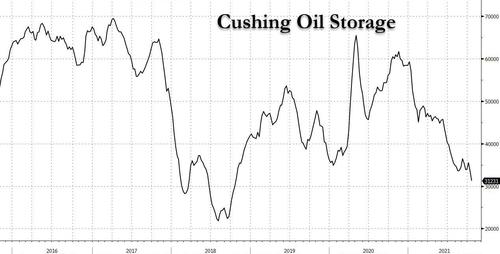

JPM: “We Could Be Just Weeks Away From Cushing Effectively Running Out Of Crude”

Back in April 2020, the landlocked West Texas Intermediate crude oil price briefly crashed into negative territory – a stunning turn of events that cost traders massive losses – when the spot oil market found itself with an unprecedented glut as there was literally too much oil to be stored, and as such those traders who were assigned delivery would pay others just to take the physical oil off their hands. Well, in just a few weeks we may see the opposite scenario: no physical oil at all in the largest US commercial storage facility, leading to what may be a superspike in the price of oil.

In a note predicting the near-term dynamics of the oil market, JPMorgan’s commodity Natasha Kaneva writes that in a world of pervasive nat gas and coal shortages which are forcing the power sector to increasingly turn to oil (boosting demand by 750bkd during winter and drawing inventory by 2.1mmb/d in Nov and Dec), Cushing oil storage – which just dropped to 31.2mm barrels, the lowest since 2018…

… may be just weeks from being “effectively out of crude.” The bank’s conclusion: “if nothing were to change in the Cushing balance over the next two months, we might expect front WTI spreads to spike to record highs—a “super backwardation” scenario.”

Before we get into the meat of the note, first some background which as usual these days, begins with Europe’s catastrophic handling of its energy needs.

As JPM notes, the heating season of 2021/2022 is opening with record high global gas prices even as cold winter weather has yet to arrive…

…click on the above link to read the rest of the article…