Home » Posts tagged 'bubble' (Page 12)

Tag Archives: bubble

Some Folks At The Fed Are Lost——No Juice To The Macros, Part 1

Some Folks At The Fed Are Lost——No Juice To The Macros, Part 1

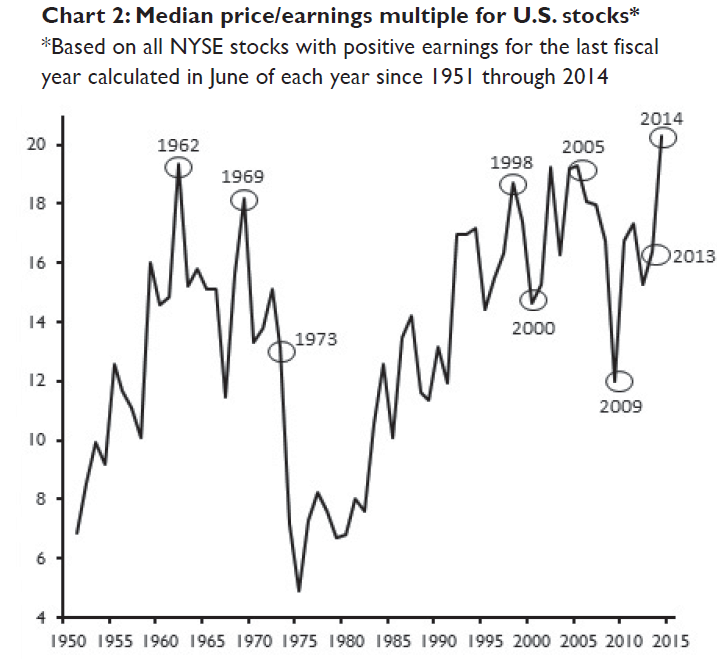

Yesterday we demonstrated that stock market valuations are not merely “on the high side” as Janet Yellen averred last week. Instead, they are positively in the nose-bleed section of history.

You don’t get the Russell 2000 trading at 90X honest-to-goodness GAAP earnings or 125 biotechs with aggregate LTM losses of $10 billion sporting a combined market cap of $280 billion unless you are deep into bubble land. In fact, the chart on the median PE multiple for all NYSE stocks bears repeating.

Recall this graph is based on trailing GAAP earnings for all companies with positive income. But that was for the LTM period ending in June 2014. Since then the market is up by 7%, yet reported earnings have basically flat-lined. S&P 500 earnings for the June 2014 LTM period, for example, were $103 per share——-a level that has now dropped to $102 per share for the December LTM period.

In short, the median NYSE valuation multiple is now at upwards of 22X—a level far above even the dotcom and housing bubble peaks. It is no wonder, therefore, that even a certified Cool-Aid drinker like St Louis Fed head, James Bullard, has now confessed that he fears a “violent” Wall Street sell-off when the Fed finally ends an 80 month streak of ZIRP sometime this fall.

So what are they waiting for? Actually, this morning’s

Wall Street Journal expressed it about as plaintively as it comes. In a word, the monetary politburo is waiting for zero interest rates, massive debt monetization and its wealth effects promises and “puts” to goose the macros:

…click on the above link to read the rest of the article…

Mark Cuban Warns: This Bubble Is Far Worse Than The Tech Bubble Of 2000

Mark Cuban Warns: This Bubble Is Far Worse Than The Tech Bubble Of 2000

Just over a year ago, we warned that while the world of speculative capital is focused intently on the Twitter and Facebook #Ref/0 fundamental valuations in the publicly-traded equity markets, the real dot-com 2.0 bubble is occurring in the private markets. Few paid attention, prefering the head in the sand “well the music is still playing” meme; but one (or two) billionaires noticed, and with all eyes intently focused on Nasdaq 5,000 (as some indicator that we made it back to Nirvana), Mark Cuban unleashes uncontestible exposition why is this bubble far worse than the tech bubble of 2000.

It is different this time… and, as Mark Cuban explains, far worse…

Ah the good old days. Stocks up $25, $50, $100 more in a single day. Day trading was all the rage. Anyone and everyone you talked to had a story about how they had made a ton of money on such and such a stock. In an hour. Stock trading millionaires were being minted by the week, if not sooner.You couldn’t go anywhere without people talking about the stock market. Everyone was in or new someone who was in. There were hundreds of companies that were coming public and could easily be bought and sold. You just pick a stock and buy it. Then you pray it goes up. Which most days it did.

Then it ended. Slowly by surely the air came out of the bubble and the stock markets declined and declined till the air was completely gone. The good news was that some people were able to see it coming and get out. The bad is that others were able to get out, but at significant losses.

If we thought it was stupid to invest in public internet websites that had no chance of succeeding back then, it’s worse today.

…click on the above link to read the rest of the article…

Junk-Bond Bubble Implodes Beyond Energy, Deals Scuttled, Yields Soar, Suddenly “Insufficient Demand”

Junk-Bond Bubble Implodes Beyond Energy, Deals Scuttled, Yields Soar, Suddenly “Insufficient Demand”

The year 2015 has just started, and already there have been two junk-bond casualties: the first on Thursday, and the second one today. They weren’t energy companies. Energy companies don’t even try anymore. They’ve been locked out. Both deals had to be scuttled because, even at the high yields they offered, there were suddenly no buyers. 2014 had been a harbinger: 17 junk-bond deals for $5.8 billion in total were shelved, most of them during the last four months.

