly evolving 3-D chess in which the rules keep changing in unpredictable ways.

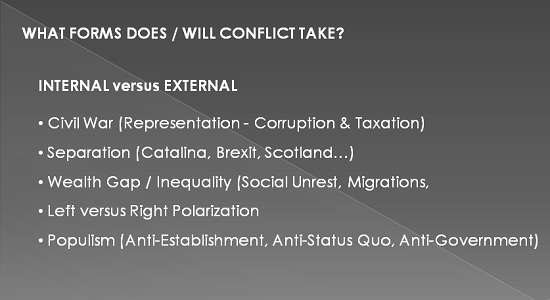

A declining standard of living in the developed world, declining growth for the developed world and geopolitical jockeying for control of resources make for a highly combustible mix awaiting a spark: welcome to the era of intensifying chaos and the rapid advance of new weapons of conflict as ruling elites attempt to stamp out dissent and global powers pursue supremacy by whatever means are available.

Gordon Long and I discuss these dynamics in a new video The New Weapons of Conflict (28:30) that explores the drivers of increasing global chaos and a permanent state of intensifying conflict in both domestic (internal) and global (external) affairs.

Domestic conflict is erupting and intensifying across the globe: political polarization and populism, driven by soaring wealth/income inequality and the decay of the social contract and the erosion of standards of living, and social disunity and disorder as cooperation has failed to fix what’s broken.

Geopolitical conflicts are now expanding across a vast spectrum from endless wars in contested regions to cyber-meddling in other nation’s domestic affairs, cyber-warfare via theft of intellectual property and targeting essential digital infrastructure, economic sanctions and currency-based warfare, along with a wide array of disruptive military technologies, including “first strike”-enabling hypersonic weaponry, anti-missile technologies and space-based weaponry.

The relative stability of the Cold War has given way to a multi-polar world in which nations are competing with a host of other nations, including erstwhile allies and economic/trade rivals. Geopolitics has moved from a slow-moving, relatively predictable chess match to rapidly evolving 3-D chess in which the rules keep changing in unpredictable ways.

There’s much more in the program; click on either graphic to go to the video:

…click on the above link to read the rest of the article…

Skyrocketing Costs Will Pop All the Bubbles

Skyrocketing Costs Will Pop All the Bubbles

The reckoning is coming, and everyone who counted on “eternal growth of borrowing” to stave off the reckoning is in for a big surprise.

We’ve used a simple trick to keep the status quo from imploding for the past 11 years: borrow whatever it takes to keep paying the skyrocketing costs for housing, healthcare, college, childcare, government, permanent wars and so on.

The trick has worked because central banks pushed interest rates to zero, lowering the costs of borrowing more as costs continued spiraling higher.

But that trick has been used up. The next step–negative interest rates–has failed to spark the “growth” required to pay for insanely overpriced housing, healthcare, college, childcare, government, etc.

We’ve reached the end of the line on lowering interest rates as a way of borrowing more to keep our heads above water. We’ve reached the point where households and enterprises can’t even afford the principle payments, i.e. no interest at all.

How are banks supposed to make money at zero interest rates? By charging outrageous overdraft fees and offering marginally qualified borrowers sky-high credit cards, and getting in on the federally guaranteed mortgage/student loan racket, that’s how.

The point here is the discipline of rising costs has been destroyed by easy money. Take higher education as an example. If there was no federally backed student loan “industry,” universities would have been forced to innovate 20 years ago to lower costs and improve the market value of their “product.”Instead, they left their bloated cost structure untouched as it spiraled ever higher, and simply passed the higher costs onto students, who have had to borrow over $1.5 trillion to feed the bloated higher education cartel.

…click on the above link to read the rest of the article…

A “Market” That Needs $1 Trillion in Panic-Money-Printing by the Fed to Stave Off Implosion Is Not a Market

A “Market” That Needs $1 Trillion in Panic-Money-Printing by the Fed to Stave Off Implosion Is Not a Market

It was all fun and games enriching the super-wealthy but now the karmic cost of the Fed’s manipulation and propaganda is about to come due.

A “market” that needs $1 trillion in panic-money-printing by the Fed to stave off a karmic-overdue implosion is not a market: a legitimate market enables price discovery. What is price discovery? The decisions and actions of buyers and sellers set the price of everything: assets, goods, services, risk and the price of borrowing money, i.e. interest rates and the availability of credit.

The U.S. has not had legitimate market in 12 years. What we call “the market” is a crude simulation that obscures the Federal Reserve’s Socialism for the Super-Wealthy: the vast majority of the income-producing assets are owned by the super-wealthy, and so all the Fed money-printing that’s been needed to inflate asset bubbles to new extremes only serves to further enrich the already-super-wealthy.

The apologists claim the bubbles must be inflated to “help” the average American, but that claim is absurdly specious. The majority of Americans “own” near-zero assets that earn income; at best they own rapidly-depreciating vehicles, a home that doesn’t generate any income and a life insurance policy that pays off only when they pass away.The average American uses the family home for shelter, and so its currently inflated price does nothing to improve the household income: it’s paper wealth, and we’ve already seen how rapidly that paper wealth can vanish when Housing Bubble #1 popped. (Housing Bubble #2 is currently sliding toward the edge of the abyss.)

Were legitimate price discovery allowed, the asset bubbles would pop, and the real-world impact on the average household that owns essentially zero income-producing assets would be minimal.

…click on the above link to read the rest of the article…