The total U.S. public debt hit a new record high of $21.145 trillion on the last day in May. As the U.S. debt increased, so did the interest expense which jumped by more than $26 billion in the first seven months of the fiscal year. That’s correct; the United States government forked out an additional $26 billion to service its debt (Oct.-Apr) versus the same period last year.

While the U.S. debt reached a new high on May 31st, it took nearly two months to do it. Let me explain. During tax season, the total U.S. public debt actually declined from a peak of $21.135 trillion on April 10th to a low of $21.033 trillion on May 3rd. Since then, the U.S. debt has been steadily moving higher (including some daily fluctuations):

If you spend some time on the TreasuryDirect.gov site, you will see that the total public debt doesn’t go up in a straight line. There are days or weeks where the total debt declines. However, the overall trend is higher.

Now, a rising debt level impacts the interest the U.S. Treasury must pay on this debt… especially when the average interest rate also increases. According to the TreasuryDirect.gov, the interest expense rose from $257.3 billion (Oct-Apr) 2017 to $283.6 billion (Oct-Apr) this year:

As I mentioned, the U.S. government paid an additional $26 billion to service the debt than it did last year. Now, $26 billion may not seem like a lot of money these days, but it could buy the total global Registered Silver inventory:

Thus, the extra $26 billion paid by the U.S. Treasury to service its debt would have purchased the 1+ billion ounces of silver held in the COMEX (270 million oz) and all the Global Silver ETFs. And, this would include the 138 million oz of silver supposedly stored at the JP Morgan vaults.

…click on the above link to read the rest of the article…

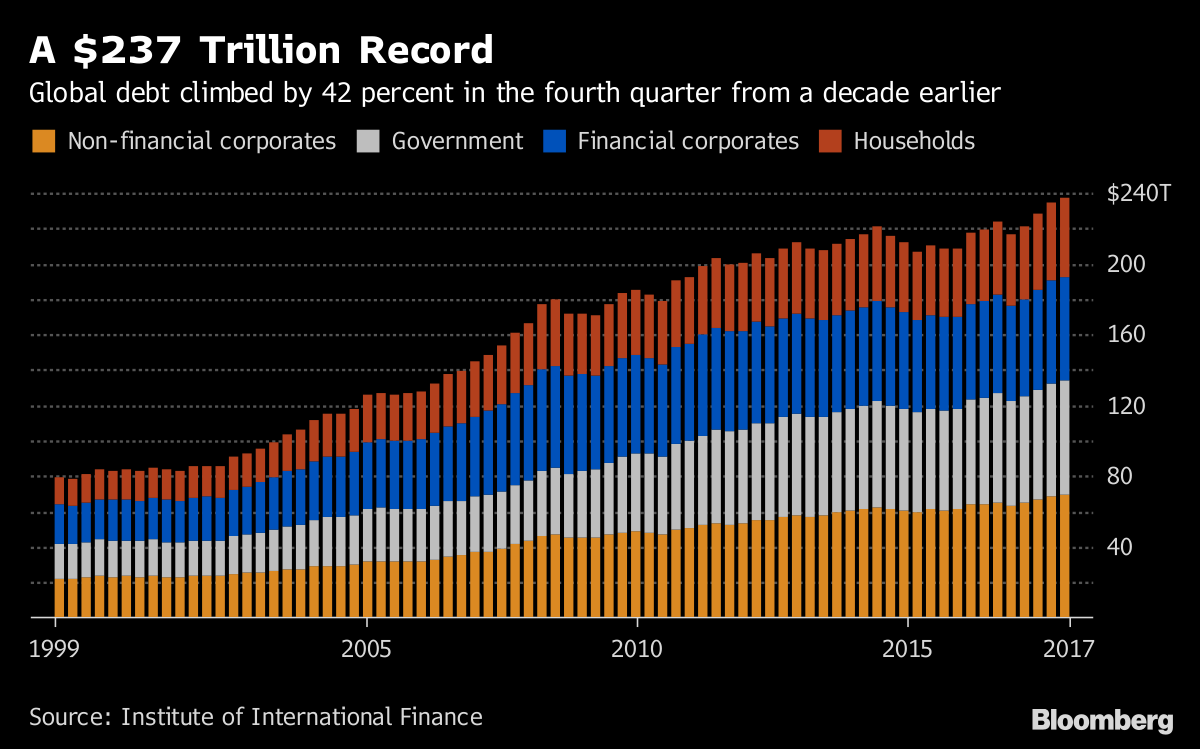

As the markets and financial system continue to be propped up by an ever-increasing amount of debt and leverage, precious metals investors need to understand the two most important reasons to invest in gold and silver. While one of the reasons to own precious metals is understood by many in the alternative media community, the more important critical factor is not.

As the markets and financial system continue to be propped up by an ever-increasing amount of debt and leverage, precious metals investors need to understand the two most important reasons to invest in gold and silver. While one of the reasons to own precious metals is understood by many in the alternative media community, the more important critical factor is not.

Source: Bloomberg

Source: Bloomberg