Home » Posts tagged 'greece' (Page 28)

Tag Archives: greece

This Could Sink Banks in Greece, Portugal, Spain, and Italy

This Could Sink Banks in Greece, Portugal, Spain, and Italy

Not that much has changed in Spain since the climax of the debt crisis during which its collapsing banks were bailed out. Some of them were recombined into a bank with a new name – Bankia – and sold to the public via an IPO that immediately sank into red ink and scandal. Spanish government debt sported yields that reflected the risks of owning it. At this time in 2012, six-month T-bills yielded over 3.2%.

But that part has changed. In this absurd era when risks no longer exist in a quantifiable manner, the Spanish government today joined a growing club: it issued its first debt – 6-month T-bills – with a negative yield. Spain!

But the European Commission is now contemplating pulling the rug out from under the banking miracles in Spain, Portugal, Greece, and Italy.

Turns out, these four countries have been smart in how they propped up their rickety banks. They and their banks have declared something a “high quality” asset even though it has a dubious value, no market price, and can’t be sold. And they have included this totally illiquid asset of dubious value in the “core capital” of the banks. This asset significantly increases the “capital buffers” and makes the bank more resistant to shock and collapse, on paper. That’s how they solved their banking crisis.

…click on the above link to read the rest of the article…

Is Greece planning to print energy?

Is Greece planning to print energy?

Over the past couple of months the story keeping many people on the edge of their seats has been the ongoing dilemma of Greece’s detested debt burden, its Great Depression-worthy 25% contraction of its economy, and its voluntary or even forced withdrawal from the eurozone – the fabled “Grexit.”

For about five years now, heavy austerity policies (cutbacks in government spending) have contributed to what is being described by some as a “humanitarian crisis.” As per stated in the conditions of €240 billion in loans that Greece has received over these years, the Greek government has had to significantly cut back on expenditures, which has included laid off government workers, reduced pensions, a gutted minimum wage, and the selling of state institutions. Partially as a result of this, general unemployment is a bit above 25% while youth unemployment is at nearly 60%; suicide rates are up by 35%; rates of divorce, depression, children suffering from malnutrition, children suffering from physical and emotional abuse, and hospitals lacking basic equipment and medicines are all up; infant mortality has increased 43%; and married women are begging brothels to let them work, but who are then turned away because, well, it’s apparently illegal to sell oneself for sex if one is already betrothed.

Nonetheless, and to the acclaim of many alternative media outlets, late-January saw the stunning election-win of what is called a far-left political party, Syriza. The prime mandate on which it was voted in on by the Greek electorate was to reverse the five-year policy of austerity and to essentially tell its Troika creditors (the European Union, the European Central Bank, and the International Monetary Fund) to shove it where the sun don’t shine.

…click on the above link to read the rest of the article…

Greece Said To Prepare “Grexit”, Drachma, Bank Nationalization Plans

Greece Said To Prepare “Grexit”, Drachma, Bank Nationalization Plans

On Thursday morning, we took an in-depth look at what the progression of events is likely to be in the event a cash-strapped, negotiation-weary Greece finally, for lack of will or for lack of options, fails to scrape together enough cash to pay its creditors. As BofAML notes, a missed IMF payment and/or failure to make interest payments to either the ECB or private creditors over the coming weeks would likely lead to default within 30 days, at which point “mark-to-fantasy” becomes mark-to-market and then “mark-to-default” in very short order.

Although Greek officials came out midday with a “categorical” denial of reports that the country was set to run completely out of cash in just 7 days, it now appears Athens may be prepared to chance a missed IMF payment and all that comes with it if it means saving face and preserving Syriza’s campaign promises to the beleaguered Greek populace.

More, via The Telegraph:

Greece is drawing up drastic plans to nationalise the country’s banking system and introduce a parallel currency to pay bills unless the eurozone takes steps to defuse the simmering crisis and soften its demands.

Sources close to the ruling Syriza party said the government is determined to keep public services running and pay pensions as funds run critically low. It may be forced to take the unprecedented step of missing a payment to the International Monetary Fund next week.

