In the eyes of many people, the Federal Reserve (Fed) is an indispensable institution. We are told it supports growth and employment, fends off the negative shocks, and fights inflation. Nothing could be farther from the truth. The Fed’s fiat money regime is economically and socially highly destructive — causing far-reaching societal and political consequences that extend beyond what most people would imagine.

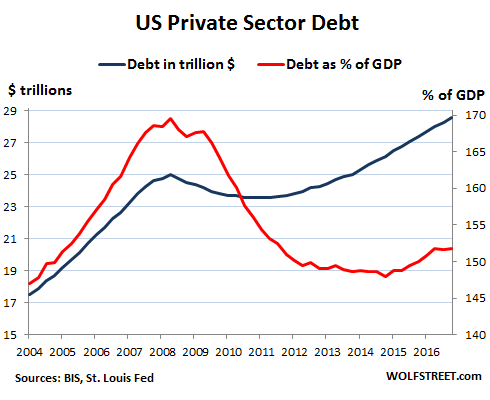

Fiat money is inflationary, it debases the purchasing power of money; it benefits a few at the expense of the many; it causes boom-and-bust cycles that hurt many people economically; it makes people run into too much debt, leading to over-indebtedness; it corrupts society’s morals; it makes government grow at the expense of individual liberty; it encourages the state’s aggressiveness and fuels its war machine.

Tragically, however, people consider falsely the Fed as their “knight in shining armor” coming to their rescue in times of trouble rather than what the institution really is: the very source of economic and societal grievance. People do not blame the Fed for the trouble it causes, but instead welcome Fed action for overcoming the damage it has caused in the first place. That is why many people keep their fingers crossed that the Fed’s latest “exit plan” will succeed.

The Fed’s Exit Plan

In the course of the financial and economic crisis of 2008–2009, the Fed lowered interest rates to basically zero. It also increased its balance sheet from $879.4 billion at the end of 2007 to $4.5 trillion in September 2017. It did this by purchasing US Treasuries and agency mortgage-backed securities (MBS) in the amount of $2.4 trillion and $1.7 trillion, respectively, thereby having injected additional ‘base money’ into the US banking system.

…click on the above link to read the rest of the article…