Home » Posts tagged 'currency devaluation' (Page 7)

Tag Archives: currency devaluation

Turkmenistan Devalues Currency By 18%, Armstrong Warns Of “Economic Collapse On A Global Scale”

Turkmenistan Devalues Currency By 18%, Armstrong Warns Of “Economic Collapse On A Global Scale”

The energy-rich former Soviet republic of Turkmenistan Thursday devalued its currency against the US dollar by 18%, as AFP notes, in the latest sign of contagion among Russia’s neighbors from the plunging ruble (following Krgyzstan’s 17% plunge in 2014 and Kazakhstan’s 14% tumble). However, as Martin Armstrong warns, this is symptomatic of a deflationary contagion that “will contribute to now force the dollar higher… We are in a major economic collapse on a global scale. Most people do not understand that this is the real threat we face.”

On Thursday, the website of Turkmenistan’s central bank published the rate of 3.50 manats to the US dollar, from 2.85 manats, a depreciation of 18.6 percent.

The devaluation came as the plunge in value of the Russian ruble, linked to Western sanctions over Ukraine and falling oil prices, sent shockwaves through former Soviet republics.

…click on the above link to read the rest of the article…

Crashing Yen Leads To Record Number Of Japanese Bankruptcies | Zero Hedge

Crashing Yen Leads To Record Number Of Japanese Bankruptcies | Zero Hedge.

Last week, Zero Hedge first showed a chart so simple, even a Krugman could get it: at this point (and really ever since USDJPY 110 and higher), any incremental Yen devaluation is destructive for the Japanese economy, leading to an unprecedented surge in corporate bankruptcies and, ultimately, economic depression.

The obvious logic here led even the Keynesian studs at Goldman to declare that “Further yen depreciation could be a net burden.” Unfortunately for Abe and Kuroda, halting the Yen devaluation here would be suicide, as Japan now needs its currency to devalue every single day to mask the fact of the underlying economic devastation, or else the Japanese people may (and should) vote Abe out, which would lead to a prompt end to Abenomics, an epic collapse in the Nikkei, and put thousands of weak-Yen chasing Mrs. Watanabes in margin call purgatory.

Sadly, that will not happen. We say “sadly” because an end end to Abenomics, which is really Krugmanomics now, is the only thing that could save Japan now. And just to prove that, here is Japan Times confirming what we said, with a report that “Corporate bankruptcies linked to the yen’s slide hit a new record in November, highlighting the strains on small and midsize companies as Prime Minister Shinzo Abe campaigns for re-election on his deflation-busting economic strategy.“

…click on the above link to read the rest of the article…

Goldman Warns “Further Yen Depreciation Could Be A Net Burden” As Japanese Bankruptcies Soar | Zero Hedge

It is no secret that one of the primary drivers of relentless S&P 500 levitation over the past two years, ever since the start of Japan’s mammoth QE, has been the use of the Yen as the carry currency of choice (once again as during the credit bubble of the early-2000s), whose shorting has directly resulted in E-mini levitation. One look at the intraday chart of any JPY pair and the S&P500 is largely sufficient to confirm this. Those days, however, may be coming to an end, at least according to Goldman which overnight released a note saying that the Yen is “Almost at breakeven: Further yen depreciation could be a net burden.”

Here are the highlights:

The yen has depreciated quickly beyond ¥115/US$ from the ¥107/US$ level since the FOMC made the decision to terminate quantitative easing and the BOJ surprised with additional easing at the end of October. This has prompted concern over possible damage to Japan as a whole if the yen weakens further.

Using industry input/output tables to investigate the costs and benefits of a weak yen, we find that the manufacturing sector still reaps forex translation gains under Japan’s current economic structure. However, in materials and nonmanufacturing industries that have limited opportunity to pass on forex-driven cost growth to exports, the costs of a weak yen far outweigh the benefits. According to our calculations, a 25% decline in the yen’s valueresults in a ¥4.1 tn net cost increase for Japanese industry as a whole since 2012 and a ¥10.5 bn increase in household sector import inducement.

…click on the above link to read the rest of the article…

The Price Of Oil Exposes The True State Of The Economy – The Automatic Earth

The Price Of Oil Exposes The True State Of The Economy – The Automatic Earth.

We should be glad the price of oil has fallen the way it has (losing another 6% today as I write this). Not because it makes the gas in our cars a bit cheaper, that’s nothing compared to the other service the price slump provides. That is, it allows us to see how the economy is really doing, without the multilayered veil of propaganda, spin, fixed data and bailouts and handouts for the banking system.

