Hurtling toward a massive financial crisis.

Forty-five years and counting: We’ve been on a debt spree since the early 1970s when we went off the gold standard, covering every possible angle. Trade deficits, government deficits, unfunded entitlements, private debt – you name it! Our total debt has grown 2.5-times GDP since 1971.

How could economists not see this as a problem? How is this the least bit sustainable?

It isn’t. We’re hurtling toward a massive financial crisis, and all we have to show for it are financial asset bubbles destined to burst. And when they do, they’ll wipe out the artificial wealth they’ve created for many decades… in just a few years, as they did from late 1929 into late 1932!

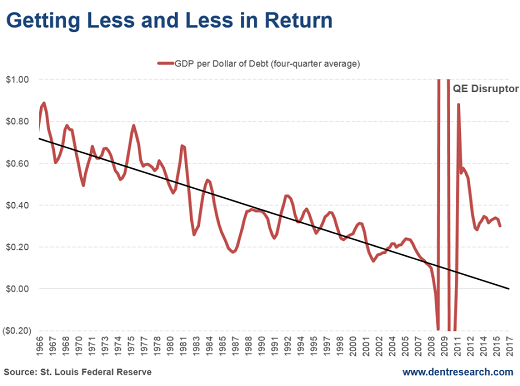

The chart below shows the common-sense truth.

As with any drug – and debt is a financially enhancing drug – it takes more and more to create less and less of an effect. Eventually, you reach the “zero point” where there is no effect and the drug kills you from its very strain and toxicity.

We’re rapidly approaching that zero point, after every dollar of debt has produced less and less GDP steadily since 1966:

Note that the anomaly in the chart after 2008 was due to the impact of unprecedented QE. Ever since that disruption, the trends have pointed back down – making a beeline toward that zero point again.

Back in 2002, Swiss investor and market prognosticator Marc Faber published a similar chart. His findings showed the zero point for debt creation would occur around 2015. With updated data, we now see that the zero point will hit around the beginning of 2017.

…click on the above link to read the rest of the article…