Home » Posts tagged 'of two minds' (Page 14)

Tag Archives: of two minds

2019: Fragmented, Unevenly Distributed, Asymmetric, Opaque

2019: Fragmented, Unevenly Distributed, Asymmetric, Opaque

Add up Fragmented, Unevenly Distributed, Asymmetric and Opaque and you get a world spinning out of centralized control.

Here are the key dynamics of 2019: fragmented, unevenly distributed, asymmetric, opaque. Want to know what’s happening with inflation, deflation, recession, populism, etc.?

It depends on what you own, when you own it, where you own it and its relative scarcity and stability–assuming you have trustworthy information on its scarcity and stability.

By ownership I mean all forms of capital: cash, tools, skills, social capital, trust in institutions, etc. Whatever forms of capital you own, the returns on that capital and its relative stability depend on the specifics of context and timing.

Will there be deflation or inflation? The right question is: Will there be deflation or inflation in my household?. In a rapidly fragmenting economy and society characterized by opacity, asymmetric information and unevenly distributed results, generalizations are intrinsically misleading / false. The only possible answers arise in a carefully limited context: my household, my neighborhood, my industry, my company, etc.

Here’s an example I’ve mentioned in the past: healthcare costs. If you’re one of the lucky households with heavily subsidized healthcare costs (for example, a government employee with limited deductibles, low per-visit costs and modest co-pays), your healthcare inflation is likely negligible.

But if your household doesn’t qualify for subsidies and has to pay market rates, you’re very likely to suffer double-digit healthcare inflation.

2019 is the year that central banks and states lose control of the narratives, the economy and the social contract, all of which are dynamic complex systems which excel in producing banquets of unintended consequences.

Control of the narrative requires harvesting “the right data” and spinning an interpretation that supports the status quo.

…click on the above link to read the rest of the article…

Could Stocks Rally Even as Parts of the Economy Are Recessionary?

Could Stocks Rally Even as Parts of the Economy Are Recessionary?

It’s not yet clear that the stock market swoon is predictive or merely a panic attack triggered by a loss of meds.

We contrarians can’t help it: when the herd is bullish, we start looking for a reversal. When the herd turns bearish, we also start looking for a reversal.

So now that the herd is skittishly bearish, anticipating a recession, contrarians start wondering if a most hated rally is in the offing, one that would leave most punters off the bus.

The primary theme for 2019 in my view is everything accepted by the mainstream is not as it seems. Everything presented as monolithic and straightforward is fragmented, asymmetric and complex.

Take “recession.” The standard definition of recession is two consecutive quarters of negative GDP. But is this metric useful in such a fragmented, complex economy? What we’re seeing develop is certain sectors are already in recession, others are sliding while others are doing OK.

So the question of stocks rising or falling partly depends on which parts of the economy are most heavily weighted in the stock market. If the sectors most heavily represented by listed stocks are doing OK, then other chunks of the economy can be in freefall and stocks could still rise.

There’s also the psychological state of market participants. Was the 20% decline in the 4th quarter a much-delayed reaction to impending recession or was it a panic attack caused by the Federal Reserve withdrawing some of its largesse, i.e. lowering the Fed Put?

It it turns out to be more panic-attack than rational response, a relief rally might be expected.

…click on the above link to read the rest of the article…

Commoditization = Deflation

Commoditization = Deflation

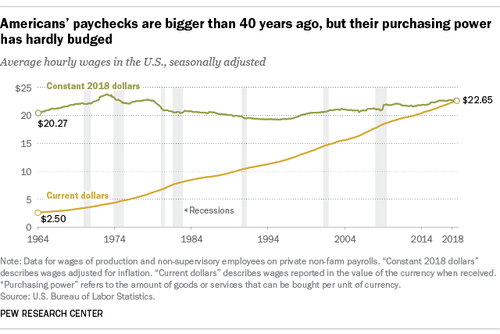

The other deflationary pressure is the stagnation of wages for the bottom 90%.

