Home » Posts tagged 'currency' (Page 19)

Tag Archives: currency

China Completes SWIFT Alternative, May Launch “De-Dollarization Axis” As Soon As September

China Completes SWIFT Alternative, May Launch “De-Dollarization Axis” As Soon As September

One of the recurring threats used by the western nations in their cold (and increasingly more hot) war with Russia, is that Putin’s regime may be locked out of all international monetary transactions when Moscow is disconnected from the EU-based global currency messaging and interchange service known as SWIFT (a move, incidentally, which SWIFT lamented as was revealed in October when we reported that it announces it “regrets the pressure” to disconnect Russia).

Of course, in the aftermath of revelations that back in 2013, none other than the NSA was exposed for secretly ‘monitoring’ the SWIFT payments flows, one could wonder if being kicked out of SWIFT is a curse or a blessing, however Russia did not need any further warnings and as we reported less than a month ago, Russia launched its own ‘SWIFT’-alternative, linking 91 credit institutions initially. This in turn suggested that de-dollarization is considerably further along than many had expected, which coupled with Russia’s record dumping of TSYs, demonstrated just how seriously Putin is taking the threat to be isolated from the western payment system. It was only logical that he would come up with his own.

There were two clear implications from this use of money as a means of waging covert war: i) unless someone else followed Russia out of SWIFT, its action, while notable and valiant, would be pointless – after all, if everyone else is still using SWIFT by default, then anything Russia implements for processing foreign payments is irrelevant and ii) if indeed the Russian example of exiting a western-mediated payment system was successful and copied, it would accelerate the demise of the Dollar’s status as reserve currency, which is thus by default since there are no alternatives. Provide alternatives, and the entire reserve system begins to crack.

…click on the above link to read the rest of the article…

The Global Dollar Funding Shortage Is Back With A Vengeance And “This Time It’s Different”

The Global Dollar Funding Shortage Is Back With A Vengeance And “This Time It’s Different”

The last time the world was sliding into a US dollar shortage as rapidly as it is right now, was following the collapse of Lehman Brothers in 2008. The response by the Fed: the issuance of an unprecedented amount of FX liquidity lines in the form of swaps to foreign Central Banks. The “swapped” amount went from practically zero to a peak of $582 billion on December 10, 2008.

The USD shortage back, and the Fed’s subsequent response, was the topic of one of our most read articles of mid-2009, “How The Federal Reserve Bailed Out The World.”

As we discussed back then, this systemic dollar shortage was primarily the result of imbalanced FX funding at the global commercial banks, arising from first Japanese, and then European banks’ abuse of a USD-denominated asset-liability mismatch, in which the dollar being the funding currency of choice, resulted in a massive matched synthetic “Dollar short” on the books of commercial bank desks around the globe: a shortage which in the aftermath of the Lehman failure manifested itself in what was the largest global USD margin call in history. This is how the BIS described first the mechanics of the shortage:

…click on the above link to read the rest of the article…

The Monetary Illusion Again in Trade

The Monetary Illusion Again in Trade

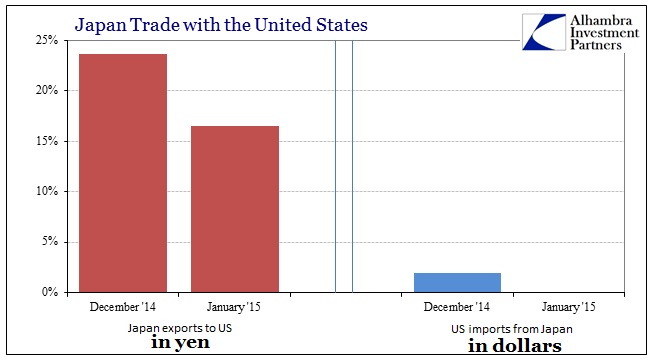

Just as a follow-up to further highlight and emphasize the “monetary illusion” of currency devaluation in this closed environment, the yen’s returned devaluation against the “dollar” more recently has renewed confusion (or intentional misdirection) about what Abenomics is supposedly accomplishing. Taken solely from the perspective of the Japanese internally, exports to the US are once more growing, and doing so rather sharply. December’s year-over-year gain, in yen, was almost 24% while January came in at an equally robust 16.5%.

