Energy is the economy. That’s a radical concept because most people think that the economy runs on money. It doesn’t.

What is energy? It is the potential or capacity to do work. The economy runs on work. That’s why energy is the economy. That’s simple.

What is money? That’s a little more complex.

“Money is not the value for which goods are exchanged, but the value by which they are exchanged.”

In other words, money has no inherent value. Economists often attempt to change the subject by pointing out that money is at least a medium of exchange, a store of value or a unit of account. The same, however, could be said for cigarettes that were used as money in Communist Romania in the 1980s.

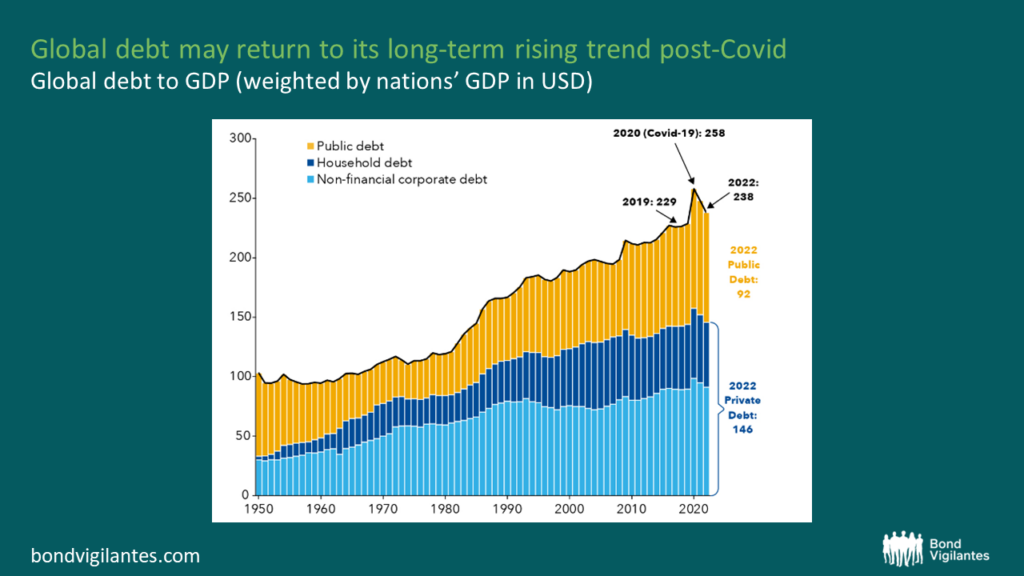

“Society runs on energy and materials, but most people think it runs on money…[Money] is created as debt subject to mathematical laws of compound interest…Money eventually gets spent on a good or service which will contain embodied energy. Money is a claim on energy yet its creation is not tethered to energy availability or cost.”

In the end, money–as paper, coins, gold or cigarettes–is just a financial claim on energy, a marker, a unit of account. For example, I may contract someone to do work for me—to build a fence or to move some heavy equipment—and we agree on a payment amount. I pay him dollars for his physical work (joules). He may then use those dollars to buy food (joules), gasoline for his car (joules) or contract someone else’s labor to do some work for him (joules). Money is the medium of exchange but the value exchanged is energy.

…click on the above link to read the rest…