U.S. Dot-Com Bubble Was Nothing Compared to Today’s China Prices http://www.bloomberg.com/news/articles/2015-04-07/u-s-dot-com-bubble-was-nothing-compared-to-today-s-china-prices … $FXI $PEK

Home » Posts tagged 'bubble' (Page 11)

Tag Archives: bubble

The Great China Ponzi—-An Economic And Financial Trainwreck Which Will Rattle The World

The Great China Ponzi—-An Economic And Financial Trainwreck Which Will Rattle The World

There is an economic and financial trainwreck rumbling through the world economy. Namely, the Great China Ponzi. In all of economic history there has never been anything like it. It is only a matter of time before it ends in a spectacular collapse, leaving the global financial bubble of the last two decades in shambles.

But here’s the Wall Street meme that is stupendously wrong and that engenders blind complacency with respect to the impending upheaval. To wit, the same folks who brought you the myth of the BRICs miracle would now have you believe that China is undergoing a difficult but doable transition——-from an economy driven by booming exports and monumental fixed asset investment to one based on steady as she goes US-style consumption and services.

There may well be some bumps and grinds along the way, we are cautioned, such as the recent stock market and currency turmoil. But do not be troubled—–the great locomotive of the world economy will come out the other side better and stronger. That’s because the wise, pragmatic and powerful leaders and economic managers who deftly guide China’s version of capitalism have the capacity to make it all happen.

No they don’t!

China is not a clone-in-the-making of America’s $18 trillion consume till you drop economy—-even if that model were stable and sustainable, which it is not. China is actually sui generis—–a historical freak accident that has no destination other than a crash landing.

It’s leaders are neither wise nor deft economic managers. In fact, they are a bunch of communist party political hacks who have an iron grip on state power because China is a crude dictatorship. But their grasp of the fundamentals of economic law and sound finance can not even be described as negligible; it’s non-existent.

…click on the above link to read the rest of the article…

An economic earthquake is rumbling

An economic earthquake is rumbling

While the people sleep, an economic earthquake rumbles underneath. The day that they begin to feel the quake draws near.

History will record that in this decade more people will lose more money (forget about the trillions of dollars already lost) than at any time in our history, including during the Great Depression.

At the same time, a very small group has made and will make huge sums of money.

During the Y2K scare (a real hoax) many people stored food. Then, after Y2K, many people wanted to dump their cache; and some did.

We advised readers of my Bob Livingston Letter at the time to store food simply because of the crisis world we live in, but to store those foods that you could rotate and consume. Stored food is a hedge against inflation. It’s a hedge against natural disaster. It’s a hedge against economic collapse. It was our advice before, and it has been our advice since.

This advice is still valid. People who don’t have some stored food don’t realize how dependent they are on the system and government. Of course, the system was designed and created to make the people dependent on government. That makes them easier to control.

Many people have been in hard times since 2008, thanks to bursting housing and derivatives bubbles — both fueled by the Federal Reserve’s money printing and both predicted by me in my Letter and by many other writers. For those of us who are not well-connected (those of us who are not in the 1 percent), there has been no relief. While the banksters got bailouts and Wall Street and the banksters benefited from the money printers, the middle class was impoverished. Savings were wiped out.

…click on the above link to read the rest of the article…

China’s 1929 moment

China’s 1929 moment

Anyone with a nose for markets will tell you that the Chinese government’s attempt to rescue the country’s stock markets from collapse is far from succeeding.

Bubbles collapse, period; and government interventions don’t stop them. Furthermore, we are beginning to see a crack widen in the foundations of China’s capital markets that could end up undermining the whole economy.

Since the government owns the banking system, some of the knock-on effects will doubtless be concealed. A consequence for China is that domestic financial instability could threaten her current plans for the international development of her currency. Here the timing couldn’t be worse, because in a few months the IMF is due to announce its decision about the inclusion of the renminbi in the SDR*. The odds were in favour of China succeeding in this quest, on the basis that China was deemed to have fulfilled the necessary conditions, and the IMF itself has been supportive.

