Diesel is the workhorse of the global economy. It’s used everywhere to keep trucks, tractors, freight trains and factories moving. And its ubiquity means the increase in its price will exacerbate global inflationary pressures.From central bank interest rates to supermarket prices, a lot hinges on diesel. On Tuesday, average U.S. retail diesel prices posted the fifth-consecutive fresh daily record, surging above $5.3 per gallon, up nearly 75% from a year ago. The price spike is worse on the Eastern seaboard, where diesel retails now for more than $6 per gallon, nearly double 2021’s price.The oil tanks in New York harbor are nearly empty for reasons both global and local. Around the world, diesel is in short supply as demand has surged well above pre-Covid levels, spurred by a boom in freight…

…click on the above link to read the rest of the article…

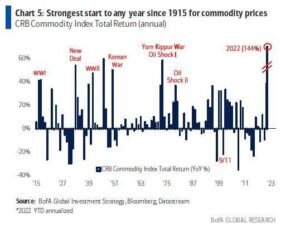

NEW YORK – The new reality with which many advanced economies and emerging markets must reckon is higher inflation and slowing economic growth. And a big reason for the current bout of stagflation is a series of negative aggregate supply shocks that have curtailed production and increased costs.

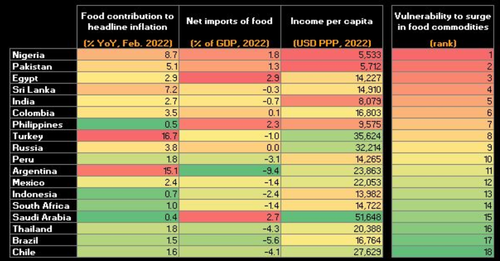

This should come as no surprise. The COVID-19 pandemic forced many sectors to lock down, disrupted global supply chains, and produced an apparently persistent reduction in labor supply, especially in the United States. Then came Russia’s invasion of Ukraine, which has driven up the price of energy, industrial metals, food, and fertilizers. And now, China has ordered draconian COVID-19 lockdowns in major economic hubs such as Shanghai, causing additional supply-chain disruptions and transport bottlenecks.

But even without these important short-term factors, the medium-term outlook would be darkening. There are many reasons to worry that today’s stagflationary conditions will continue to characterize the global economy, producing higher inflation, lower growth, and possibly recessions in many economies.

For starters, since the global financial crisis, there has been a retreat from globalization and a return to various forms of protectionism. This reflects geopolitical factors and domestic political motivations in countries where large cohorts of the population feel “left behind.” Rising geopolitical tensions and the supply-chain trauma left by the pandemic are likely to lead to more reshoring of manufacturing from China and emerging markets to advanced economies – or at least near-shoring (or “friend-shoring”) to clusters of politically allied countries. Either way, production will be misallocated to higher-cost regions and countries.

…click on the above link to read the rest of the article…