Greece no longer has enough money to pay the IMF €458m on April 9 and also to cover payments for salaries and social security on April 14, unless the eurozone agrees to disburse the next tranche of its interim bail-out deal in time.

“We are a Left-wing government. If we have to choose between a default to the IMF or a default to our own people, it is a no-brainer,” said a senior official…

…click on the above link to read the rest of the article…

Is Greece About to Play its Geopolitical Trump Card and Ignite a Chain Reaction Across Europe?

Is Greece About to Play its Geopolitical Trump Card and Ignite a Chain Reaction Across Europe?

If the EMU powers persist mechanically with their stale demands – even reverting to terms that the previous pro-EMU government in Athens rejected in December – they risk setting off a political chain-reaction that can only eviscerate the EU Project as a motivating ideology in Europe.

Forced Grexit would entrench a pervasive suspicion that EU bodies are ultimately agents of creditor enforcement. It would expose the Project’s post-war creed of solidarity as so much humbug.

Greece could not plausibly remain in Nato if ejected from EMU in acrimonious circumstances. It would drift into the Russian orbit, where Hungary’s Viktor Orban already lies. The southeastern flank of Europe’s security system would fall apart.

Mr Tsipras is now playing the Russian card with an icy ruthlessness, more or less threatening to veto fresh EU measures against the Kremlin as the old set expires. “We disagree with sanctions. The new European security architecture must include Russia,” he told the TASS news agency.

He offered to turn Greece into a strategic bridge, linking the two Orthodox nations. “Russian-Greek relations have very deep roots in history,” he said, hitting all the right notes before his trip to Moscow next week.

– From Ambrose Evans Pritchard’s article in the Telegraph: Greek Defiance Mounts as Alexis Tsipras Turns to Russia and China.

Over the past couple of months, I’ve at times been a strong critic of Greek leadership’s seeming unwillingness to demonstrate the courage necessary to flip the bird to EU bureaucrats and usher in paradigm level change for the long suffering nation. At the core of the problem seems the be the mandate under which Syriza was elected — namely to end austerity, but remain in the euro.

…click on the above link to read the rest of the article…

Steve Keen: The Deliberate Blindness Of Our Central Planners

Steve Keen: The Deliberate Blindness Of Our Central Planners

The models we use for decision making determine the outcomes we experience. So, if our models are faulty or flawed, we make bad decisions and suffer bad outcomes.

Professor, author and deflationist Steve Keen joins us this week to discuss the broken models our central planners are using to chart the future of the world economy.

How broken are they? Well for starters, the models major central banks like the Federal Reserve use don’t take into account outstanding debt, or absolute levels of money supply. It’s why they were completely blindsided by the 2008 crash, and will be similarly gob-smacked when the next financial crisis manifests.

And within this week’s podcast is a hidden treat. Steve’s character exposition on Greek Financial Minister Yanis Varoufakis. Steve has known Varoufakis personally for over 25 years, and is able to offer a window into his constitution, how his mind thinks, and what he’s currently going through in his battle with the Troika for Greece’s future.

…click on the above link to listen to the podcast…

Recovery, Geopolitics and Detergents

Recovery, Geopolitics and Detergents

Increasingly over the past year or so, when people ask me what I do, and that happens a lot on a trip like the one I’m currently on in the world of down under, I find myself not just stating the usual ‘I write about finance and energy’, but adding: ‘it seems to become more and more about geopolitics too’. And it’s by no means just me: a large part of the ‘alternative finance blogosphere’, or whatever you wish to call it, is shifting towards that same orientation.

Not that no-one ever wrote about geopolitics before, but it used to be far less prevalent. Much of that, I think, has to do with a growing feeling of discontent with the manner in which a number of topics are handled by the major media and the political world. Moreover, as would seem obvious, certain topics lay bare in very transparent ways how finance and geopolitics are intertwined.