A 1929-style collapse in China’s stock markets would change this delicate balance. In mainstream macroeconomic theory, the only way China can resolve her excessive financial imbalances is to devalue the renminbi against other SDR currencies, hardly a good start for a new member. The IMF, probably egged on by the Americans, could be forced to defer its decision again, reviewing it in 2020.

This would be a bad outcome, given China has set her sights on joining the IMF’s top table. There can be little doubt that the recent announcement increasing her gold reserves by only 600 tonnes was made in the context of her desire for the currency to be included in the SDR. If she is rejected, China could swing the emphasis more firmly towards gold, which she owns and mines in abundance.

…click on the above link to read the rest of the article…

Its 1929 In China—-Here’s The Chapter And Verse

Its 1929 In China—-Here’s The Chapter And Verse

I’ve mentioned the Chinese stock market mania here briefly in recent weeks. I’ve now compiled a fair amount of data along with some interesting anecdotes that show just how crazy it’s gotten so I thought I’d spend this week’s market comment laying it all out for you.

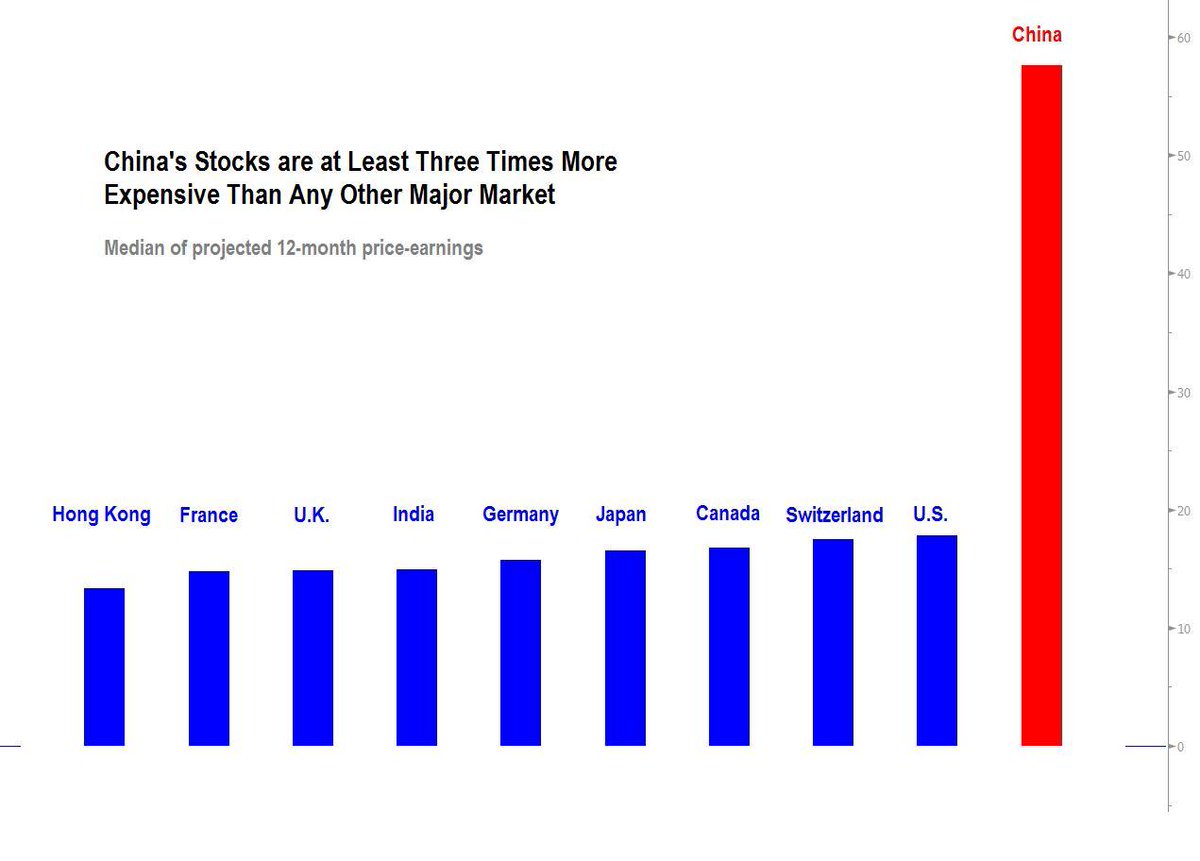

The first thing I like to focus on is valuations. If the dot-com bubble is the gold standard, then China is a bona fide financial bubble. According to Bloomberg:

Valuations in China are now higher than those in the U.S. at the height of the dot-com bubble just about any way you slice them. The average Chinese technology stock has a price-to-earnings ratio 41 percent above that of U.S. peers in 2000, while the median valuation is twice as expensive and the market capitalization-weighted average is 12 percent higher, according to data compiled by Bloomberg.