Apple’s slumping sales growth in China re-energized discussions on the commoditization of smart phones: the basic idea is that once devices, services, goods, platforms, etc. are interchangeable and can be produced/generated anywhere, they are effectively commodities and their value declines accordingly.

In the case of Apple’s iPhone, many observers see diminishing returns on the latest model’s features as the price point (around $1,000) now exceeds what many customers are willing to pay for the status of owning an Apple product and the declining differentiation of the iPhone when compared to other smart phones available at a fraction of the iPhone’s price.

Commoditization doesn’t just affect the top tier of the food chain; it affects the entire food chain. The commodity $400 smart phone has diminishing returns over the commodity $200 smart phone, and the $200 smart phone has diminishing returns over the commodity $100 smart phone.

Commoditization ravages price and profitability. Once the production facility is paid for by the first run, the cost basis of future production drops, enabling the producer to reap profits even as price plummets.

This is why perfectly good tablets cost $35 wholesale in some Asian markets.

Commoditization doesn’t just affect tech devices: passive index funds have commoditized investing. Why pay a hedge fund’s steep fees when a passive index fund may beat the net return (i.e. after fees) of the hedge fund?

No wonder hedge funds are closing left and right; investing is being commoditized by passive funds, funds managed by software, etc.

Commoditization is inherently deflationary as prices and profits are pushed down along the entire food chain.

…click on the above link to read the rest of the article…

A Couple of Thoughts on 2019

A Couple of Thoughts on 2019

The story of the 21st century is debt is soaring while earned income is stagnating for the bottom 95%.

Best wishes to all my readers and correspondents for a safe, healthy and productive 2019. Thank you, longstanding supporters, for renewing your financial support at the new year without any pathetic begging on my part. (The pathetic begging will commence shortly.)

While I don’t have any predictions for 2019 (why look any dumber than I have to?), I do have a couple of thoughts on the economy, markets, globalization, etc. Here are a few of the key issues confronting humanity:

1. The war being waged by Corporate Power (Globalization / Open Borders) to eradicate democracy and the power of nation-states to control their own destiny. Democracy ceases to exist in a corporate-controlled globalized system of governance; the sole structure that enables a citizen to have political and economic agency is the nation-state.

Try voting for a U.N. resolution or E.U. regulation. Sorry, pal, there are no elections or representation of the rabble in globalized governance. Globalization destroys democracy and the agency of the citizenry. That’s its goal.

Global corporations seek to destroy any and all barriers to their power and profits, and globalization / tax havens / Open Borders are the means to co-opt, marginalize and neuter nation-states and the political and economic agency of the citizenry. The net result of Corporate Power controlling the machinery of governance is neofeudalism.

2. Energy and capital flows. The status quo holds that energy flows don’t matter very much because energy represents a shrinking percentage of economic activity. In other words, capital is what matters, not energy, because capital can always buy whatever it wants.

…click on the above link to read the rest of the article…

The Crisis of Capital

The Crisis of Capital

These three dynamics render capital increasingly vulnerable to catastrophic losses as backstops and distorted markets fail.

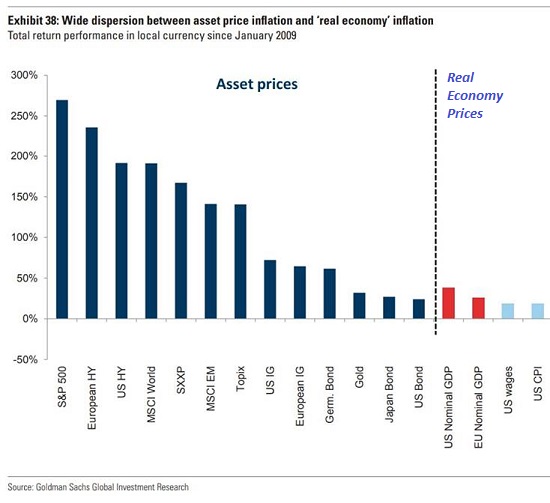

The undeniable reality of the 21st century economy is that capital has gained while labor has stagnated. While various critics quibbled about his methodology, Thomas Piketty’s core finding–that capital expanded faster than GDP and wages/salaries (i.e. earned income from labor)–is visible in these charts.