In the past year, we’ve seen the crash of the oil price, which will have – financial and political – effects in the future that dwarf what we’ve seen thus far. We’ve seen Europe and its banks stepping up their efforts to wrestle Greece into – financial and political – submission. And then there’s the nigh unparalleled propaganda machine that envelops the Ukraine-Crimea-Russia issue, which has bankrupted the economy of the first and imposed heavy economic sanctions on the latter, for political reasons.

…click on the above link to read the rest of the article…

Eurasian Pivot? Moscow Expects “Progress” From Tsipras Visit

Eurasian Pivot? Moscow Expects “Progress” From Tsipras Visit

As Athens prepares to try and convince eurozone creditors that its latest set of proposed reforms represents a credible attempt to address Greece’s fiscal crisis, and as Greek depositors face the very real possibility that they will soon be Cyprus’d, a leverage-less Alexis Tsipras faces a rather unpalatable choice: bow to the Troika which “wants real reforms… meaning that Greece finally has to implement some/any of the long ago promised and never delivered redundancies in the government sector,” or to quote Credit Suisse, be “digitally bombed back to barter status.” Unfortunately for the Greek populace, the latter seems to be far more likely than the former. Here’s WSJ:

Greek proposals for a revised bailout program don’t have enough detail to satisfy the government’s international creditors, eurozone officials said, making it more likely that Athens will need to go several more weeks without a new infusion of desperately-needed cash…“The proposals were piecemeal, vague and the Greek colleagues could not explain technically what some of them actually implied,” a eurozone official said. “So, let’s hope that they present something more competent next week.”

Senior eurozone finance officials will hold a teleconference on Wednesday to discuss the situation, officials said. But they said it is highly unlikely eurozone ministers will meet before mid-April to release more money for Greece. That means Athens will have to scrape together cash to pay salaries and pensions at the end of the month and make a €460 million debt repayment to the IMF on April 9.

As a reminder, here are two charts which demonstrate the urgency of the situation:

…click on the above link to read the rest of the article…

Greece Prepares To Leave

Greece Prepares To Leave

Speculation and expert comments are thrown around once more – or still – like candy on Halloween. Let me therefore retrace what I’ve said before. Because I think it’s really awfully simple, once you got the underlying factors in place.

But first, if one thing has become obvious after Syriza was elected to form a Greek government on January 25, it’s that the party is not ‘radical’ or ‘extremist’. Those monikers can now be swept off all editorial desks across the world, and whoever keeps using them risks looking like an awful fool.

All Syriza has done to date, when you look from an objective point of view, is to throw out feelers, trying to figure out what the rest of the eurozone would do. And to make sure that whatever responses it got are well documented.

Because of course Greece (through Syriza) is preparing to leave the eurozone. Of course the effects and consequences of such a step are being discussed, non-stop. They would be fools if they didn’t have these discussions. And of course there will be a referendum at some point.

There’s just that one big caveat: Syriza insists on needing a mandate from its voters for everything it does, whether that may be kowtowing to Greece’s EU overlords or walking away from them. At present, however, it doesn’t have a mandate for either of these actions.

…click on the above link to read the rest of the article…

Transformation or replication? On the aftermath of the Greek government shift

Transformation or replication? On the aftermath of the Greek government shift

“I’m a pessimist because of intelligence, but an optimist because of will” (A. Gramsci)

We might err, but we believe that in the night of the elections in January 2015 a symbolic “tipping point” has been reached in Greece, signifying a break with a one way pre-dictated future, and adding vital fresh wind by pointing to the possibility of multiple alternative imaginary worldviews. Those may never come, but a point has been reached from where, so it seems, can be no simple return to the previous state of affairs, and a process of envisioning different futures has finally been initiated.

No one can foresee the results of this unpredictable process, as the aforementioned “opening” of alternatives takes place in a highly complex spatiotemporal context where different – and at times opposing – forces constantly influence their flourishing and/or failure. Greece is affected by the global economic recession more than any other European country, and is the first Western nation to face such a dramatic economic downturn since the end of World War II. Macroeconomic and social indicators point to a deep humanitarian crisis: real GDP has shrunk by 25,5%, general unemployment skyrocketed from 7.2% in 2008 to 27.2 in late 2014 and more than 3 million people have no health insurance.