Another way to look at it is to compare current valuations around the world:

One of these bars doesn’t belong. http://www.bloomberg.com/news/articles/2015-06-16/real-cost-of-china-stocks-dwarfs-2007-bubble-as-valuations-jump …

I’ve made the case that US stocks are more overvalued than they appear due to the fact that the median stock is now more highly valued than ever. There’s now a very similar but far more dramatic situation going on in China. Again, from Bloomberg:

…click on the above link to read the rest of the article…

The problem with the Shanghai Composite is that 94 percent of Chinese stocks trade at higher valuations than the index, a consequence of its heavy weighting toward low-priced banks. Use average or median multiples instead and a different picture emerges: Chinese shares are almost twice as expensive as they were when the Shanghai Composite peaked in October 2007 and more than three times pricier than any of the world’s top 10 markets.

…click on the above link to read the rest of the article…

The Punch Bowl Stays And The Bubble Keeps Inflating

The Punch Bowl Stays And The Bubble Keeps Inflating

It is well known that I don’t think much of the ability of government officials to correctly forecast much of anything. Alan Greenspan and Ben Bernanke have made famously clueless predictions with respect to stock and housing bubbles, and rank and file Fed economists have consistently overestimated the strength of the economy ever since their forecasts became public in 2008 (see my previous article on the subject). But there is one former Fed and White House economist who has a slightly better track record…which is really not saying much. Over his public and private career, former Fed Governor and Bush-era White House Chief Economist Larry Lindsey actually got a few things right.

…click on the above link to read the rest of the article…

Canadian Mortgage Insurer Tells US Hedge Funds Why Canada’s Housing Bubble Is Immortal. Hilarity Ensues

Canadian Mortgage Insurer Tells US Hedge Funds Why Canada’s Housing Bubble Is Immortal. Hilarity Ensues

Home prices in Canada’s two largest metro areas have been red-hot for years. In May, the average selling price for all types of homes in the Greater Toronto Area jumped 11% from a year ago to C$649,600 on a 6% increase in sales. In Greater Vancouver, the composite benchmark price for all homes rose 9.4% to C$684,400 on a 23% increase in sales.

But these overall price changes paper over what’s happening with detached homes,whose prices soared 14% to C$1,104,900 in Vancouver and 18% to C$1,115,120 in Toronto.

Already last summer, Fitch fretted about overvaluation in housing and the high debt burden relative to disposable income of Canadian households. At about the same time, seven in ten mortgage lenders expressed concerns in a poll by FICO that home prices were in a “bubble” that could burst any time. Last October, the Bank of Canada thought that the housing bubble could threaten Canada’s financial stability.

This January, Deutsche Bank estimated that homes in Canada were 63% overvalued. In March, the IMF warned that high household debt levels and the “overheated housing market” are two risks it would “need to keep an eye on.” In April, the Economistdetermined that home prices in Canada were overvalued by 35% when compared to incomes, and 89% when compared to rents.

Now hedge funds are trying to engineer ways to short the Canadian housing market one way or the other, because surely this would be another “short of a lifetime.”

Maybe they’re right: beyond Toronto and Vancouver, the housing market is already drifting lower.

…click on the above link to read the rest of the article…

How To Spot A Bubble

How To Spot A Bubble

We’ve been entertaining ourselves to no end the past couple days with a ‘vast array’ of articles that purport to provide us with ‘expert’ opinion on the question of whether we are witnessing a bubble or not. Got the views of Goldman’s David Kostin, Robert Shiller, Jeremy Grantham, Jeremy Siegel, Howard Marks.