Real wages have gone nowhere for decades. Only the top 5% of wage earners have outpaced inflation’s erosion of the purchasing power of their earnings.

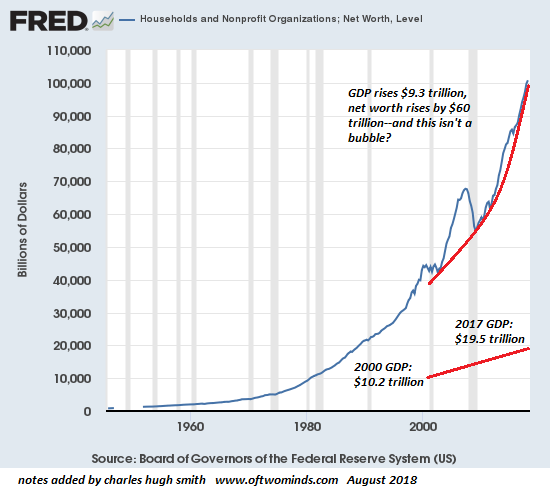

Household net worth has soared $60 trillion while GDP expanded by $9 trillion.Compare the relative growth trajectories of the economy and net worth of assets. Clearly, capital has expanded at rates far above the expansion rate of the economy.

Assets (capital) have exploded higher while real-world inflation (including wages) has remained in line with GDP growth: modest at best.

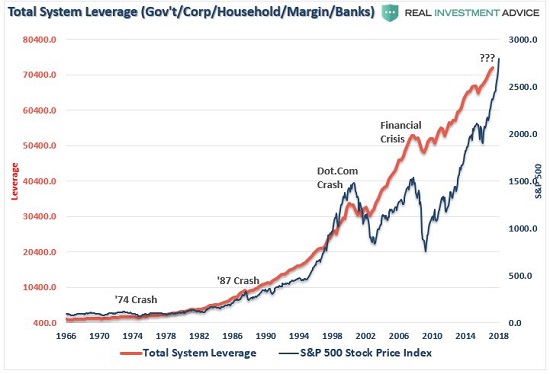

Courtesy of Lance Roberts and Real Investment Advice, here is a chart of total leverage and the S&P 500 stock index. Leverage / debt hasn’t pushed wages higher, but it’s certainly pushed stock valuations to the moon.

While labor / earned income is clearly in a systemic crisis, so too is capital, though it may seem as if capital is far from danger.

Capital’s crisis has several sources. One is the financial system, from pension funds to passive index-fund investors to hedge funds to government tax revenue projections, has become dependent on outsized capital gains for its stability.

Any extended period of low growth rates for capital or–perish the thought, sustained losses– will destabilize every financial structure that is counting on a projection of current returns far into the future.

…click on the above link to read the rest of the article…

When Certainty Frays, Capital Gets Skittish

When Certainty Frays, Capital Gets Skittish

The net result is capital is impaired in eras of uncertainty.

As we look ahead to 2019, what can we be certain of? Maybe your list is long, but mine has only one item: certainty is fraying.

Confidence in financial policies intended to eliminate recessions is fraying, confidence in political processes that are supposed to actually solve problems rather than make them worse is fraying, confidence in the objectivity of the corporate media is fraying, and confidence in society’s ability to maintain any sort of level playing field is fraying.

When certainty frays, capital gets skittish. Predicting increased volatility is an easy call in this context, as capital will not want to stick around to see how the movie ends if things start unraveling. The move out of stocks into government bonds is indicative of how capital responds to uncertainty.