Furthermore, as it became obvious in the recent negotiations regarding the Greek public debt and the continuation of the financing of the state, core EU countries appeared explicitly hostile even to the articulation of a storyline that contradicts the imperative of austerity. Thus, any alternative narrative coming out of Greece has not only to compete with vested interests within the country, but also has the dual task to simultaneously provide immediate relief from the effects of the accumulated austerity measures and create the necessary alliances at a European level in order to find the vital space to flourish.

…click on the above link to read the rest of the article…

EU and Greece Running Out of Time – As Bank Runs Intensify, Bail-Ins Likely

EU and Greece Running Out of Time – As Bank Runs Intensify, Bail-Ins Likely

– EU and Greece running out of time as talks end “in disarray” – again

– Greece warns Merkel of ‘impossible’ debt

– Concerns Greece out of money by end of April

– Friday’s “agreement” in Brussels falls apart hours later as protagonists fail to agree on specifics

– Greece now insolvent – will run out of liquidity by end of April

– Greek banks on verge of collapse as runs continue – €1.5 billion emptied out of banks last week alone

– ‘Grexit’ could propel gold to over $2,000/oz

– Cyprus style bail-ins look increasingly possible

Greece’s place in the Eurozone is as precarious as ever as talks between Prime Minister Tsipras and European leaders in Brussels broke down – hours after reaching general agreement – and Greece warned Germany that it will be “impossible” for Greece to service debt payments due in the coming weeks if the EU fails to provide short-term financial assistance.

Greece – faced with illiquidity, insolvency and a potential banking collapse – is running out of time and appears to be on the back foot as its international creditors refuse to countenance any debt restructuring, rescheduling or forgiveness.

The warning from Greece came in a letter from Tsipras to Angele Merkel provided to the Financial Times. It comes as concerns mount that Athens will struggle to make pension and wage payments by as early as next week, the end of March, and could run out of cash completely before the end of April.

The letter, dated March 15, came just before Ms Merkel agreed to meet Mr Tsipras on the sidelines of an EU summit last Thursday and invited him for a one-on-one session in Berlin, scheduled for Monday evening.

…click on the above link to read the rest of the article…

Rich Man’s Bank Hit by Bank Run, Collapse, “Bail-In”

Rich Man’s Bank Hit by Bank Run, Collapse, “Bail-In”

In Europe nary a day seems to go by without some mention or rumor of a bank run or bank closure. Ground Zero of the current troubles is Greece, whose broken financial system is now wholly dependent on regular infusions of euros from the ECB. The moment those infusions stop – something the ECB has warned could happen at any time – the country’s banking system collapses. On Wednesday Greek banks saw deposit outflows of €300 million, the highest in a single day since a February deal with the euro zone that staved off a banking collapse.

But it’s not just on Europe’s periphery that banks are experiencing problems. At the beginning of this month, Austria sent shockwaves throughout the old continent’s financial markets when the Austrian government refused to grant the scandal-tarnished, “bottomless pit” bank Hypo Alde another taxpayer-funded bailout. Instead, bondholders, even those with bonds guaranteed by the Austrian state of Carinthia, were made to eat the losses in one of the first cases of bank bail-ins since sweeping changes to EU-wide legislation last year [It was a “long-yearned-for shock of liberation” for taxpayers; read… Austria ‘Pulls Ripcord’ on Bailouts, Lets ‘Bottomless Pit’ Hypo Alpe Bank Drag State of Carinthia into Bankruptcy].

