The IEA’s forecast that U.S. shale will dominate the oil market over the next three years because of skyrocketing shale production made global headlines on Monday, but the conclusions should not be taken as gospel. The industry could run into a series of headwinds that could slow production growth, starting with demands from investors to see higher returns.

“Last year, it was drill, baby, drill,” John Hess, CEO Hess Corp., told the audience at the CERAWeek Conference in Houston on Monday. “This year, it’s show me the money.” He argued that shale drillers are feeling pressure from investors to post profits, which could slow the pace of development.

Yet, so far, while the newfound and highly-touted capital discipline mantra is being talked about quite a lot, it has not translated into a slower pace of drilling. The U.S. is breaking production records every week, and output is growing at a blistering rate.

However, that doesn’t mean that the growth rate will continue, or that U.S. shale will add nearly 4 million barrels per day over the next five years, as the IEA predicts.

There are a variety of bottlenecks that could constrain output and slow growth. For instance, with so much drilling concentrated in a relatively small area in West Texas, there are shortages of oilfield services, fracking crews, labor, and frac sand.

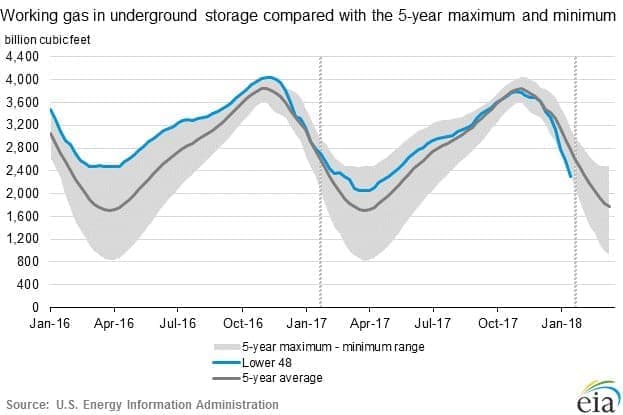

Last year, the backlog of drilled but uncompleted wells (DUCs) mushroomed as shale E&Ps drilled more wells than they could complete. The completion rate is now on the upswing, up 79 percent from a year ago, according to Reuters. But the number of DUCs is also rising, illustrating a persistent bottleneck in completion services. There are other holdups, including takeaway capacity for natural gas and limits on gas flaring, which could hamper oil production.

…click on the above link to read the rest of the article…