Taken by themselves without context, it would seem great fortune and monetary capability to gain in exports at such huge growth rates. But, as I have shown time and again, what goes out of Japan is matched by what comes in to the US. For all that buzz over huge export growth, nothing much shows up on this end.

Both months were positive in “dollars” but barely and thus no actual growth took place. Economists and central bankers even concede the disparity, but don’t much care about it. They simply assume that Japanese exporters now flush with more yen will hire more workers and pay the ones they have even more, igniting that virtuous circle of “aggregate demand.” In reality, why would they do that?

…click on the above link to read the rest of the article…

Why Japan is Not Greece or EU For that Matter

Why Japan is Not Greece or EU For that Matter

QUESTION: Hello Martin

There are a few writers who speculate the the yen will be the first currency to fall (because Japan has been tied into QE and flat interest rates for decades already, and their manufacturing is suffering). How do you think the currency situation will play out for Japan?

thank you, best wishes

M

ANSWER: This is the classic example of people who keep touting fiat and money supply as if it was the beginning and end to everything. I have stated that ALL money is fiat even when a government fixes the price of gold for they are dictating its value. The floating exchange rate has its advantages. It is truly the check against government for money is simply the expression of confidence in the total productivity of a nation. It is not gold – it is the people.

Japan rose to the 2nd largest economy with a tiny island, no gold, and no resources. It did so proving Adam Smith was correct based upon the total productivity of its people. Inflation does not correlate to money supply. If it did, thenALL commodities would be higher today. Inflation is a matter of confidence and as long as people know someone else will freely accept whatever money might be at that moment, then they will accept it as well. Disturb that confidence and you get inflation all the way up the scale to hyperinflation, which also involves the collapse in confidence in banks and people spending everything as fast as they get it – the opposite of deflationary hoarding.

Interest Rates are also a reflection of INFLATION. You would never lend money with a rate of return BELOW the purchasing power of money at the time you expect a return. Therefore, rates have been flat in Japan because of the massive deflation that is also the hallmark of hoarding (savings).

…click on the above link to read the rest of the article…

Just How Low Will The Loonie Go?

Just How Low Will The Loonie Go?

The Canadian dollar fell to below 80 cents on Friday, battered by bad news at home and good news south of the border, leaving economists scrambling to predict just how low it could go.

The loonie ended the week at 79.3 cents U.S., sinking after a report showed Canada had its worst trade balance in nearly three years alongside news of an improving job situation south of the border that lifted the U.S. greenback.

In theory, the low loonie should help exports by making Canadian-made goods cheaper abroad. But Canada posted its largest trade deficit since 2012, of $2.5 billion in January on the back of plunging oil prices.

Meanwhile, the U.S. economy easily surpassed expectations and pumped out 295,000 jobs in February, bringing the unemployment rate to 5.5 per cent, the lowest it has been since 2008.

With little evidence that other sectors will pick up the economic slack from the sinking oil sector, along with record high household debts and a volatile labour market, economists have been racing to find the bottom.

“The Bank of Canada keeps touting the long-awaited rotation to exports and investment; I say the rotation is keeping itself very well disguised,” BMO chief economist Doug Porter wrote in a note Friday.

BMO predicts the loonie will continue to be at its cheapest rate in six years for 2015.

Scotiabank’s chief currency strategist Camilla Sutton said she expects the loonie to sink further, to as low as 75 cents.

…click on the above link to read the rest of the article…

Petrodollar Mercantilism Explained In One Chart

Petrodollar Mercantilism Explained In One Chart

Over the past several months, with the price of crude plummeting to half where it was compared to a year ago, we have written much about the monetary reality of the Petrodollar (and more importantly, its recent disappearance), the socioeconomic implications for oil/commodity exporters, the liquidity considerations for the those who create the “recycled” currency in question, and the resultant demand for assets created by public and private entities sold by the currency creator, in the process boosting the “value” of both the commodity, the demand for the currency (usually the world’s reserve at any given moment), and the assets of the currency host.

