“Let markets clear.” It’ll be just “a financial engineering shock.”

Stock and bond markets are in denial about the effects of the Fed’s forthcoming QE unwind, whose kick-off is getting closer by the day, according to the minutes of the Fed’s July meeting.

“Several participants” were fretting how financial conditions had eased since the rate hikes began in earnest last December, instead of tightening. “Further increases in equity prices, together with continued low longer-term interest rates, had led to an easing of financial conditions,” they said. So something needs to be done about it.

And “several participants were prepared to announce a starting date for the program at the current meeting” – so the meeting in July – “most preferred to defer that decision until an upcoming meeting.” So the September meeting. And markets are now expecting the QE unwind to be announced in September.

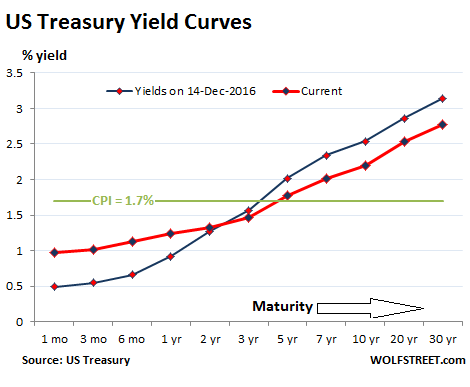

Since then, short-term Treasury yields have remained relatively stable, reflecting the Fed’s current target range for the federal funds rate of 1% to 1.25%. But long-term rates, which the Fed intends to push up with the QE unwind, have come down further. As a consequence, the yield curve has flattened further, which is the opposite of what the Fed wants to accomplish.

The chart shows how the yield curve for current yields (red line) across the maturities has flattened against the yield curve on December 14 (blue line), when the Fed got serious about tightening:

Yields of junk bonds at the riskiest end (rated CCC or below) surged in the second half of 2015 and in early 2016, peaking above 20% on average, as bond prices have plunged (they move in opposite directions) in part due to the collapse of energy junk bonds, which caused a phenomenal bout of Fed flip-flopping.

…click on the above link to read the rest of the article…