The coordinated efforts of global central banks to backstop and boost markets also backstopped confidence in the banks’ monetary policies. Regardless of the long-term impact of the policies of quantitative easing and repression of interest rates, capital could count on the policies remaining in force and act accordingly.

With the Federal Reserve apparently ending the Fed Put and normalizing interest rates after a decade of near-zero rates, certainty about global central bank policies and the impacts of those policies has dissipated.

With valuations at historic highs and real estate rolling over, confidence that gains are essentially permanent is also fading. Buying at the top and holding onto the asset as it loses value is a predictable way to destroy capital, and so capital’s willingness to exit is rising, as is its preference for deep, liquid markets such as U.S. Treasury bonds, markets where big chunks of capital can be safely parked until clarity and confidence return.

…click on the above link to read the rest of the article…

Why I’m Hopeful

Why I’m Hopeful

A more humane, sustainable world lies just beyond the edge of the Status Quo.

Readers often ask me to post something hopeful, and I understand why: doom-and-gloom gets tiresome. Human beings need hope just as they need oxygen, and the destruction of the Status Quo via over-reach and internal contradictions doesn’t leave much to be happy about.

The most hopeful thing in my mind is that the Status Quo is devolving from its internal contradictions and excesses. It is a perverse, intensely destructive system with powerful incentives for predation, exploitation, fraud and complicity.

A more humane, sustainable world lies just beyond the edge of the Status Quo.

I know many smart, well-informed people expect the worst once the Status Quo (the Savior State and its corporatocracy partners) devolves, and there is abundant evidence of the ugliness of human nature under duress.

But we should temper this Id ugliness with the stronger impulses of community and compassion. If greed and rapaciousness were the dominant forces within human nature, then the species would have either died out at its own hand or been limited to small savage populations kept in check by the predation of neighboring groups, none of which could expand much because inner conflict would limit their ability to grow.

The remarkable success of humanity as a species is not simply the result of a big brain, opposable thumbs, year-round sex or even language; it is ultimately the result of social and cultural associations that act as a “network” for storing knowledge and relationships– what we call intellectual and social capital.

I have devoted significant portions of my books–

An Unconventional Guide to Investing in Troubled Times

Resistance, Revolution, Liberation

Why Our Status Quo Failed and Is Beyond Reform

A Radically Beneficial World: Automation, Technology & Creating Jobs for All

…click on the above link to read the rest of the article…

Why Everything That Needs to Be Fixed Remains Permanently Broken

Why Everything That Needs to Be Fixed Remains Permanently Broken

Just in case you missed what’s going on in France: the status quo in Europe is doomed.

The status quo has a simple fix for every crisis and systemic problem:

1. create currency out of thin air

2. give it to super-wealthy banks, financiers and corporations to boost their wealth and income.

One way these entities increase their wealth and income is to lend this nearly free money to commoners at much higher rates of interest. I borrow from central banks at 1% and lend it to you at 4.5%, 7% or even 19% or more. What’s not to like?

If a bank is insolvent, it can borrow money at 1% from central banks. If Joe Blow is insolvent, the only loan he can get is at 23%, if he can get any credit at all.

3. China has a variant fix for every financial crisis: build tens of millions of empty flats only the wealthy can afford as second or third “investment” flats. If the empty flats start dropping in price, government entities start secretly buying flats to support the market.

4. Empty malls, bridges to nowhere and ghost cities are also a standard-issue fix in China. Built it and they will come, until they don’t. But who cares, the developers and local governments (i.e. corrupt officials) already pocketed the dough.

You see the problem: making rich people richer doesn’t actually fix what’s broken, it only makes the problems worse. So why can’t we fix what’s broken?

It’s a question that deserves an answer, and the answer has six parts:

1. Any meaningful systemic reform threatens an entrenched, self-serving interest/elite which has a tremendous incentive to squash, co-opt or water down any reform that threatens their monopoly, benefits, etc.