We have explained this cycle and more importantly, what happens when this cycle goes into reverse, in “How The Petrodollar Quietly Died, And Nobody Noticed” and “The Death Of The Petrodollar Was Finally Noticed” (not to mention “Russia Just Pulled Itself Out Of The Petrodollar“).

Still, the underlying concept of how Petrodollar recycling, or as some call it, petrocurrency mercantilism works, leaves some confusion. So in order to alleviate that, here courtesy of Cult State, is a quick and simple primer that should hopefully answer all questions.

…click on the above link to read the rest of the article…

BREAKING BAD (DEBT) – EPISODE THREE

BREAKING BAD (DEBT) – EPISODE THREE

In Part One of this three part article I laid out the groundwork of how the Federal Reserve is responsible for the excessive level of debt in our society and how it has warped the thinking of the American people, while creating a tremendous level of mal-investment. In Part Two I focused on the Federal Reserve/Federal Government scheme to artificially boost the economy through the issuance of subprime debt to create a false auto boom. In this final episode, I’ll address the disastrous student loan debacle and the dreadful global implications of $200 trillion of debt destroying the lives of citizens around the world.

Getting a PhD in Subprime Debt

“When easy money stopped, buyers couldn’t sell. They couldn’t refinance. First sales slowed, then prices started falling and then the housing bubble burst. Housing prices crashed. We know the rest of the story. We are still mired in the consequences. Can someone please explain to me how what is happening in higher education is any different?This bubble is going to burst.” – Mark Cuban

Now we get to the subprimiest of subprime debt – student loans. Student loans are not officially classified as subprime debt, but let’s compare borrowers. A subprime borrower has a FICO score of 660 or below, has defaulted on previous obligations, and has limited ability to meet monthly living expenses. A student loan borrower doesn’t have a credit score because they have no credit, have no job with which to pay back the loan, and have no ability other than the loan proceeds to meet their monthly living expenses. And in today’s job environment, they are more likely to land a waiter job at TGI Fridays than a job in their major. These loans are nothing more than deep subprime loans made to young people who have little chance of every paying them off, with hundreds of billions in losses being borne by the ever shrinking number of working taxpaying Americans.

…click on the above link to read the rest of the article…

Ukraine Enters The Endgame

Ukraine Enters The Endgame

Back in March 2014 we forecast that it in the aftermath of the US State Department-sponsored military coup in Kiev, it was only a matter of time before Ukraine (all of its sovereign gold having since “vaporized“) succumbed to full blown hyperinflation and economic implosion. Less than a year later, precisely this outcome has finally played out, and as a result, the entire nation has finally entered its economic endgame, one which has two conclusion: either it joins Greece in becoming a ward of Europe (of which it is not an official member) and the IMF (thank you Joe Q Public taxpayer), or it quietly fades away into insolvent “failed state” status.

This is in a nutshell the assessment by Goldman Sachs, presented below, which really doesn’t say much we didn’t cover earlier in “Ukraine Enters Hyperinflation: Currency Trading Halted, “Soon We Will Walk Around With Suitcases For Cash“, but which does lays out the (very unpleasant) alternatives for yet another nation brought to ruin through American neo-colonial expansion, in what may well be a record short period of time. Of these, the primary ones focus on yet another IMF bailout which the agency may find some resistance to as a result of the near-total collapse of Greece at the same time. And not only that but Goldman’s “base case of IMF fund disbursement in mid-March may not come quickly enough to stabilize the Hryvnia.” Oops.

