The Green New Deal has been in the air lately. In a recent piece on this website, Rob Urie writes that the Green New Deal is “the last, best hope for environmental and social resolution outside of rapid dissolution toward dystopian hell.”

Quite a claim. Let’s take a closer look.

The Green New Deal, first articulated by the Green Party but now supported by many progressive Democrats, calls for “real financial reform” to address the twin problems of climate change and economic insecurity.

Included are some of the standard proposals we regularly hear, such as restoring the Glass-Steagell Act (separating commercial and investment banking), breaking up the big banks, ending bank bailouts, reducing debt burdens, regulating derivatives, and taxing bank bonuses.

These are serious proposals, and would likely provide some relief, but they are partial measures subject to rollback and evasion–just the kind of incremental strategy that has failed for decades.

But the “real financial reform” the Green New Deal calls for goes a lot further. It promises genuine radical change with two new proposals: One is to “democratize monetary policy to bring about public control of the money supply and credit creation,” and the other is to “support the formation of federal, state, and municipal public owned banks that function as non-profit utilities.”

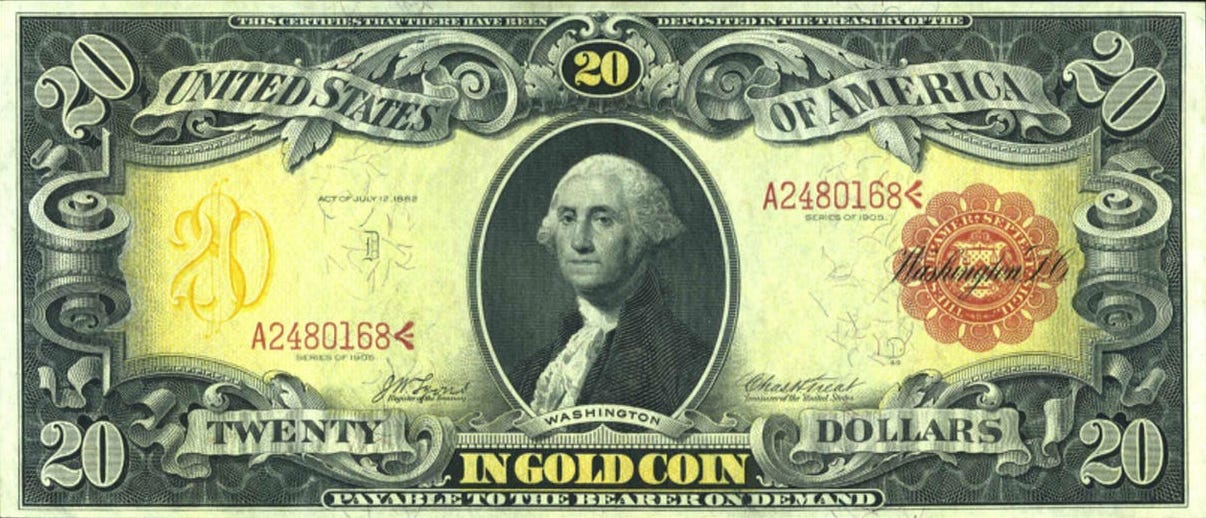

First, some background. Most people don’t realize that the government does not issue money; the private banking system does, by issuing loans at interest. The last time the government issued money in any quantity was during the Civil War, when so-called greenbacks were printed by the Treasury department to pay for the war. Greenbacks were not debt, but direct currency printed to give government contractors money for the goods and services provided, which they then spent into the general economy, stimulating commerce.

…click on the above link to read the rest of the article…