Ever since the Fed unleashed its waves of QE, institutional investors, driven to near insanity by the relentless interest rate repression, have been chasing yields ever lower in a desperate effort to get some kind of return. In the process, junk bonds and leveraged loans boomed and spiraled to such heights that the Fed – which is never able to see any bubbles – and other bank regulators began fretting over a year ago about the risks they posed to “financial stability.” And in December, it was the Treasury that hit the alarm button about leveraged loans [read… Treasury Warns Congress (and Investors): This Financial Creature Could Sink the System].

Now QE Infinity is gone, interest-rate hikes are vaguely shaping up on the horizon, and institutional investors – bond mutual funds, for example – are getting second thoughts.

Junk bond issuance, at $13.4 billion so far this year, is down 32% from the same period in 2014, according to S&P Capital IQ/LCD’s HighYieldBond.com. Lower-rated companies are “forced to pay-up significantly,” explained LCD’s Joy Ferguson. And some of them, like the Presidio Holdings deal today, are having trouble finding any buyers – despite offering a yield of 11% or higher.

…click on the above link to read the rest of the article…

Overvalued housing prices and how to read them: Don Pittis

Overvalued housing prices and how to read them: Don Pittis

I was reading about baseball cards over the Christmas holidays and it made me think of Canadian houses.

From the Bank of Canada’s warning to last week’s devastating analysis from Germany’s Deutsche Bank that claimed a 63 per cent overvaluation, it seems we are being told once again that we think our houses are worth a lot more than they really are.

As we wait for the latest figures from the Canadian Real Estate Association (CREA) this week, homeowners and prospective buyers will be looking for concrete signals about what to believe.

- Bank of Canada says Canadian house prices up to 30% overvalued

- Fears of a Canadian housing bubble overblown

The article I read about collectible cards ostensibly had nothing whatever to do with houses. It was light and charming, an autobiographical feature in the Economist’s Christmas double issue, about how a childhood craze for collectible cards had turned into a serious financial speculation.

Baseball cards that had sold in the thousands began trading at absurd prices. Canadian hockey star Wayne Gretzky bought one card for nearly half a million dollars.

…click on the above link to read the rest of the article…

Prepare for Property Prices to Fall in U.S. and Globally

Prepare for Property Prices to Fall in U.S. and Globally

At the start of the New Year, there are increasing signs that the recovery seen in property prices in many cities in western countries — namely New York and other U.S. cities, and Dublin, London and other UK cities — is beginning to peter out.

Many cities have seen speculative frenzies return in recent months which led to price surges which would appear to be unsustainable – especially given the uncertain and poor geopolitical and economic backdrop.

This has been the case in the UK and Ireland, the U.S. and indeed in Canada, Australia, New Zealand and a few other markets.

The question at the start of 2015, is whether we are likely to see continued price gains or falls. There are all the hallmarks of an echo bubble akin to the one that burst so painfully in the ‘noughties’.

In the UK, the respected Centre for Economic and Business Research (CEBR) has predicted a decline in British property prices this year. Prices rose 8.8%, on average, in 2014 with prices in London ballooning another whopping 20%.

…click on the above link to read the rest of the article…

The Fracturing Energy Bubble Is the New Housing Crash | David Stockman’s Contra Corner

The Fracturing Energy Bubble Is the New Housing Crash | David Stockman’s Contra Corner.

Let’s see. Between July 2007 and January 2009, the median US residential housing price plunged from $230k to $165k or by 30%. That must have been some kind of super “tax cut”.

In fact, that brutal housing price plunge amounted to a $400 billion per year “savings” at the $1.5 trillion per year run-rate of residential housing turnover. So with all that extra money in their pockets consumers were positioned to spend-up a storm on shoes, shirts and dinners at the Red Lobster.

Except they didn’t. And, no, it wasn’t because housing is a purported “capital good” or that transactions are largely “financed” at upwards of 85% leverage ratios. None of those truisms changed consumer incomes or spending power per se.

The Treasury’s Worst-Case Scenario: Over $3.3 Trillion In Student Loans In A Decade | Zero Hedge

The Treasury’s Worst-Case Scenario: Over $3.3 Trillion In Student Loans In A Decade | Zero Hedge.

One of the recurring topics on Zero Hedge over the past 3 years has been the relentless increase in student loans which, as a result of their cumulative default and loss severity (including those loans which are “merely” in deferment and forbearance) has surpassed the subprime bubble in terms of size.

In fact, as the following table from the TBAC shows, the actual default risk from student loans is several orders of magnitude above the 9% student loans which the Fed has revealed as currently “in default”, as one has to add those 12% of loans in deferment and 11% in forbearance to the entire risk pool. In short: a third of all student loans are likely to end up unrepaid!

Why is this number a problem? Because as the TBAC also forecasts, in its worst economic case scenario for the millennial generation (which sadly, based on recent employment and income trends for America’s young adults is more like the base case scenario), total student loans, which currently stand a little over $1 trillion (or more than all the credit card debt in America), is set to triple in just the next decade, hitting a whopping $3.3 trillion by 2024.

…click on the above link to read the rest of the article…