…click on the above link to read the rest of the article…

Ten Banks, Including JPM, Goldman, Deutsche, Barclays, SocGen And UBS, Probed For Gold Rigging

Ten Banks, Including JPM, Goldman, Deutsche, Barclays, SocGen And UBS, Probed For Gold Rigging

No matter how many times the big banks are caught red-handed manipulating precious metals, some failed former Deutsche Bank prop-trader (you know who you are) will take a vociferous stand based on ad hominem attacks and zero facts that no, what you see in front of you is not precious metal rigging at all but a one-off event that has nothing to do with a criminal banking syndicate hell bent on taking advantage of anyone who is naive and dumb enough to still believe in fair and efficient markets.

The last time this happened was in November when we learned that “UBS Settles Over Gold Rigging, Many More Banks To Follow“, and sure enough many more banks did follow, because in Europe, where the stench of gold market manipulation stretches far beyond merely commercial banks, and rises through the central banks, namely the BOE and ECB, culminating with the Head of Foreign Exchange & Gold at the BIS itself, all such allegations have to be promptly settled or else the discovery that the manipulation cartel in Europe involvesabsolutely everybody will shock and stun the world, which heretofore was led to believe that such things as gold market (not to be confused with Libor or FX) manipulation only exist in the paranoid delusions of a few tinfoil fringe-blogging lunatics.

However, as usually happens, someone always fails to read the memo that when it comes to gold-market manipulation one must i) find nothing at all incriminating if one is a paid spokesman for the entities doing the manipulation such as former CFTC-sellout Bart Chilton or ii) if one can’t cover it, then one must settle immediately or else the chain of revelations will implication everyone.

…click on the above link to read the rest of the article…

THE MONEY WARS

THE MONEY WARS

At some point in the future, those who have the privilege of writing the history about our present day events will find clever turns of phrase to describe our times. If those future scribes have any inkling of what actually transpired I imagine they will be able to clearly communicate these were the years of the ‘Money Wars’.

It certainly is an ingenious way to keep the world’s population passionately quarreling between themselves while the pirates, those who are actually looting the world, are busy scheming and directing the pillage. It is my sincerest hope it all ends on a positive note, one that entails some big unintended consequence for all the plotting parties involved.

While we live through this Great War of Money, the initial battles of which are already well under way, it is fascinating to observe, study and most importantly learn what is going on. Doing so provides an opportunity to examine the flaws in our systems and engage our fellow man in conversation and debate. This in turn has the potential to lead to innovation and solutions. For me any conversation where learning is involved is indeed a worthy one.

But there is also a need for urgency. Sadly this urgency creates fear and heightened emotions which impede our conversations and seem to be fueled in many ways. The burning question eventually becomes, “What should I do?”

…click on the above link to read the rest of the article…

Why Does Fiat Money Seemingly Work?

Why Does Fiat Money Seemingly Work?

Introducing Money

Imagine three men living on a small island. Toni is mining the local salt mine, and apart from him there are Pete the fisherman and Tom the apple grower and their families. They have a barter trading system set up: Toni exchanges his salt for Pete’s fishes and Tom’s apples, who in turn exchange fishes and apples between each other.

One day Pete says: “I have an idea. Instead of fish, I will from now on give you pieces of papyrus with numbers marked on them”. Papyrus grows in great quantities nearby, but has so far not been of practical use to any of the islanders. Pete continues: “One papyrus mark will represent 1 fish or 5 apples or 2 bags of salt (equivalent to current barter exchange rates). This will make it easier for us to trade among ourselves. We won’t have to lug fishes, apples and salt around all the time. Instead, we can simply present the pieces of papyrus to each other for exchange on demand.”

In short, Pete wants to modernize their little island economy by introducing money – and he already has one of those new papyrus notes with him, which he is eager to trade for salt. However, the others would immediately realize that there is a problem: the papyrus per se is not of any value, since none of them have found a use for it as yet. If they were all to agree on using the papyrus as a medium of exchange, its value would rest on a promise alone – Pete’s promise that any papyrus he issues will actually be “backed” by fish, which would make Toni and Tom willing to accept it in exchange for salt and apples.