…click on the above link to read the rest of the article…

Neofeudalism Isn’t a Flaw of the System–It’s the System Working Perfectly

Neofeudalism Isn’t a Flaw of the System–It’s the System Working Perfectly

Fakery is always precarious: the truth about the asymmetries of power might slip out and spread like wildfire.

I’ve been writing about neofeudalism and its cousin neocolonialism for seven years:

500 Million Debt-Serfs: The European Union Is a Neo-Feudal Kleptocracy (July 22, 2011)

The E.U., Neofeudalism and the Neocolonial-Financialization Model (May 24, 2012)

The basic idea here is the socio-economic-political system is structured such that the only possible output is neofeudalism. In other words, neofeudalism isn’t a flaw in the system that can be changed with policy tweaks or electing a new president or PM– it’s the result of the system working as designed.

Neofeudalism is a peculiarly invisible hierarchical structure of power: The New Nobility (or aristocracy if you prefer) wields vast concentrations of political, social and financial power, and does so without the formalized aristocrat-serf relationships and obligations of classic neofeudalism.

We appear to be free but we’re powerless to change the power asymmetry between the New Nobility and the commoners. This reality is reified into social relations that are simulacra of actual power, pantomimes acted out in media-theaters to instill the belief that the foundational myths of democracy and social mobility are real rather than misleading shadows.

Neofeudalism is fundamentally a financial-political arrangement, marketed and managed by cultural elites who strive to convince us that we still have some shreds of power. These elites have a variety of tools at their disposal. One has been described by filmmaker Adam Curtis as pantomime: Trump says/does something outrageous, the Democrats cry “impeachment,” and so on.

This theater of pantomime serves two purposes: it projects a simulation of functional democracy that makes us believe impeaching one president and getting another one in office will change anything about the neofeudal power structure; it won’t.

…click on the above link to read the rest of the article…

France in a Nutshell: “The Government Stopped Listening to the People 20 Years Ago”

France in a Nutshell: “The Government Stopped Listening to the People 20 Years Ago”

The elites’ clever exploitation of politically correct cover stories has enthralled the comatose, uncritical Left, but not those who see their living standards in a free-fall.

A family member who has lived in France for decades summarized the source of the gilets jaunes protests in one sentence: “The government stopped listening to the people 20 years ago. It would be difficult to deny the generalization of this: many if not most governments stopped listening to their people decades ago, preferring instead to listen to financial and political elites and entrenched cultural eliteswho view commoners with disdain.

Legions of commentators are weighing in on the economic and cultural sources of France’s distemper. Many have characterized the protests as working class, broadly speaking, the multitudes who have seen an erosion in the purchasing power of their wages or pensions while France’s financial, political and cultural elites have feasted on whatever meager gains the French economy has registered in the past 20 years.

The protesters rightly perceive that they are politically invisible: the ruling class, regardless of its ideological flavor, doesn’t believe it needs the support of the I>politically invisible to rule as it sees fit. The ruling class has counted on the cultural elites to marginalize and suppress the politically invisible by dismissing any working-class dissent as racist, fascist, nationalistic and other words expressly intended to push dissent into the political wilderness.

The cultural elites reckoned their ceaseless depiction of working-class dissent as racist-fascist populism would continue marginalizing the commoners, but the worm has turned: the financially, politically and culturally marginalized classes are fed up.

…click on the above link to read the rest of the article…

The Conflicting Forces of Modernism: Kafka and Kierkegaard

The Conflicting Forces of Modernism: Kafka and Kierkegaard

We seem to be heading into a confrontation between the two forces of Modernism: the primacy of the individual versus the increasing technological and economic might of the central state.

In Kafka’s Nightmare Emerges: China’s “Social Credit Score” (May 7, 2018), I wrote about Kafka’s vision of a bureaucratic nightmare emerging in China’s “Social Credit Score.”

