‘Texas Miracle’ “On Ice For Time Being” As Crude-Carnage & COVID-Chaos Double-Whammy Strikes Lone-Star State

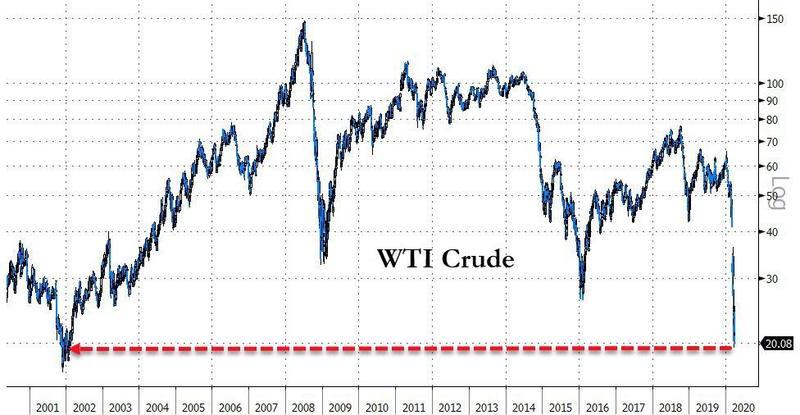

West Texas Intermediate (WTI) spot prices plunged 7.5% to the 19-handle on Sunday evening, hitting lows not seen since 2002.

WTI has crashed 70% in the last 56 trading sessions amid the COVID-19 crisis triggering a demand bust across the world. As a result, an economic storm risks triggering a shale debt bomb in Texas, jeopardizing the state’s $1.8 trillion economy and may damage crude output from the Permian basin that has more than quadrupled in a decade.

In three weeks’ time, Saudi Arabia and Russia launched an oil price war that has sent WTI prices tumbling 57% and now risks imminent doom for US shale (and its junk bonds). More specifically, Texas accounts for 42% of US crude output and has been hit with twin shocks: one from waning crude demand, and another from the COVID-19 outbreak forcing the state to issue a “stay at home” public health order – restricting the travel of residents.

The collapse in oil prices this time around is more unique than past ones, mostly because demand has evaporated overnight due to a pandemic with no clear timetables of when it will return. A major concern for producers is that the recovery might not be V-shape…

“As much a tragedy as the coronavirus is, most states are dealing with one problem. Texas is dealing with two because we’re dealing with coronavirus and the dramatic drop in oil and gas prices,” Dale Craymer, president of the Texas Taxpayers and Research Association and a former state budget director, told Financial Times.

Plains All-American, a pipeline company, was offering WTI per barrel for $17.50 on Friday, a drastic discount from $63 in January. Drillers need about $49 per barrel to stay profitable, a prolonged downturn under $40 for several years could bankrupt 40% of all US shale.

…click on the above link to read the rest of the article…