Workers, bondholders, savers get sacked. So what would Yellen do?

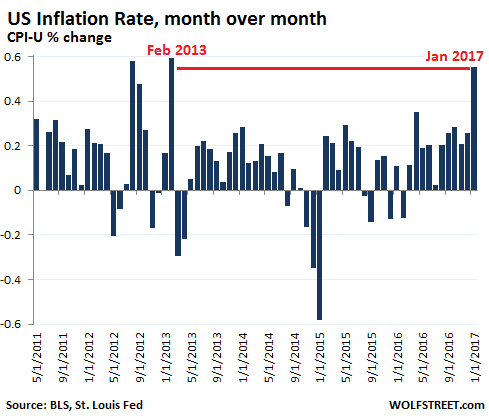

Consumer prices surged 0.6% in January from December, double the consensus forecast of a 0.3% rise. The sharpest monthly increase since February 2013, according to the Bureau of Labor Statistics.

Energy prices jumped 4% month over month, including gasoline which jumped 7.8%. Food prices edged up 0.1%. Within this group, “food at home” was unchanged, but prices for “food away from home” – restaurants, taco trucks, and the like – rose 0.4%. In just one month, the prices of apparel rose 1.4%, of new vehicles 0.9%, of auto insurance 0.8%, of airline fares 2.0%. Shelter rose “only” 0.2%, as the national numbers are now feeling the downward pressure on rents in some of the most expensive rental markets in the US.

This chart shows just how sharp that jump in monthly price increases is, compared to recent years:

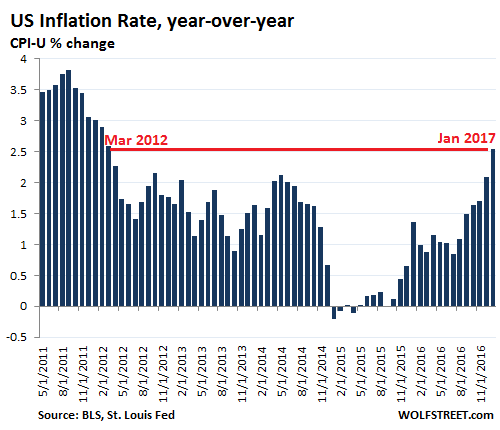

Compared to January a year ago, consumer prices as measured by CPI-U surged 2.5%, after having already jumped 2.1% in December. The rate of inflation has now accelerated for the sixth month in a row. It has surged one full percentage point over the past four months and hit the highest rate since March 2012:

So-called core inflation – which excludes food and energy – jumped 2.3% in January from a year ago. The consensus expected 2.1%. So you can’t just blame the rising costs of energy. This “core” measure of price increases has been above 2% since November 2015. Even during the Financial Crisis, when overall year-over-year CPI dipped briefly into the negative, core CPI remained in positive territory.

However much these inflation measures may understate actual increases in the costs of living that people experience in their daily lives, even those understated measures are now beginning to exude a lot of heat. And afterwards, the consensus will say that no one saw this coming.

…click on the above link to read the rest of the article…

Only two? There were four last time!

Only two? There were four last time!