The idea here is the central state sets up a vast, pervasive surveillance system to monitor all its citizens, and assigns a social score to each citizen based on his/her compliance with regulations and social norms as defined by the state.

In Kafka’s nightmarish novels, an opaque, impenetrable and impersonalized bureaucracy controls the social and economic structures of everyday life.

China’s system is based on a social score, but one’s social score has enormous economic consequences: the citizen with a low score can be denied rights to travel, his/her children can be denied access to educational opportunities and so on.

As I noted, there doesn’t appear to be a legal process for challenging one’s low social score, or much transparency on the various violations and weighting of violations that go into calculating each individual’s score.

I’ve often written about the difference between force and power: as per Edward Luttwak, force (coercion) is costly and clumsy, while power works via persuasion, grudging or otherwise.

China is attempting to create a system that is extremely coercive (a low score generates severe punishments) but also seeks to internalize the social scoring system: no authority figure is required to force individuals to comply; each individual internalizes the rules and modifies their own behavior accordingly.

This aligns with China’s historic reliance on internalized social norms to control its vast populace. Even in the Song Dynasty (960 AD to 1279 AD), the central state relied on the internalized social norms of Confucian values to “order society” with minimal coercion.

…click on the above link to read the rest of the article…

Are We in a Recession Already?

Are We in a Recession Already?

The value of declaring the entire nation in or out of recession is limited.

Recessions are typically only visible to statisticians long after the fact, but they are often visible in real time on the ground: business volume drops, people stop buying houses and vehicles, restaurants that were jammed are suddenly sepulchral and so on.

There are well-known canaries in the coal mine in terms of indicators. These include building permits, architectural bookings, air travel, and auto and home sales.

Home sales are already dropping in most areas, and vehicle sales are softening. Airlines and tourism may continue on for awhile as people have already booked their travel, but the slowdown in other spending can be remarkably abrupt.

All nations are mosaics of local economies, and large nations like the U.S. are mosaics of local and regional economies, some of which (California, Texas, New York) are the equivalent of entire nations in and of themselves.

As a result, there can be areas where the Great Recession of 2008-09 never really ended, and other areas that have experienced unprecedented building booms (for example, the San Francisco Bay Area where I live part-time.)

Changes in sentiment are reflected in different sectors of the economy: people become hesitant about big purchases first (autos, houses) and then start deciding to save more by spending less (Christmas shopping, eating out, vacations, etc.)

Given the structural asymmetries of our economy (a few winners, most people lucky to be losing ground slowly), each economic class also responds differently. The lower 60% of households don’t have the disposable income of the top 10%, so “cutting back” for them might be buying fewer fast-food meals per week.

…click on the above link to read the rest of the article…

The View from the Trenches of the Alternative Media

The View from the Trenches of the Alternative Media

What’s scarce in a world awash in free content and nearly infinite entertainment content?

After 3,701 posts (from May 2005 to the present), here are my observations of the Alternative Media from the muddy trenches.

It’s increasingly difficult to make a living creating content outside the corporate matrix. The share of advert revenues paid to content creators / publishers has declined precipitously, shadow banning has narrowed search and social media exposure and the expansion of free content and competing subscription-based publishing has made subscription services an increasingly tough sell.

The most effective ways to silence critics and skeptics is to 1) de-monetize their sites / platforms and 2) restrict their access to the public via shadow banning and search algorithm “adjustments.” The two are related, of course; as audiences dwindle, so do revenues and opportunities to sell subscriptions or promote patronage.

The corporate media’s lumping of all alternative media in with “fake news” and troll-farms has intentionally tarnished all alternative media, as underminings independent journalism and commentary is an essential part of unifying public opinion behind “approved” ideologically uniform narratives.