…click on the above link to read the rest of the article…

Failed Discipline, Failed Reforms and Grexit: Why the Euro Failed

Failed Discipline, Failed Reforms and Grexit: Why the Euro Failed

There is no substitute for the discipline of a market that cannot be manipulated by political elites.

It’s not that difficult to understand why the euro is doomed to fail. Given its structure, there is no other possible outcome but failure. Greece’s exit (Grexit) will simply be the first manifestation of the inevitable structural failure of the euro.

To understand why this is so, we have to start with two forms of discipline: the market and the state.The market disciplines its participants by discovering the price of not just goods and services but of currencies and the potential risks generated by fiscal and trade imbalances.

When nations issue their own sovereign currencies, the global foreign exchange (FX) market enforces an iron discipline on all participants. If a nation prints excessive quantities of its currency without boosting its production of goods and services by an equivalent amount, the FX market punishes this nation by devaluing its currency.

The market provides unwelcome feedback to the imbalances of interest rates, credit and currency: imports become prohibitive, nobody wants to buy the nation’s bonds unless the interest rate compensates for the higher risk, and so on.

…click on the above link to read the rest of the article…

Reckless Stock-Market Leverage Intoxicates Politicians

Reckless Stock-Market Leverage Intoxicates Politicians

The sudden bloodletting that leveraged currency speculators experienced when the Swiss National Bank yanked the cap on the franc should have been a warning: central-bank promises that everything is under control are meaningless. And because of leverage, innumerable trading accounts blew up in a matter of moments.

Leverage acts like a powerful drug. It creates buying pressure and inflates asset prices further on the way up. But when asset prices sink, leverage begets forced selling, which drives down asset prices further, which begets more forced selling….

And stock-market leverage, encouraged by the Fed’s monetary policies that make nearly free money available to all sorts of speculators, has ballooned.

Some of it is closely watched, like margin debt. FINRA’s 4,000 member securities firmsreported that their customers carried $496 billion in margin debt by the end of December, after a multi-year surge. Margin balances had peaked in September at $504 billion, by far the highest in absolute terms, and at 2.8% of GDP, the highest ever in relationship to the economy. Alas, the last two stock-market leverage bubbles ended in phenomenal crashes – the dotcom implosion and the Financial Crisis.

And corporations are issuing mountains of debt to buy back their own shares at peak prices – replacing equity with debt on their balance sheets, leveraging them up to the hilt, like others leverage up their brokerage accounts. In many cases, such as IBM, “tangible net worth” has turned negative, and stockholders are already under water.

Other forms of stock-market leverage are more difficult to quantify, like people borrowing against their home equity lines of credit or their credit cards to plow that moolah into stocks to make that quick buck that their neighbors have been bragging about.

…click on the above link to read the rest of the article…

Will China’s Currency Peg Be the Next to Fall?

Will China’s Currency Peg Be the Next to Fall?

I suspect China’s leadership is wary of unpegging the RMB for one reason: the FX market is too large to manipulate for long.

What is China’s currency the renminbi (RMB, a.k.a. yuan) really worth? Nobody knows, because price discovery has been thwarted by the RMB’s peg to the U.S. dollar. This peg has shifted over time, from 8-to-1 some years ago to the current peg of 6.24-to-1.

What does the peg mean for China’s currency and economy? Gordon T. Long and I discuss the many issues in our latest video program (see below).

Now that the USD has gained 16% in less than a year, that rise is dragging the RMB higher with it, making China’s goods less competitive in markets outside the U.S. (and countries which use the USD as their currency).A pegged currency rises and falls against other currencies along with the underlying currency. As the dollar weakened from 2010 to mid-2014, China’s RMB weakened along with it. This allowed Chinese authorities to lower the peg without affecting the competitive value of the RMB.

This major move has prompted Chinese authorities to widen the peg’s range to allow the RMB to weaken slightly against the dollar. Japan’s stunning devaluation of the yen has prompted much speculation that China will be forced to either end the peg to the USD or loosen the peg to match the depreciation of the yen.

…click on the above link to read the rest of the article…