But although these things can be quite amusing because while they’re at it, of course, the ‘experts’ say the darndest things (check Bloomberg ‘Intelligence’s Carl Riccadonna: “You had equity markets benefit from QE, but eventually QE also jump-started the broader recovery..Ultimately everyone’s benefiting.”), we can’t get rid of this one other nagging question: who needs an expert to tell them that today’s markets are riddled with bubbles, given that they are the size of obese gigantosauruses about to pump out quadruplets?

Moreover, when inviting the opinions of these ‘authorities’, you inevitably also invite denial and contradiction (re: Siegel). And before you know what hit you, it turns into something like the climate change ‘debate’: just because a handful of ‘experts’ deny what’s right in front of their faces as tens of thousands of scientists do not, doesn’t mean there’s a valid discussion there. It’s just noise with an agenda.

And though the global climate system is infinitely more complex than the very vast majority of people acknowledge, fact remains that a plethora of machine-driven and assisted human activities emit greenhouse gases, greenhouse gases trap heat and higher concentrations of greenhouse gases trap more heat. In very similar ways, central banks’ stimuli (love that word) play havoc, and blow bubbles, with and within the economic system. Ain’t no denying the obvious child.

But even more than the climate ‘debate’, the bubble expert articles made us think of a Jerry Seinfeld episode called The Opera, which ends with Jerry doing a stand-up shtick that goes like this:

…click on the above link to read the rest of the article…

A Much Bigger Threat Than Our National Debt

A Much Bigger Threat Than Our National Debt

The markets are acting as though it was already summer. They are wandering around with little ambition in either direction.

Meanwhile, we’ve been wondering about… and trying to explain… what it is we are really doing at the Diary.

We expect a violent monetary shock, in which the dollar – the physical, paper dollar – disappears.

But why?

Credit Bubble, the Sequel

As you know, we tend to take the side of the underdogs… as well as half-wits, dipsomaniacs, and unrepentant romantics.

But currently, we are standing up for the young, the poor, and all the others the credit bubble has hurt and handicapped.

It’s not that we are saints or do-gooders. We are just trying to make a living, like everybody else.

But we come at it from a different direction than most. Almost all the movers and shakers have the same bias: They want to see the credit extravaganza continue.

The Federal Reserve has already “invested” (if that’s the right word for throwing phony money down the drain in a futile and jackass effort to hold off the future) $4.5 trillion to protect the balance sheets of the elite.

This money has been amplified by zero-interest-rate policies to something like $17 trillion of stock market gains… and umpteen trillion in bond and real estate profits.

Naturally, the people who own these things – and not coincidentally provide early stage funding for congressional and presidential candidates – do not want to see a new movie.

They want to see the sequel, Credit Bubble 5. Then Credit Bubble 6. And so on…

And the show goes on! They buy their candidates. They place their ads. The newspapers they support voice their opinions. Their corporations wheel and deal on Wall Street, spinning off bonuses, fees… and even higher stock prices.

And the pet economists appointed to run central banks do their bidding.

…click on the above link to read the rest of the article…

Something Smells Fishy

SOMETHING SMELLS FISHY

It’s always interesting to see a long term chart that reflects your real life experiences. I bought my first home in 1990. It was a small townhouse and I paid $100k, put 10% down, and obtained a 9.875% mortgage. I was thrilled to get under 10%. Those were different times, when you bought a home as a place to live. We had our first kid in 1993 and started looking for a single family home. We stopped because our townhouse had declined in value to $85k, so I couldn’t afford to sell. In 1995 I convinced my employer to rent my townhouse, as they were already renting multiple townhouses for all the foreigners doing short term assignments in the U.S. We bought a single family home in 1995 with the sole purpose of having a decent place to raise a family that was within 20 minutes of my job.

Considering home prices on an inflation adjusted basis were lower than they were in 1980, I was certainly not looking at it as some sort of investment vehicle. But, as you can see from the chart, nationally prices soared by about 55% between 1995 and 2005. My home supposedly doubled in value over 10 years. I was ecstatic when I was eventually able to sell my townhouse in 2004 for $134k. I felt so smart, until I saw a notice in the paper one year later showing my old townhouse had been sold again for $176k. Who knew there were so many greater fools.