Significant swaths of the public get their “news” and commentary solely from social media (Facebook and Twitter, and to a lesser degree, Instagram) or a handful of corporate media (which included PBS/NPR). As these channels limit / delegitimize alternative media voices, the public’s access to alternative analysis and commentary diminishes even further.

A few quasi-monopolistic corporations have effectively become gatekeepers: what’s approved is allowed to be viewed / heard / read, what raises eyebrows effectively disappears.

It’s become increasingly difficult to make a living writing books. Advances for established authors have fallen from $10,000 or $20,000 to $2,500 or $1,000, and in the academic publishing world, $1,000 may be the entire sum paid to the author for writing a book.

…click on the above link to read the rest of the article…

Truth Is What We Hide, Self-Serving Cover Stories Are What We Sell

Truth Is What We Hide, Self-Serving Cover Stories Are What We Sell

The fact that lies and cover stories are now the official norm only makes us love our servitude with greater devotion.

We can summarize the current era in one sentence: truth is what we hide, self-serving cover stories are what we sell. Jean-Claude Juncker’s famous quote captures the essence of the era: “When it becomes serious, you have to lie.”

And when does it become serious? When the hidden facts of the matter might be revealed to the general public. Given the regularity of vast troves of well-hidden data being made public by whistleblowers and white-hat hackers, it’s basically serious all the time now, and hence the official default everywhere is: truth is what we hide, self-serving cover stories are what we sell.

The self-serving cover stories always tout the nobility of the elite issuing the PR: we in the Federal Reserve saved civilization by saving the Too Big To Fail Banks (barf); we in the corporate media do investigative reporting without bias (barf); we in central government only lie to protect you from unpleasant realities–it’s for your own good (barf); we in the NSA, CIA and FBI only lie because it’s our job to lie, and so on.

Three recent essays speak to the degradation of data and factual records in favor of self-serving cover stories and corrosive political correctness.

Why we stopped trusting elites (The Guardian)

“It’s not just that isolated individuals are unmasked as corrupt or self-interested (something that is as old as politics), but that the establishment itself starts to appear deceitful and dubious. The distinctive scandals of the 21st century are a combination of some very basic and timeless moral failings (greed and dishonesty) with technologies of exposure that expose malpractice on an unprecedented scale, and with far more dramatic results.

…click on the above link to read the rest of the article…

Bearish on Fake Fixes

Bearish on Fake Fixes

This systemic vulnerability is largely invisible, and so the inevitable contagion will surprise most observers and participants.

The conventional definition of a Bear is someone who expects stocks to decline. For those of us who are bearish on fake fixes, that definition doesn’t apply: we aren’t making guesses about future market gyrations (rip-your-face-off rallies, dizziness-inducing drops, boring melt-ups, etc.), we’re focused on the impossibility of reforming or fixing a broken economic system.

Many observers confuse creative destruction with profoundly structural problems. The technocrat perspective views the creative disruption of existing business models by the digital-driven 4th Industrial Revolution as the core cause of rising income inequality, under-employment, the decline of low-skilled jobs, etc.–many of the problems that plague the current economy.

I get it: those disruptive consequences are real. But they aren’t structural: the state-cartel system is structural, because cartels can buy political protection from competition and disruptive technologies. Just look at all the cartels that have eliminated competition: higher education, defense contractors, Big Pharma–the list is long.

The fake-fixes to the structural dominance of cartels and entrenched elites come in two flavors: political reforms that add complexity (oversight, compliance, etc.) but never threaten the insiders’ skims and scams, and monetary policies such as low interest rates and unlimited liquidity that enrich the already-wealthy by funneling whatever gains are being reaped to rentiers rather than to labor.

I explain how this neofeudal economy is the inevitable result of our system in my new book Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic.

Our political system, dependent on campaign contributions and lobbying, is easily influenced to protect and enhance the private gains of corporations and financiers. Combine this with the gains reaped by those with access to cheap credit and you have a financial nobility ruling a class of debt-serfs.

…click on the above link to read the rest of the article…