…click on the above link to read the rest of the article…

Looks Like Germany May Have To Pay Up

Looks Like Germany May Have To Pay Up

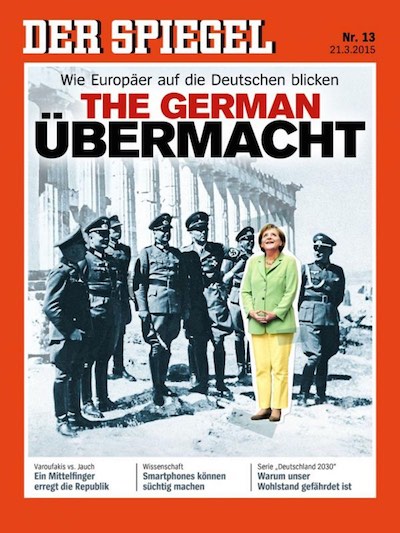

German magazine Der Spiegel digs deep(er) into the ‘Greece question’ this weekend, and does so with a few noteworthy reports. First, its German paper issue has Angela Merkel on the cover, inserted on a 1940′s photograph that shows Nazi commanders against the backdrop of the Acropolis in Athens. The headline is ‘The German Supremacy: How Europeans see (the) Germans’. The editorial staff has already come under a lot of fire for the cover, and I’ve seen little that could be labeled a valid defense for further antagonizing both Germans AND Greeks (and other Europeans) this way. Oh, and it’s also complete nonsense, nobody sees modern day Germans this way. It’s just that their government after 70 years is still skirting its obligations towards the victims. That’s what people, the Greeks in particular, don’t like.

Allegedly, Katrougalos’ law firm (in which he has had no active role since becoming a member of the European parliament last year) has a contract with these workers that will pay it 12% of whatever they receive in back pay. Predictably, the opposition has called for Katrougalos’ firing, but Tsipras has said he talked to him and is satisfied with the explanation he was given.

…click on the above link to read the rest of the article…

C’mon Angela, Let Them Greexit

C’mon Angela, Let Them Greexit

With each passing day it becomes more obvious that Europe is heading for an epochal financial conflagration. So buy-the-dip if you must, but don’t believe for a minute that the US has decoupled. When the euro and EU eventually implode it will rattle the bones of every gambler and algo left in the casinos anywhere on the planet.

Yes, the school yard name calling and roughhousing now going on in Europe makes it appear that behind the sturm und drang there is some negotiations happening. But the truth is there is nothing to negotiate. Greece is so completely and terminally bankrupt that there is no solution other than default and greexit.

To insist that Greece service the entirely of its staggering $350 billion of debt, as does Germany and the troika apparatchiks, is to advocate the extinguishment of democracy in Greece and its reduction to a colonial mandate of Brussels; and in the process, to eliminate any semblance of economic life among the debt serfs who would inhabit it.

Its just math. Sooner or later interest rates must normalize. For a country with Greece’s profligate fiscal history, there is no possibility that the interest carry cost on a public debt load equal to 175% of GDP could be any less than 6-7% in the absence of EU guarantees.That means that the Greek state’s annual interest bill would approach 10% of GDP before paying down a single dime of principal.

…click on the above link to read the rest of the article…

There’s Brussels And Then There’s Real People

There’s Brussels And Then There’s Real People

Once again, a look at Greece and the Troika, because it amuses me, it angers me, and also because it warms my cockles, in an entirely metaphorical sort of way. The Troika members love to make it appear (and everyone swallows it whole) as if in their ‘negotiations’ with Greece all sorts of things are cast in stone and have no flexibility at all. Humbug.

First, another great piece by Rob Parenteau (via Yves Smith), who lays it out in terms so simple they can’t but hit the issue square on the nose. For Europe and the Troika, there’s Greece, and then there’s the rest. No money for the Greeks lining up at soupkitchens (not even for the soupkitchens themselves), but $60 billion a month for the bond market. The $200 million anti-poverty law – a measly sum in comparison – that Athens voted in this week is a no-no because Greek government has to ask permission for everything in Brussels first, says Brussels, no matter that that only prolongs the suffering. It’s not about money, in other words, it’s about power, and the Greeks must be subdued.

Both the financial and the political press have by now perfected their picture of Yanis Varoufakis as a combination of some kind of incompetent blunderer on the one hand, and a threat the size of Vladimir Putin on the other, while the rudeness of German FinMin Schäuble is not discussed at all. The media are no longer capable of reporting anything outside of their propaganda models. The ‘middle finger’ video turns out to be a fake, but who cares, it’s done its damage. Parenteau:

…click on the above link to read the rest of the article…