This was utterly ridiculous, as home prices over the last 100 years have gone up at the rate of inflation. Robert Shiller and a few other rational thinking people called it a bubble. They were scorned and ridiculed by the whores at the NAR and the bimbo cheerleaders on CNBC. Something smelled rotten in the state of housing.

…click on the above link to read the rest of the article…

We’re In Uncharted Economic Territory

We’re In Uncharted Economic Territory

We’re in uncharted territory …

For example, this is the first time in history that most central banks worldwide have printed money during the same time period.

And one of America’s leading economists (Nobel-prize winner Robert Shiller) just said that – unlike 1929 – this time, stocks, bonds and housing are ALL overvalued:

This time around, bonds and, increasingly, real estate also look overvalued. This is different from other over-valuation periods such as 1929, when the stock market was very overvalued, but the bond and housing markets for the most part weren’t. It’s an interesting phenomenon.

There’s a connection between the two unprecedented events …

Money printing sucks money out of the real economy, and throws it at the wealthy … who use it to speculate on stocks, bonds and housing.

Indeed, the central banks have consciously been focusing all of their efforts on blowing asset bubbles …

But the bigger they come, the harder they fall.

Canada has the Most Overvalued Housing Market in World

Canada has the Most Overvalued Housing Market in World

![Canada has the Most Overvalued Housing Market in World [Chart]](http://2oqz471sa19h3vbwa53m33yj.wpengine.netdna-cdn.com/wp-content/uploads/2015/05/canada-housing-bubble.png)

Canada has the Most Overvalued Housing Market in World [Chart]

The Chart of the Week is a weekly feature in Visual Capitalist on Fridays.

In every inflating bubble, there’s usually two camps. The first group points out various metrics suggesting something is inherently unsustainable, while the second reiterates that this time, it is different.

After all, if everyone always agreed on these things, then no one would do the buying to perpetuate the bubble’s expansion. The Canadian housing bubble has been no exception to this, and the war of words is starting to heat up.

On one side of the ring, we have The Economist, that came out last week saying Canada has the most overvalued housing market in the world. After crunching the data in housing markets in 26 nations, The Economist has determined that Canada’s property market is the most overvalued in terms of rent prices (+89%), and the third most overvalued in terms of incomes (+35%). They have mentioned in the past that the market has looked bubbly for some time, but finally Canada is officially at the top of their list.

Of course, The Economist is not the only fighter on this side of the ring.

…click on the above link to read the rest of the article…

We Just Broke 2008′s Record for the Fastest Economic Unraveling!

We Just Broke 2008′s Record for the Fastest Economic Unraveling!

In my last piece I provided a technical analysis that signaled we are entering the first stage of a bursting bubble that we’ll call the Fed Bubble. Now while I do believe technicals provide good insight to the economic landscape I see them as a necessary rather sufficient qualifier. In order to be truly confident that our technicals are providing an accurate story we need to understand the fundamentals behind the charts, as we often find the engine light comes on due to a loose wire rather than a problem with the engine.

The final Q1 GDP revision was just released and we saw that GDP has again missed expectations by such a large margin that 2015 is another write off for a 3% growth year. Almost comically we heard the same excuses we got last year. “Weather was wintery and next year is going to be the turnaround year”. So in order to explain to these supposed economic and market ‘experts’ who seem wholly incapable of understanding economic and market forces with any sense of accuracy, let’s run through a few fundamentals.

I want to hone in on the category of consumer spending that is first to go away so that we may capture the first signals of a consumer spending pull back. A good proxy for this is the Johnson Redbook Chain Store yoy sales. This captures the consumer spending taking place at large department stores (Macy’s, Kohls, Walmart, Kmart, etc). This is going to be where the real discretionary retail spending takes place, as in do I have enough space on my credit card for that sassy blue dress and groceries or just groceries? And don’t think that is just a theatrical example. I remember the days of asking myself those very same questions (ok maybe not the blue dress but you get the idea). That is just real life here in the US (and Canada for that matter).

