As China Stocks Crash, Beijing Proposes Multi-Trillion Market Rescue Package

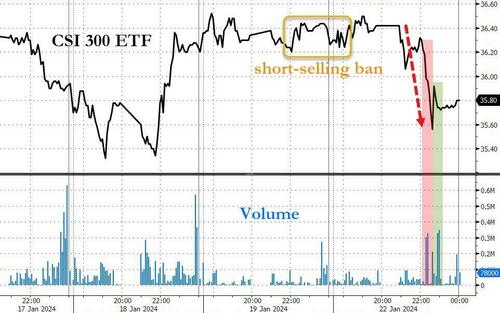

Earlier today, we lamented the latest implosion in Chinese markets, which we discussed in “China Stocks Crash Through ‘Snowball Derivatives’ Trigger Levels Overnight“, in which we pointed out the unprecedented failure of the centrally-planned market to halt its collapse be it through short selling bans, or even the latest impotent intervention by the “National Team”, China’s Plunge Protection Team, which today failed to spark even a modest rebound in the relentless selling which had triggered key liquidation levels.

We then summarized just how badly Beijing had boxed itself, noting that “after short selling ban did nothing, China PPT stepped in… and couldn’t do jack. Beijing trapped.” We concluded that “either they watch liquidation cascade as snowball derivatives are knocked in sparking rout and leading to social unrest, or they stop talking and finally do something.”

Well, just a few hours later we were proven correct again, because shortly after China reopened on Tuesday, Bloomberg reported that according to “people familiar with the matter, asking not to be identified” – i.e., government sources eager to do a market test, China is considering a package of measures to stabilize the plummeting stock market, after earlier attempts to restore investor confidence fell short and prompted Premier Li Qiang to call for “forceful” steps.

Specifically, Beijing is reportedly seeking to “mobilize” about 2 trillion yuan ($278 billion), mainly from the offshore accounts of Chinese state-owned enterprises, as part of a stabilization fund to buy shares onshore through the Hong Kong exchange link; it has also earmarked at least 300 billion yuan of local funds to invest in onshore shares through China Securities Finance Corp. or Central Huijin Investment Ltd.

…click on the above link to read the rest…