It shows us the huge extent to which consumer spending is falling, how much poorer people have become as stock markets set records. It also shows us how desperate producing nations have become, who have seen a third of their often principal source of revenue fall away in a few months’ time. Nigeria was first in line to devalue its currency, others will follow suit.

OPEC today decided not to cut production, but whatever decision they would have come to, nothing would have made one iota of difference. The fact that prices only started falling again after the decision was made public shows you how senseless financial markets have become, dumbed down by easy money for which no working neurons are required.

OPEC has become a theater piece, and the real world out there is getting colder. Oil producing nations can’t afford to cut their output in some vague attempt, with very uncertain outcome, to raise prices. The only way to make up for their losses is to increase production when and where they can. And some can’t even do that.

…click on the above link to read the rest of the article…

The Desperate Suicide of Competitive Devaluation….. | Zero Hedge

The Desperate Suicide of Competitive Devaluation….. | Zero Hedge.

The zero sum game of competitive global currency devaluations is on like Donkey Kong. Anyone still sleeping comfortably, confident that all will end well, best brace themselves for a resounding wake up call. Be alarmed, Japan just jacked the joint, and the jerry rigged monetary jig is up. Moving forward, all the other Asian export centric economies will promptly be forced to keep up with their FUBAR neighbor, the juiced Japanese Joneses.

Each Nation State in the Far East is now completely compelled to competitively devalue in tandem, in order to maintain export market share, in a desperate attempt to avert their outbound container super ship cargoes from running westwards on empty.

Throughout the new millennium, China has made great technological strides, repositioning itself away from a predominantly low tech manufacturing economy, towards a value added high tech producing exporter. In this capacity it has converged with Japan. The Japanese, on the other hand, over the same time period, have seen both the Chinese and the Koreans, as well as the other Asian Tigers, ravenously devour more and more Hamachi and California rolls, promptly snatched from their stale sushi shop lunch box.

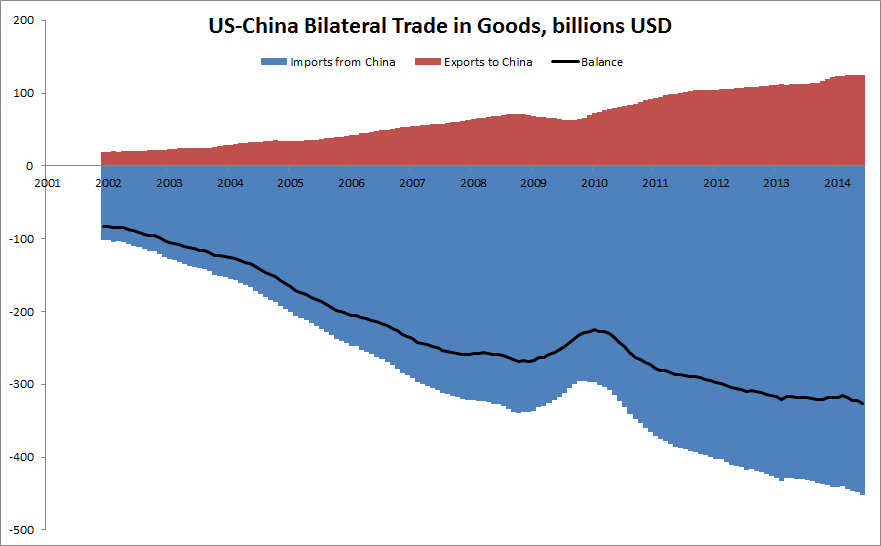

Take one quick look at the above chart and the official photo op below. You tell me why Mr. Xi nearly gagged when shaking hands with Mr. Abe the other day.

…click on the above link to read the rest of the article…

charles hugh smith-Why the Rising U.S. Dollar Could Destabilize the Global Financial System

charles hugh smith-Why the Rising U.S. Dollar Could Destabilize the Global Financial System.

I have been suggesting for several years that the U.S. Dollar would confound those anticipating its demise by starting a long secular uptrend.

In early September I made the case for a rising U.S. dollar, based on the basic supply and demand for dollars stemming from four dynamics:

- Demand for dollars as reserves

- Other nations devaluing their own currencies to increase exports

- “Flight to safety” from periphery currencies to the reserve currencies

- Reduced issuance of dollars due to declining U.S. fiscal deficits and the end of QE (quantitative easing)

Since then the dollar has continued its advance, and is now breaking out of a downtrend stretching back to 2005—and by some accounts, to 1985:

…click on the above link to read the rest of the article…