Debt is an integral aspect of modern economies and has long been hailed as a catalyst for growth. When wielded judiciously, it stands as a potent tool for economic development, providing the means to finance projects, expand operations, and invest in essential sectors like education, health, and housing. In the right context, debt fuels economic growth, creates jobs, and fosters innovation. Furthermore, during economic downturns, it offers a safety net for individuals and organizations, helping them weather financial storms.

The ghost of future wealth

Governments have traditionally argued that as long as debt remains manageable and serviceable without difficulty, there’s little cause for concern. While this notion holds some truth, the reality is that recent growth has largely been fueled by an insurmountable increase in debt. Particularly since the Global Financial Crisis of 2008, the creation of what seems like wealth has resulted in soaring asset prices, including equities and real estate, contributing to an alarming rise in wealth inequality. However, there exists a disconnect between perceived wealth and actual wealth, a scenario unlikely to endure. Distinguished economists have persistently argued that debt for consumption essentially borrows demand from the future. This borrowed debt inevitably must be repaid, heralding a probable future slowdown in demand. However, debt allocated for investment purposes differs significantly, capable of fostering future growth and potentially curbing long-term debt.

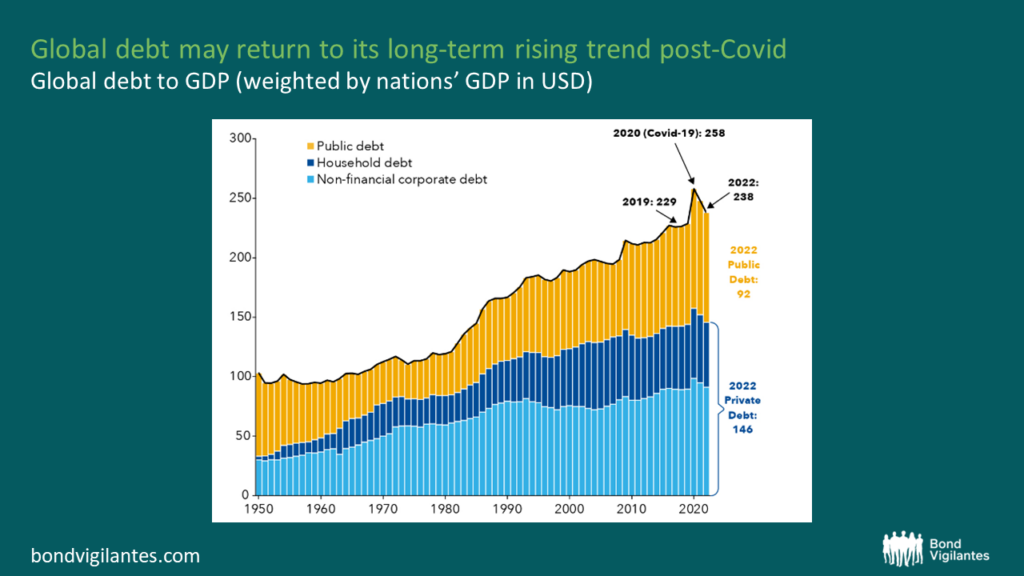

The trajectory of global debt, as depicted in the chart above, illustrates an unrelenting rise in both government and private debt over time. Up until the 2000s, the surge in debt was primarily attributed to burgeoning private debt, empowering a substantial improvement in living standards, especially in developed nations. Since 2000, private debt has plateaued, whilst government debt has sharply ascended, sustaining the growth in living standards. Yet, the overarching question remains – at what cost? However benign they might seem, debt levels can swiftly move from being a seemingly manageable concern to a formidable challenge once they surpass a particular threshold.

…click on the above link to read the rest…