…click on the above link to read the rest of the article…

The Six Too Big To Fail Banks In The U.S. Have 278 TRILLION Dollars Of Exposure To Derivatives

The Six Too Big To Fail Banks In The U.S. Have 278 TRILLION Dollars Of Exposure To Derivatives

The very same people that caused the last economic crisis have created a 278 TRILLION dollar derivatives time bomb that could go off at any moment. When this absolutely colossal bubble does implode, we are going to be faced with the worst economic crash in the history of the United States. During the last financial crisis, our politicians promised us that they would make sure that “too big to fail” would never be a problem again. Instead, as you will see below, those banks have actually gotten far larger since then. So now we really can’t afford for them to fail. The six banks that I am talking about are JPMorgan Chase, Citibank, Goldman Sachs, Bank of America, Morgan Stanley and Wells Fargo. When you add up all of their exposure to derivatives, it comes to a grand total of more than 278 trillion dollars. But when you add up all of the assets of all six banks combined, it only comes to a grand total of about 9.8 trillion dollars. In other words, these “too big to fail” banks have exposure to derivatives that is more than 28 times greater than their total assets. This is complete and utter insanity, and yet nobody seems too alarmed about it. For the moment, those banks are still making lots of money and funding the campaigns of our most prominent politicians. Right now there is no incentive for them to stop their incredibly reckless gambling so they are just going to keep on doing it.

…click on the above link to read the rest of the article…

“The Mother of All Bubbles” in Stocks and Bonds: Bank CEO

“The Mother of All Bubbles” in Stocks and Bonds: Bank CEO

The first quarter was hot across the Eurozone. The euro has gotten purposefully crushed by the ECB’s currency war. QE, first promised then implemented, became all the rage. And stocks surged: the Stoxx Europe 600 was up 16%; Italy’s FTSE MIB index up 22%; and Germany’s DAX also up 22%, the sharpest quarterly gain since Q2 2003. Since January 2012, in a little over three years, the DAX has nearly doubled. Only Greece couldn’t get it together.

And bonds have soared to ludicrous levels, with yields turning negative on €2.2 trillion in Eurozone government debt, according to Societe Generale. German government debt is now sporting negative yields up to a 7.5-year maturity, while 10-year yield – at 0.14% as I’m writing this – is on its way to negative as well.

So on March 31, Hans-Jörg Vetter, CEO of Landesbank Baden-Württemberg in Germany, spoke at the bank’s annual press conference – and fired a warning shot across the bow of investors.

Publicly owned LBBW, a full-service and commercial bank, serves as the central bank for the savings banks in the states of Baden-Württemberg, Rhineland-Palatinate, und Saxony. With €266 billion in assets and over 11,000 employees, it is the largest suchLandesbank in Germany. And it too was dutifully bailed out by taxpayers during the financial crisis.

And so the press conference had the usual feel-good fare.

“Over the past few years LBBW has gained a very good position to operate successfully on a sustained basis amid a difficult environment,” Vetter said in the bank’s press release. “On this basis we are aiming for targeted and risk-conscious growth in our core business areas,” he said.

…click on the above link to read the rest of the article…

If Anyone Doubts That We Are In A Stock Market Bubble, Show Them This Article

If Anyone Doubts That We Are In A Stock Market Bubble, Show Them This Article

The higher financial markets rise, the harder they fall. By any objective measurement, the stock market is currently well into bubble territory. Anyone should be able to see this – all you have to do is look at the charts. Sadly, most of us never seem to learn from history. Most of us want to believe that somehow “things are different this time”. Well, about the only thing that is different this time is that our economy is in far worse shapethan it was just prior to the last major financial crisis. That means that we are more vulnerable and will almost certainly endure even more damage this time around. It would be one thing if stocks were soaring because the U.S. economy as a whole was doing extremely well. But we all know that isn’t true. Instead, what we have been experiencing is clearly artificial market behavior that has nothing to do with economic reality. In other words, we are dealing with an irrational financial bubble, and all irrational financial bubbles eventually burst. And as I wrote about yesterday, the way that stocks have moved so far this year is eerily reminiscent of the way that stocks moved in early 2008. The warning signs are there – if you are willing to look at them.

The first chart that I want to share with you today comes from Doug Short. It is a chart that shows that the ratio of corporate equities (stocks) to GDP is the second highest that it has been since 1950. The only other time it has been higher was just before the dotcom bubble burst…

…click on the above link to read the rest of the article…